The Canadian dollar is weakening against many currency rivals to finish out the trading week. Following a week of modest gains, the loonie is falling on the central bank announcing an emergency cut to interest rates as the economy gets battered by coronavirus outbreak and tumbling energy prices. For the second time in less than a month, the Bank of Canada (BoC) made an unscheduled reduction to its benchmark interest rate in response to the COVID-19 pandemic. The central bank lowered … “Canadian Dollar Weakens As BoC Imposes Emergency Interest Rate Cut”

Author: admin_mm

TopBrokers.com Portal Creates a Section About US Forex Companies

The U.S. dollar is the most traded currency globally, taking up over 80% of the trading volume. If you are a trader or investor residing in the U.S., you’ve probably gained an interest in trading the USD because of it being the most liquid currency. However, you might have noticed there are only a few … “TopBrokers.com Portal Creates a Section About US Forex Companies”

Euro Falls After 4-Day Rally Amid Rising European Coronavirus Cases

The euro today fell against the US dollar as traders took their profits following 4-day rally marked by steady gains driven by positive investor sentiment. The EUR/USD currency pair headed lower as the greenback rallied higher amid rising coronavirus cases and deaths in Spain and Italy. The EUR/USD currency pair today fell from a high of 1.1086 in the … “Euro Falls After 4-Day Rally Amid Rising European Coronavirus Cases”

Japanese Yen Flat-to-Higher as Coronavirus Continues to Spread

The Japanese yen was trading either flat or higher against its most-traded rivals today as the coronavirus pandemic continued to spread across the world, causing panic and expectations of a global economic recession. While it looks like China has managed to successfully halt the spread of the COVID-19 disease, the situation in other countries worsens every day. UK Prime Minister Boris Johnson entered self-isolation after testing positive for the coronavirus. Meanwhile, the United … “Japanese Yen Flat-to-Higher as Coronavirus Continues to Spread”

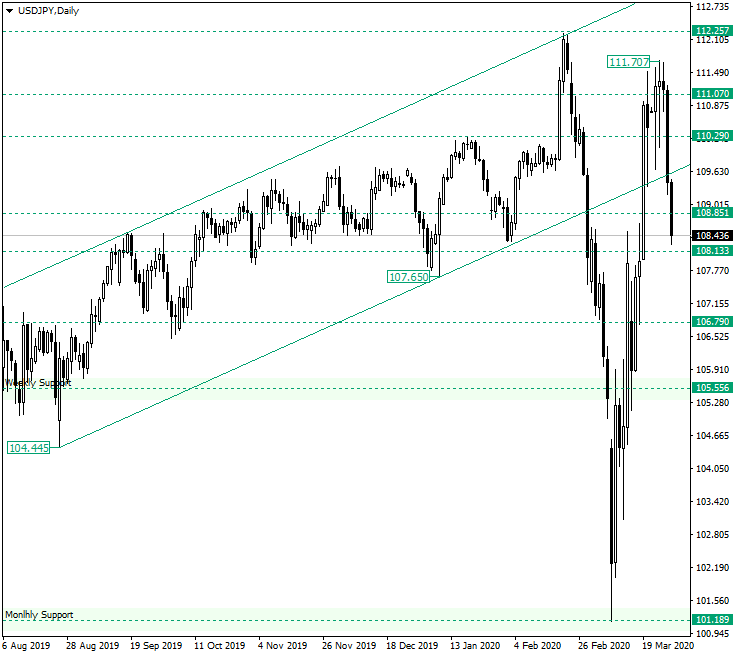

USD/JPY Dropped from 111.70

The US dollar versus the Japanese yen currency pair stalled around the 112.00 psychological level. Is this only a correction? Long-term perspective After confirming the monthly support of 101.18, the price rallied all the way up to the 111.07 level, peaking at the 111.70 high. The rally also took the price back into the ascending channel, whose support trendline starts from the 104.44 low. This led to the bulls hoping that, after a corrective … “USD/JPY Dropped from 111.70”

