The Chinese yuan is continuing its appreciation against the US dollar on Tuesday as better-than-expected manufacturing activity and continued stimulus in the banking system extended the currencyâs winning streak. The yuan has been strengthening against the greenback since the height of the coronavirus pandemic, and it is now testing the 6.8 range. In August, the Caixin/IHS Markit manufacturing purchasing managersâ index (PMI) came in at 53.1, up from 52.8 in July â anything above 50 … “Chinese Yuan Extends Winning Streak As Manufacturing Activity Beats Estimates”

Author: admin_mm

ISM Manufacturing PMI Preview: Why only a leap can stop the dollar’s decline

The ISM Manufacturing PMI is set to continue reflecting moderate growth. Dollar selling pressure remains significant after the Fed’s policy shift. Contracting employment could add pressure on the greenback. The industrial sector remains on a recovery path – that what economists expect ISM’s Manufacturing Purchasing Managers’ Index to reflect in its August report. Nevertheless, that may … “ISM Manufacturing PMI Preview: Why only a leap can stop the dollar’s decline”

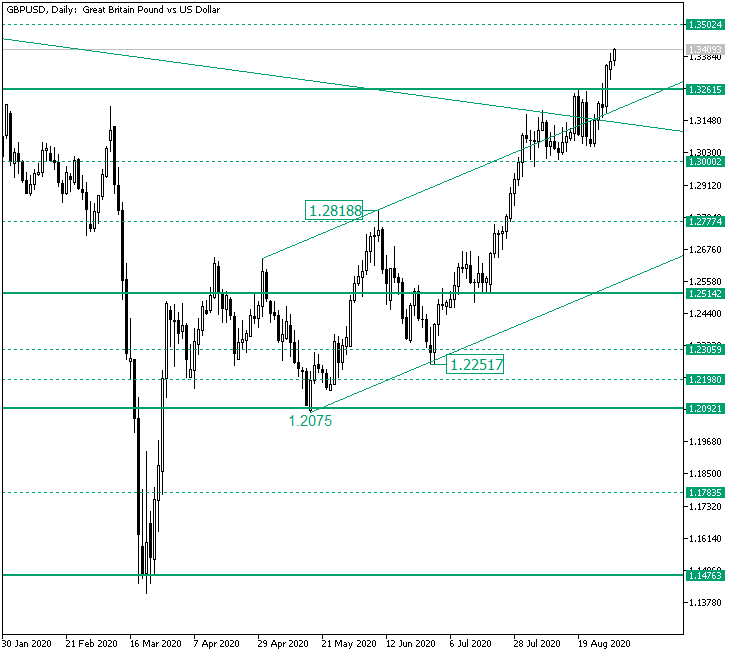

Next Target on GBP/USD: 1.3504?

The Great Britain pound versus the US dollar currency pair managed to overcome an important resistance area. But is this movement sustainable? Long-term perspective After etching the 1.2075 low, thus validating the 1.2092 area as support, the price began an ascending trend that, after piercing two intermediary levels, 1.2777 and 1.3000, respectively, put the bulls in such a good mood that they extended the impulsive swing until the triple resistance … “Next Target on GBP/USD: 1.3504?”

Australian Dollar Outlook: Can RBA Stop Aussie’s Rally?

The Australian dollar was very strong lately, reaching the highest level in more than a year and a half against its US counterpart last week. But some traders are worried that the currency will be unable to extend its rally, especially if the nation’s central bank remains dovish. Let’s look at fundamentals that will be driving the Australian currency this week. The Australian economy fared relatively well … “Australian Dollar Outlook: Can RBA Stop Aussie’s Rally?”

