The euro today rallied against the US dollar earlier in the session before falling later during the American session as the global equities sell-off deepened. The EUR/USD currency pair headed lower as European stock markets closed in the red and American markets opened lower later in the day. The EUR/USD currency pair today rallied to … “Euro Rises Then Falls on Rising Coronavirus Cases and Equities Sell-Off”

Author: admin_mm

Chinese Yuan Rises As Financial Markets Brace for Chinaâs Reboot

The Chinese yuan is rising against the US dollar and is mixed against other currency rivals, midweek as global financial markets brace for Chinaâs reboot. With the death toll and the number of confirmed cases subsiding, Beijing is preparing to gradually return to normal. But just how bad was the coronavirus for the Chinese economy? The consensus is simple: expect the worst and hope for the best. It is estimated that the worldâs second-largest economy … “Chinese Yuan Rises As Financial Markets Brace for Chinaâs Reboot”

Sterling Extremely Volatile After BoE Emergency Interest Rate Cut, Disappointing GDP

The Great Britain pound was extremely volatile today. The main reason for the currency’s sharp moves was an emergency interest rate cut from the Bank of England. The sterling sank immediately after the announcement, recovered quickly afterward but backed off a bit after a release of a bunch of disappointing macroeconomic reports, including GDP print. The BoE surprised markets by announcing an emergency interest rate cut by 50 basis points to 0.25%. While a cut … “Sterling Extremely Volatile After BoE Emergency Interest Rate Cut, Disappointing GDP”

Australian Dollar Attempts to Rebound After Flash Crash

The Australian dollar rose today, attempting to rebound after the recent flash crash. But today’s gains were nowhere near enough to erase losses the currency has logged since the end of the last week. The coronavirus continues to spread across the globe, hurting demand for riskier currencies linked to commodities. Negative domestic macroeconomic data was not helping the matter either. Guy Debelle, Deputy Governor of the Reserve Bank of Australia, talked about … “Australian Dollar Attempts to Rebound After Flash Crash”

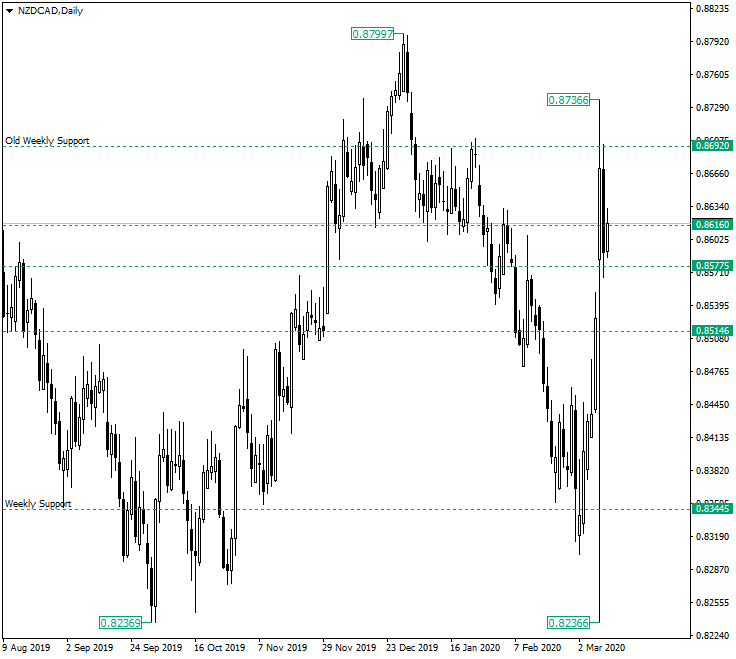

Could NZD/CAD Fall Again from 0.8616?

The New Zealand dollar versus the Canadian dollar currency pair sits just above the neckline level of the head & shoulders that started the year and fueled the strong depreciation that followed. Might it happen again? Long-term perspective The peak of 0.8799 marks the height of the head and shoulders pattern. The chart formation, after its neckline at 0.8616 was pierced and confirmed as resistance, allowed the bears to push the prices to the weekly support of 0.8344. At the beginning … “Could NZD/CAD Fall Again from 0.8616?”