Pound Rallies on Upbeat Sentiment and Hawkish BoE Rate Decision

The Sterling pound today rallied higher against the US dollar driven by the dominant risk-off market sentiment, which triggered a sell-off in the greenback. The GBP/USD currency pair today rallied higher as investors reacted to the Bank of England‘s latest monetary policy decisions. The GBP/USD currency pair today rallied from a low of 1.1818 in the early London session to a high of 1.2181 in the American session and was near these highs at the time of writing. The currency pair traded … “Pound Rallies on Upbeat Sentiment and Hawkish BoE Rate Decision”

US Dollar Falls Amid Record 3.28 Million Initial Jobless Claims

The US dollar is sliding against multiple currency rivals on Thursday, but it is holding relatively steady. This might come as a surprise for market observers because the greenback and the broader financial market should be in freefall following record-breaking jobs numbers. It is the opposite. According to the Bureau of Labor Statistics (BLS), initial jobless claims soared to an all-time high of 3.283 million for the week ending March 21. This is … “US Dollar Falls Amid Record 3.28 Million Initial Jobless Claims”

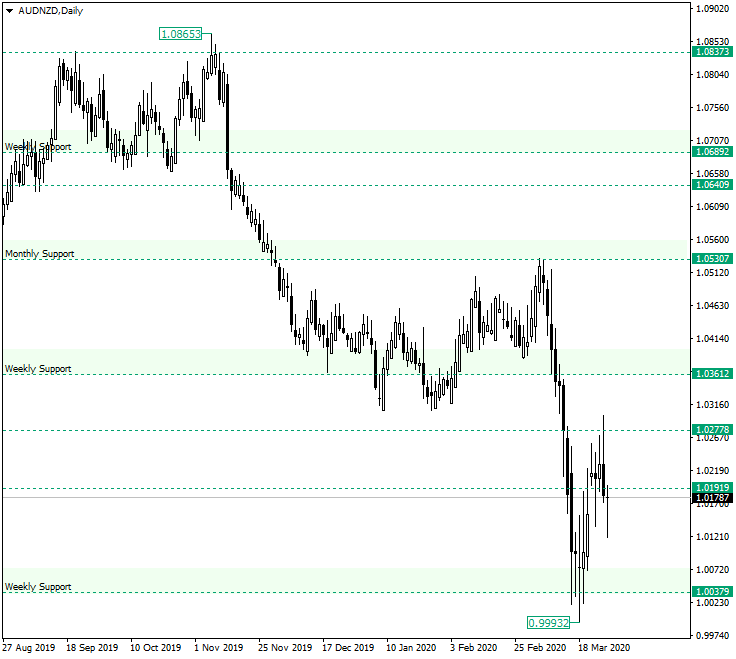

AUD/NZD Still Thinking at the 1.0200 Handle

The Australian dollar versus the New Zealand dollar currency pair seems to be undecided concerning what path to take. Long-term perspective After confirming the monthly support of 1.0530 as resistance, the price dropped until the weekly support of 1.0037, printing the low at 0.9993 and then retracing. The retracement got quite close to the next weekly support, 1.0361, respectively, but on March 25, the bears pushed the price lower, causing the candle to close under the intermediary … “AUD/NZD Still Thinking at the 1.0200 Handle”

Chinese Yuan Weakens As PBoC Mulls Additional Monetary Stimulus

The Chinese yuan is weakening against most major currency rivals midweek as reports suggest that the Peopleâs Bank of China (PBoC) is considering a reduction in interest rates that financial institutions are required to pay depositors. Analysts are still bearish on the worldâs second-largest economy, warning of double-digit economic contraction in the first quarter of 2020. Will the central bank implement more monetary stimulus measures? As China hits the reboot button … “Chinese Yuan Weakens As PBoC Mulls Additional Monetary Stimulus”

US Dollar Slips As $2 Trillion Stimulus Package Nears Agreement

The US dollar is continuing its streak of losses midweek as the federal government prepares to pass the $2 trillion stimulus package, which has sparked a rally in equities for two straight sessions. With a heightened risk appetite, investors are pouring into riskier currencies after liquidating everything to buy the greenback throughout the market turmoil. Is the buck set to plunge even further? On Tuesday evening, the White House and Senate struck a deal … “US Dollar Slips As $2 Trillion Stimulus Package Nears Agreement”