The Australian dollar rallied today even as economic data from China, Australia’s biggest trading partner, was lackluster. The Aussie joined other Asian currencies in a rally after the United States avoided government shutdown. US Congress agreed to spend $1 trillion to avert government shutdown later this week. This should be enough to fund federal agencies, which would be closed otherwise except for most essential ones, … “Aussie Joins Other Asian Currencies in Rally on Monday”

Author: admin_mm

CAD: ‘April Showers’ Hit CAD; Is It A Buy? – CIBC

The Canadian dollar suffered from subdued oil prices, Trump’s tariffs and also worries about Canadian housing. What’s next? Here is their view, courtesy of eFXnews: CIBC FX Strategy Research notes that CAD was given a kick lower this week after the US imposed duties on Canadian lumber, sparking fears that the trade relationship between Trump and Trudeau … “CAD: ‘April Showers’ Hit CAD; Is It A Buy? – CIBC”

First Week of May Should Be Important for US Dollar

The first week of May should be fairly important in determining the US dollar’s performance in the near future due to the policy meeting of the Federal Reserve and plenty of major economic reports, including nonfarm payrolls. The Fed will announce its decision on Wednesday. While the general consensus is that the central bank will not make changes to its monetary policy, market participants will pay close attention to the accompanying statement. They will … “First Week of May Should Be Important for US Dollar”

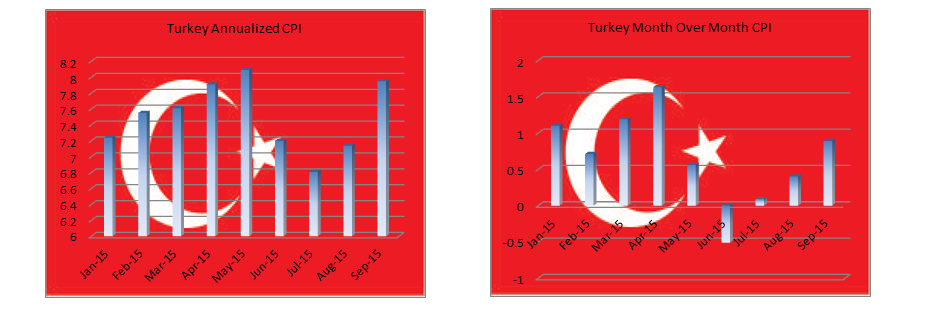

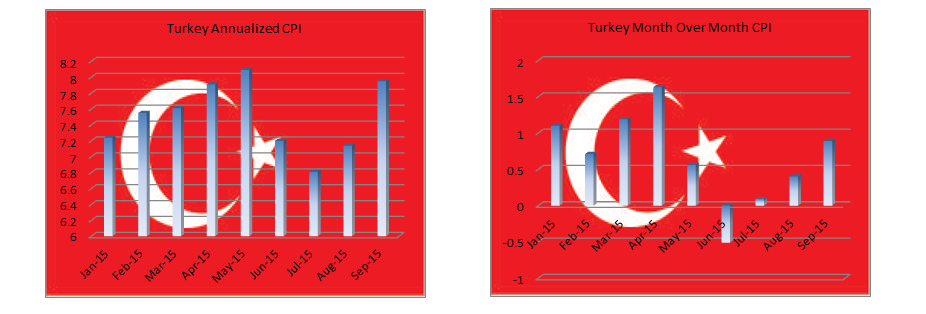

What’s going on in Turkey?

In the past year, regulators across Europe have been anything but shy about clamping down on Forex brokerage’s modus operandi, from FCA’s lowering of leverage limits to CySEC’s prohibition of bonus offering. As a result, FX brokers have been having a hard time adapting to the new landscape and are therefore looking at countries in … “What’s going on in Turkey?”

What’s going on in Turkey?

In the past year, regulators across Europe have been anything but shy about clamping down on Forex brokerage’s modus operandi, from FCA’s lowering of leverage limits to CySEC’s prohibition of bonus offering. As a result, FX brokers have been having a hard time adapting to the new landscape and are therefore looking at countries in … “What’s going on in Turkey?”

US Dollar Weakens Versus a Basket of Major Counterparts on Disappointing GDP Growth

The US dollar declined against most of its main peers on Friday, which drove an index that tracks the greenbackâs strength to its lowest level since November 9 earlier today before partly erasing some of its losses. The US currency was weaker today following a report on gross domestic product growth in the United States, which revealed data that fell short of expectations. The US Bureau of Economic Analysis released … “US Dollar Weakens Versus a Basket of Major Counterparts on Disappointing GDP Growth”

USD/CAD Rallies Briefly After Release of Flat Canadian GDP Data

The USD/CAD currency pair today declined slightly from multi-month highs that had been registered earlier after the release of Canadian GDP data by Statistics Canada. The currency pair had rallied higher briefly after the announcement of both the Canadian and US GDP data before retracing some of its daily gains. The currency pair rallied to hit a new daily high after the announcement of the Canadian and US GDP data, which were simultaneously … “USD/CAD Rallies Briefly After Release of Flat Canadian GDP Data”

EUR/USD Rallies Higher on Positive Eurozone CPI Data

The EUR/USD currency pair rallied to new highs today after the release of positive CPI data from the Eurozone. The euro gained significantly against the US dollar as the Eurozone inflation figures for the month of April released by Eurostat exceeded expectations. The currency pair gained over 70 points at the height of its rally as investors bought the pair due to the better economic outlook signaled by the CPI data. The CPI data from the Eurozone for April came in at 1.9% … “EUR/USD Rallies Higher on Positive Eurozone CPI Data”

Japanese Yen Soft Following Economic Data & BoJ Meeting

The Japanese yen fell during the current trading session following the barrage of economic reports in Japan today and yesterday’s policy meeting of the Bank of Japan. Plenty of reports were released from Japan today. Among them were Japan’s core Consumer Price Index, which rose 0.2% in March from the previous year (in line with expectations), and Tokyo core CPI, which fell 0.1% in April from a year ago (less than … “Japanese Yen Soft Following Economic Data & BoJ Meeting”

GBP/USD Rises to Highest Since September, Ignoring Data

The Great Britain pound gained today, reaching the highest level since September, despite underwhelming economic data released from the United Kingdom today. UK gross domestic rose 0.3% in the first quarter of this year, missing the analysts’ estimate of 0.4%. It was the slowest growth rate in a year. Released earlier, UK GfK consumer confidence slipped to -7 in April from March’s -6. GBP/USD rallied from 1.2902 to 1.2946 … “GBP/USD Rises to Highest Since September, Ignoring Data”