EUR/USD managed to gain some ground after Draghi removed some urgency. What does this mean for the euro? Here are three opinions: Here is their view, courtesy of eFXnews: EUR: Here Is The Next Step From The ECB After the ‘Hawkish Twist’ – Danske The ECB kept all policy measures unchanged at today’s meeting, and … “ECB’s hawkish twist – what’s next for EUR? – 3 opinions”

Author: admin_mm

British Pound Weakens to Lowest Level in 8 Weeks Against US Dollar

The British pound declined against the US dollar on Thursday, after concerns towards Brexit returned to the market as the end of the current month is expected to be the time when the government triggers Article 50. Chancellor of the Exchequer Philip Hammond released the spring budget of the United Kingdom yesterday, which did not contain mentions of Brexit. However, investors believe that the government is preparing plans to shape the economy of the nation after departing from … “British Pound Weakens to Lowest Level in 8 Weeks Against US Dollar”

Euro Rallies Briefly Boosted by Mario Draghi’s Hawkish Comments

The euro rallied briefly against its major peers today after Mario Draghi, the President of the European Central Bank, outlined a hawkish outlook during the press briefing after the bank’s meeting. The euro gained significantly as the ECB revised its growth and inflation outlooks for the Eurozone and announced that the quantitative easing program would continue until December. The euro gained significantly against the Japanese yen, the British pound and the US dollar although the currency had retraced most … “Euro Rallies Briefly Boosted by Mario Draghi’s Hawkish Comments”

US Dollar Reaches Strongest Level in 6 Weeks Against Japanese Yen

The US Dollar touched its highest level against the yen in three weeks on Thursday, as the greenback headed for a fourth consecutive day of gains against the Japanese currency. The US dollar remained supported today by strong private sector employment data on Wednesday. Following yesterdayâs report from the ADP Research Institute, investors expect upcoming nonfarm payroll data, which will be released on Friday, to reflect a positive image of the US labor market. … “US Dollar Reaches Strongest Level in 6 Weeks Against Japanese Yen”

EUR/USD: Trading the US Nonfarm Payrolls March 2017

US Nonfarm Employment Change measures the change in the number of newly employed people in the US, excluding workers in the farming industry. A reading which is higher than the market forecast is bullish for the dollar. Here are the details and 5 possible outcomes for EUR/USD. Published on Friday at 13:30 GMT. Indicator Background Job … “EUR/USD: Trading the US Nonfarm Payrolls March 2017”

ECB Preview: a short-lived blow to the euro? [Video]

The European Central Bank is unlikely to change its policy. Nevertheless, this is an important meeting as new forecasts are released and as inflation lifts its head. Mario Draghi will have to play a fine balancing act between acknowledging the improving reality and expressing a need and desire for more stimulus. His magic could work … “ECB Preview: a short-lived blow to the euro? [Video]”

ECB Preview: acknowledging reality or playing it down?

The European Central Bank not only makes its decision (where no change is expected) but also releases new staff forecasts for growth and inflation. This makes the March 9th decision an important one. With the latest inflation figures for February already out, it’s time to analyze the big event that will hopefully move the euro out of … “ECB Preview: acknowledging reality or playing it down?”

EUR: ECB To Keep A Dovish Stance This Week – Danske

EUR/USD is awaiting the ECB decision with the updated forecasts. What can we expect? Here is their view, courtesy of eFXnews: We expect the ECB to maintain its dovish stance at the meeting this week although inflation has reached the 2% target. The reason why we do not expect the ECB to react to the stronger … “EUR: ECB To Keep A Dovish Stance This Week – Danske”

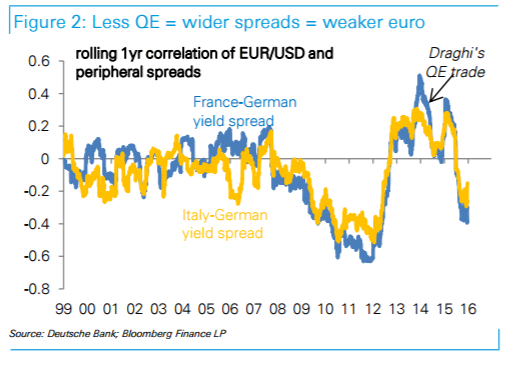

3 Reasons Why ECB Tapering Won’t Prevent Further EUR/USD

The European Central Bank is pondering over its next steps regarding the QE program. The team at Deutsche Bank sees weakness in any case: Here is their view, courtesy of eFXnews: One of the pushbacks we get to our weaker euro view is that the ECB will signal tapering this year preventing EUR/USD weakness. We … “3 Reasons Why ECB Tapering Won’t Prevent Further EUR/USD”

Great Britain Pound Struggles as Brexit Uncertainty Weighs

The Great Britain pound was vulnerable on Wednesday due to Brexit uncertainties but bounced to trade near the opening level against most of its major rivals. The US dollar was an exception as against it the sterling retained losses, falling for the third day in a row. The House of Lords passed the Brexit Bill but with the critical amendment that the Parliament should have a say in Brexit talks. Many analysts were concerned that it … “Great Britain Pound Struggles as Brexit Uncertainty Weighs”

![ECB Preview: a short-lived blow to the euro? [Video]](https://investinearth.org/wp-content/uploads/2017/03/Fotolia_77768687_S-351x185-1.jpg)