The Australian dollar fell against almost all of the most-traded currencies today with the exception of the New Zealand dollar. The main reasons for the decline were the negative market sentiment and the dovish outlook for the monetary policy of Australia’s central bank. Markets were rattled by the unprecedented move of prices for North American crude oil below $0. Analysts were quick to point out that the move was in the May contract that expires today, making traders … “Australian Dollar Trades Lower After RBA Minutes, Drop of Crude Oil Below $0”

Author: admin_mm

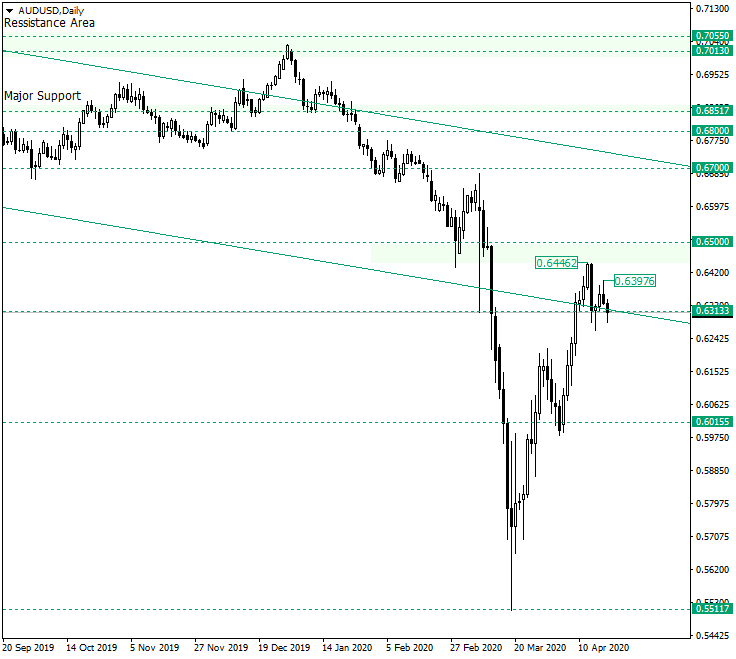

Bears on AUD/USD May Start Pushing from 0.6313

The Australian dollar versus the US dollar currency pair seems to offer conflicting signals, but how can some light be shed upon the situation? Long-term perspective The advancement that started from the level of 0.5517 extended to as high as 0.6446, almost reaching the major area just beneath the 0.6500 psychological level. After peaking at 0.6446, the price went under the 0.6313 support level only to peak again at 0.6397. The fact that … “Bears on AUD/USD May Start Pushing from 0.6313”

Chinese Yuan Flat As PBoC Slashes Benchmark Loan Rate

The Chinese yuan is barely budging against its G10 currency competitors on Monday, despite the central bank showing its willingness to get serious about monetary easing. Investors may be trying to see if China can successfully hit the reboot button after last weekâs worse-than-expected gross domestic product (GDP) reading for the first quarter. It is evident that Beijing will employ every fiscal and monetary … “Chinese Yuan Flat As PBoC Slashes Benchmark Loan Rate”

Euro Recovers After Mixed Economic Data, Supported by Plans for Easing Lockdown

The euro opened sharply higher today but has erased losses against the majority of its most-traded peers by now. The traders’ cautious mood was weighing on the currency, but hopes about an end to lockdown in the foreseeable future were supporting the euro. Eurozone macroeconomic data released over Monday’s trading session was mixed. Destatis reported that the German Producer Price Index fell by 0.8% in March, both on a monthly and annual basis. Analysts … “Euro Recovers After Mixed Economic Data, Supported by Plans for Easing Lockdown”

Japanese Yen Moves Lower After Exports Collapse

The Japanese yen opened sharply higher against its most-traded rivals today but immediately started to move lower and continued its decline after the release of a poor report on the Japanese trade balance. Japan’s Ministry of Finance reported that the trade balance logged a deficit of ¥0.19 trillion in March after logging a surplus of ¥0.48 trillion in February. Economists were expecting a smaller deficit of ¥0.11 trillion. Exports dropped … “Japanese Yen Moves Lower After Exports Collapse”

NZ Dollar Flat-to-Higher on CPI, Easing Lockdown Restrictions

The New Zealand dollar traded flat or higher against its most-traded counterparts today. There were two reasons for the currency’s good performance: the government’s plans to ease the lockdown restrictions and positive inflation data released today. New Zealand Prime Minister Jacinda Ardern announced that the government will reduce the threat level one notch to three next week, allowing some businesses to open. That should benefit the nation’s economy … “NZ Dollar Flat-to-Higher on CPI, Easing Lockdown Restrictions”

Euro Rallies on Reports of COVID-19 Cure and In-Line Eurozone CPI

The euro today rallied higher against the US dollar driven by bullish investor sentiment amid hopes that a cure for the coronavirus was on the horizon. The EUR/USD currency pair initially fell as the greenback rallied before changing course and surging higher as risk-appetite improved. The EUR/USD currency pair today fell to a low of … “Euro Rallies on Reports of COVID-19 Cure and In-Line Eurozone CPI”

Chinese Yuan Mixed As Economy Contracts 6.8% in Q1, Retail Sales Crash

The Chinese yuan is mixed against its currency competitors to finish the trading week as investors weigh Chinaâs near-term economic recovery. With the latest bearish numbers suggesting Beijingâs COVID-19 devastation, analysts are hoping that the worst is over and that the nationâs reboot will lead to better results. According to the National Bureau of Statistics (NBS), the gross domestic product (GDP) plummeted 6.8% in the first quarter, worse than the market … “Chinese Yuan Mixed As Economy Contracts 6.8% in Q1, Retail Sales Crash”

Loonie Sinks As Crude Oil Trades at 18-Year Lows Despite Supply Cuts

The Canadian dollar today extended its losing streak against the US dollar for the second day in a row despite yesterday’s hawkish rate decision by the Bank of Canada. The USD/CAD currency pair surged higher as the loonie remained under pressure due to falling crude oil prices despite recent output cust by OPEC+ and some US producers. The USD/CAD currency pair today rallied from a low of 1.4063 in the early American session to a high of 1.4182 … “Loonie Sinks As Crude Oil Trades at 18-Year Lows Despite Supply Cuts”

Euro Extends Decline Amid Fears of a Looming Recession in the EU

The euro today fell against the US dollar as market sentiment remained decisively risk-averse amid fears that the eurozone was facing an imminent recession. The EUR/USD currency pair fell for the second consecutive session despite the release of upbeat data from Germany and the euro area, which did little for the pair. The EUR/USD currency pair today fell from an opening high of 1.0907 to a … “Euro Extends Decline Amid Fears of a Looming Recession in the EU”