The US dollar is trading relatively flat against its G10 currency counterparts after the US government reported that initial jobless claims declined to their lowest levels of the COVID-19 pandemic. The greenback has been trading quietly ahead of the July jobs report on Friday. The broader financial market, except the precious metals, was also subdued toward the end of the trading week. According to the Department of Labor, the number of Americans filing for first-time … “US Dollar Flat As Initial Jobless Claims Fall to Lowest Level of Pandemic”

Author: admin_mm

BOE Analysis: Three pound-positive on Super Thursday open door to new highs

The Bank of England has left its policy unchanged, without dissent toward negative rates. Growth forecasts have been substantially upgraded. Officials are content with positive high-frequency figures. Non-event? GBP/USD has hit the highest since March, showing that the Bank of England’s decision is included powerful punches, propelling the pound. Here are three factors that are … “BOE Analysis: Three pound-positive on Super Thursday open door to new highs”

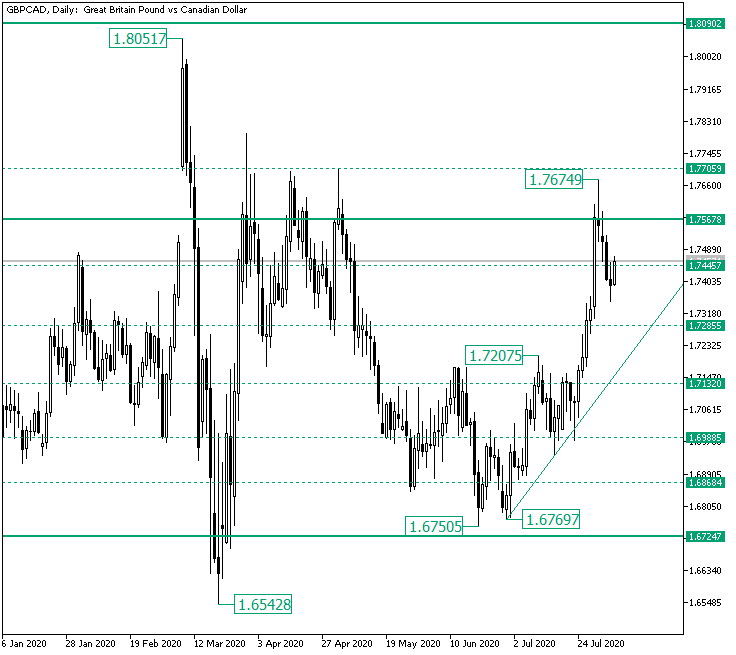

Bulls on GBP/CAD Stopped by the Same 1.7565 Resistance Level?

The Great Britain pound versus the Canadian dollar currency pair dropped after a new attempt to conquer 1.7567 seems to have failed. Long-term perspective The rally from the 1.6542 low, after the 1.6724 level was confirmed as support back in March 2020, managed to extend until the 1.7567 resistance level. But out of the three attempts to overcome the level, none succeeded, as the bulls were only able to stretch the price until the 1.7705 intermediary … “Bulls on GBP/CAD Stopped by the Same 1.7565 Resistance Level?”

BOE Preview: Three things that will move the pound on “Super Thursday”

The Bank of England is set to leave its policy unchanged but publish new economic assessments. Hints about more QE would boost the pound despite fears of independence. Reopening the door to negative rates may weigh on sterling. Summer is about to become hotter – after a steaming hot weekend, pound traders are ready for … “BOE Preview: Three things that will move the pound on “Super Thursday””

Canadian Dollar Rallies Against US Peer on Strong Oil Prices, Later Falls

The Canadian dollar today rallied against its US peer as oil prices hit new multi-month highs before giving up its gains and heading lower. The USD/CAD currency pair later recouped most of its losses as oil lost its lustre at a crucial resistance level dragging the loonie lower. The USD/CAD currency pair today fell from … “Canadian Dollar Rallies Against US Peer on Strong Oil Prices, Later Falls”

Sterling Gets Help from Strong Rebound in Services, Rally of Stocks

The Great Britain pound demonstrated a decent performance during Wednesday’s trading session, even though it was not among the strongest currencies on the Forex market. The sterling got support from the strong rebound of the UK service industry as well as a rally of British stocks. The FTSE 100 Index, which tracks the major London-listed stocks, climbed more than 1% today. Other European stock indices also demonstrated a strong performance, and so … “Sterling Gets Help from Strong Rebound in Services, Rally of Stocks”

Euro Strong, Propelled by Domestic & US Macroeconomic Data

The euro was among the strongest currencies on the Forex market today, trading about flat against the Swiss franc and the Australian dollar, while rising versus other most-traded currencies. The currency got a boost from the recovery of the European services industries, though the weakness of the US dollar after an extremely disappointing employment report also helped the shared 19-nation currency. July’s IHS Markit Eurozone PMI Services Business Activity Index was finalized … “Euro Strong, Propelled by Domestic & US Macroeconomic Data”

US Data Analysis: Big jobs number? Negative NFP looks more likely, trends could extend in gold, dollar

ADP reported an increase of only 167,000 private-sector jobs in July. Manufacturing employment remains depressed according to ISM. The broader services sector also looks depressed. “Big jobs number on Friday” – said President Donald Trump to Fox News and the public ahead of July’s all-important Non-Farm Payrolls report. It doesn’t look that way – the … “US Data Analysis: Big jobs number? Negative NFP looks more likely, trends could extend in gold, dollar”

Chinese Yuan Strengthens to Five-Month High Despite Disappointing PMI

The Chinese yuan is strengthening against the US dollar midweek, despite disappointing economic data. The yuan has been gaining momentum against the greenback, primarily due to the rebounding economy and the buck languishing in recent weeks. With the central bank suggesting that it will not enhance its aggressive monetary policy efforts, could the worldâs second-largest economy continue its recovery? Speaking to local media outlets, Peopleâs Bank of China … “Chinese Yuan Strengthens to Five-Month High Despite Disappointing PMI”

Australian Dollar Strongest amid Positive Market Sentiment

The Australian dollar rose against a basket of most-traded currencies, including the New Zealand dollar, which itself was very strong. The likely reason for the Aussie’s strong performance was the positive market sentiment caused by a rally of US and European stocks. Domestic macroeconomic data was also helpful to the currency, while disappointing data from China, Australia’s biggest trading partner, did not have a material impact on the Australian currency. The Commonwealth Bank … “Australian Dollar Strongest amid Positive Market Sentiment”