Pound Falls on UK Politics and US Fiscal Stimulus Expectations

The British pound today fell against the much stronger US dollar as markets waited for a fiscal stimulus package to be announced by the US government. The GBP/USD currency pair was also weighed down by British politics as the government gave up its massive majority in a crunch vote on Huawei. The GBP/USD currency pair today fell from an initial high of 1.3088 to a low of 1.2899 in the … “Pound Falls on UK Politics and US Fiscal Stimulus Expectations”

US Dollar Rallies As Equities Bounce Back, Business Optimism Jumps

The US dollar is rallying against several currency competitors on Tuesday as the stock market bounces back following Black Monday 2020. But is the spark triggered by central bank stimulus and expected cuts to interest rates at next weekâs policy meeting or is it a dead cat bounce. Where does the greenback go from here? Financial markets are trying to pare Mondayâs steep losses. The Dow Jones, the S&P 500, … “US Dollar Rallies As Equities Bounce Back, Business Optimism Jumps”

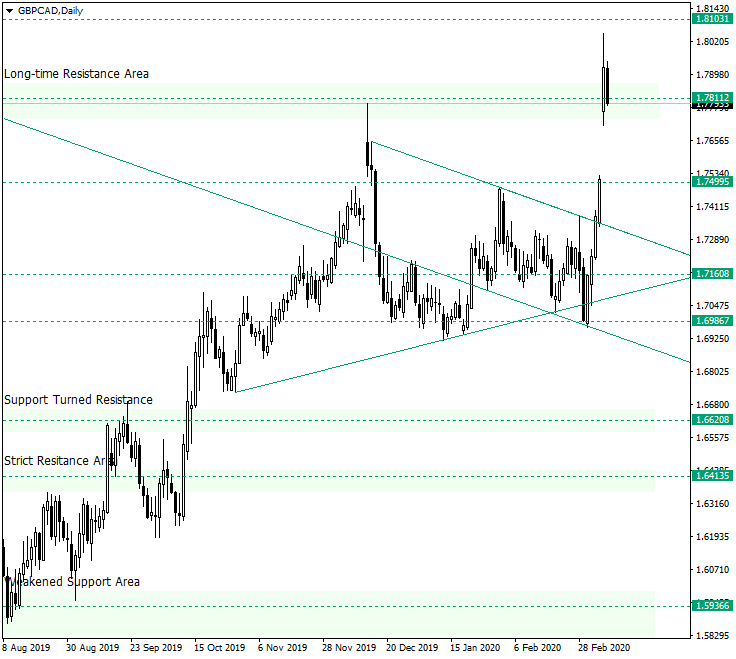

GBP/CAD Jumps Back Above 1.7811

The Great Britain pound versus the Canadian dollar currency pair gapped above the important long-time resistance area of 1.7811. Long-term perspective After confirming the weakened support area of 1.5936, the price started to move upward, passing two important levels, 1.6413 and 1.6620, respectively and confirming 1.7811 as resistance. After that, it went into a consolidation phase that began to look very alike a symmetrical triangle but towards its end … “GBP/CAD Jumps Back Above 1.7811”

Euro Inches Higher on Coronavirus Fears and Global Equities Sell-Off

The euro today traded in a wide range against the US dollar with a slightly bullish bias as markets reeled from the spreading coronavirus outbreak and the crash in oil prices. The EUR/USD currency pair today traded with a bullish bias as bears fought for control amid a major sell-off in global equity markets. The … “Euro Inches Higher on Coronavirus Fears and Global Equities Sell-Off”

Japanese Yen Soars As Investors Flee to Safe-Haven Assets

The Japanese yen is soaring against multiple currency rivals to kick off the trading week as investors are fleeing to traditional safe-haven assets amid the market crash. With the major leading stock indexes worldwide posting steep losses, traders are buying the yen, despite the disappointing economic data. Will the yen be the best performing currency in the first quarter? While Covid-19 is still lingering in the background, the main headline at the opening … “Japanese Yen Soars As Investors Flee to Safe-Haven Assets”