Euro Firm After Mixed Data, Comments from ECB Board Member

The euro rose today. In fact, the shared 19-nation currency was one of the strongest currencies during Monday’s trading session despite mixed domestic macroeconomic data released during Monday’s trading. Positive comments made in an interview with a European Central Bank board member were supportive of the currency. The German consumer price index reported by Destatis was disappointing, falling by 0.1% in August, while analysts had predicted no change. At the same … “Euro Firm After Mixed Data, Comments from ECB Board Member”

Australian Dollar Among Strongest on Economic Data, Risk Appetite

The Australian dollar was among the strongest most-traded currencies today thanks to the risk appetite caused by the surge of the Nikkei stock index. Decent macroeconomic data in China, Australia’s biggest trading partner, and in Australia itself also provided support to the Aussie. The Reserve Bank of Australia reported that private sector credit fell by 0.1% in July, decelerating from the previous month’s 0.2% rate of decline and matching expectations. According to a report from the Australian Bureau … “Australian Dollar Among Strongest on Economic Data, Risk Appetite”

NZ Dollar Flat-to-Lower as Business Confidence Deteriorates

The New Zealand dollar traded either flat or lower against its most-traded peers today, though it managed to gain on few currencies, like the US dollar and the Japanese yen. The kiwi was soft despite the news about the lockdown easing in Auckland. The headline ANZ business confidence indicator was at -41.8% at the end of August, relatively little changed from the reading of -41.4% registered in the first half of the month. It was a significant drop … “NZ Dollar Flat-to-Lower as Business Confidence Deteriorates”

Japanese Yen Weakens on Disappointing Retail Sales, Construction Orders

The Japanese yen is weakening against multiple currency rivals to start the trading week, driven primarily by disappointing macroeconomic data. Despite higher-than-normal inflows into the traditional safe-haven asset, the yen slumped on worse-than-expected retail sales, construction orders, and housing starts. But could the worldâs third-largest economy get a boost from one billionaire hedge fund managerâs recent play? Retail sales tumbled 3.3% in July, down from the 13.1% … “Japanese Yen Weakens on Disappointing Retail Sales, Construction Orders”

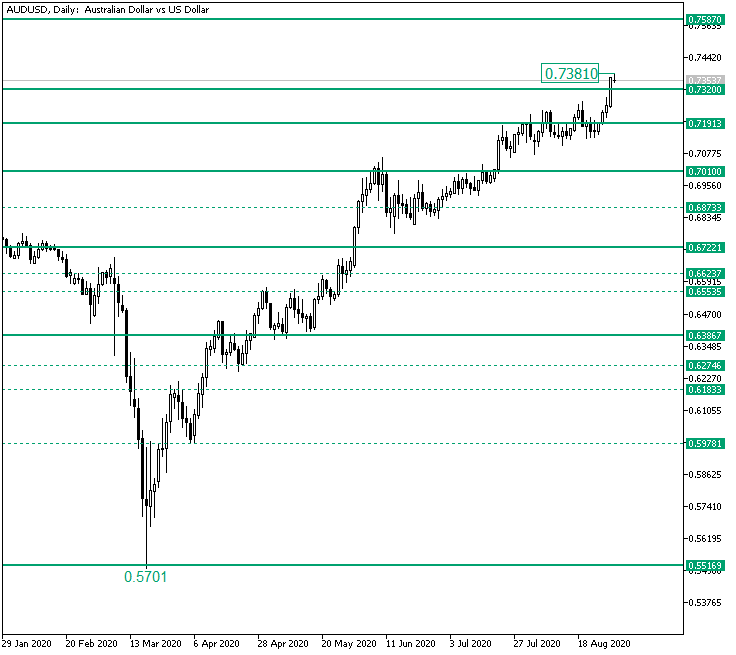

AUD/USD Above 0.7320. Could the Bulls Push the Price Further?

The Australian dollar versus the US dollar currency pair seems to have conquered 0.7320. Do the bears have any plans? Long-term perspective The rally that started at the 0.5700 low managed to fuel a very convincing upwards movement. Along the way, the rise validated important levels as support. However, because the last one, 0.7191, was not taken that much into consideration by the price action, the market participants could have argued … “AUD/USD Above 0.7320. Could the Bulls Push the Price Further?”

GBP/USD: Time to take profits? Why sterling may suffer in back-tos-school week

GBP/USD has been rising amid Powell-powered dollar weakness. Brexit headlines, coronavirus news, BOE speeches, and Non-Farm Payrolls are set to move the currency pair. Early September’s daily chart is pointing to near overbought conditions. The FX Poll is pointing to falls in the short, medium and long terms. Fed-fueled dollar weakness has been overshadowing everything … “GBP/USD: Time to take profits? Why sterling may suffer in back-tos-school week”