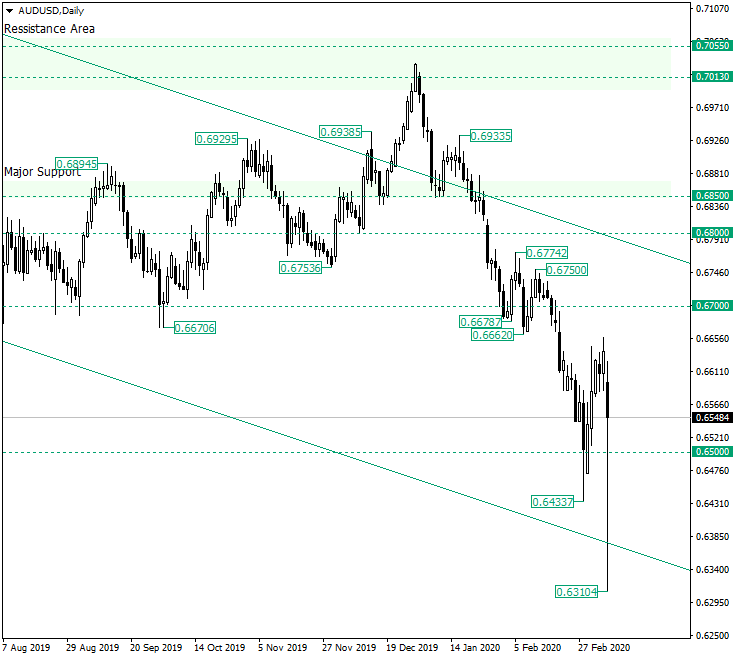

The Australian dollar versus the US dollar currency pair depreciated strongly. Will the recovery last? Long-term perspective After confirming the double resistance area marked by the levels of 0.7055 and 0.7013, respectively, the price formed a head and shoulders pattern that favored a return inside the descending channel. Once back in the channel, the bears pushed the price lower and lower, disengaging the supportive role of 0.6700 and piecing the 0.6500 psychological level. But the 0.6500 was backed … “AUD/USD Plunged to 0.63 and Recovered. What Now?”

Author: admin_mm

Japanese Yen Strong as Coronavirus Panic Persists

The Japanese yen was among the strongest currencies on the Forex market today, rising against almost all of its major peers, though not against the Swiss franc, another refuge currency, and the surprisingly strong New Zealand dollar. The worsening coronavirus pandemic was driving investors to safer assets, including the yen. Domestic macroeconomic reports were mixed, giving no reason for the currency to move in any particular direction. It looks like … “Japanese Yen Strong as Coronavirus Panic Persists”

Euro Gains on German Factory Orders, US Dollar’s Woes

The euro fell against safer currencies, like the Swiss franc and the Japanese yen, but gained on other most-traded rivals, including the US dollar, the Great Britain pound, and commodity currencies. Surprisingly, that did not include the New Zealand dollar, which turned out to be one of the strongest currencies during Friday’s trading session. German factory orders were arguably the most important economic release in the eurozone today. According to data … “Euro Gains on German Factory Orders, US Dollar’s Woes”

Australian Dollar Soft on Market Sentiment, Weak Economic Data

The Australian dollar was soft today. While it managed to gain on the US and Canadian dollars, the Aussie fell against other most-traded currencies. It declined even against its New Zealand counterpart, which is also considered riskier commodity currency. The market sentiment remained in a risk-off mode, weighing on Australian currency, and Australia’s macroeconomic releases were not helping either. The Australian Bureau of Statistics reported that retail sales … “Australian Dollar Soft on Market Sentiment, Weak Economic Data”

Canadian Dollar Gains on Upbeat Jobs Report, Falls on Russian Oil News

The Canadian dollar today posted gains against the US dollar after the release of upbeat Canadian employment data in the early American session. The USD/CAD currency pair alternated between gains and losses, given that both the loonie and the greenback were weak overall. The USD/CAD currency pair today traded in a wide range marked by a low of 1.3379 and a high … “Canadian Dollar Gains on Upbeat Jobs Report, Falls on Russian Oil News”

US Dollar Uncertainty Despite Strong February Jobs Report, Trade Data

The US dollar is mixed against several currency rivals to close out the trading week as a blend of strong February jobs data, the coronavirus, and financial market turmoil is causing widespread confusion. Will the greenback rebound or will it continue its fall? According to the Bureau of Labor Statistics (BLS), the US economy added 273,000 jobs in February, up from 225,000 in January. The market had forecast 175,000 new jobs. The unemployment … “US Dollar Uncertainty Despite Strong February Jobs Report, Trade Data”

Pound Rallies Against Weak US Dollar on Bullish BoE Stance

The Sterling pound today rallied higher against the much weaker US dollar as traders bought the pound given the Bank of England‘s bullish stance on interest rates. The GBP/USD currency pair rallied for the fourth consecutive session as the bearish sentiment towards the greenback persisted as US Treasury yields continue to fall. The GBP/USD currency … “Pound Rallies Against Weak US Dollar on Bullish BoE Stance”

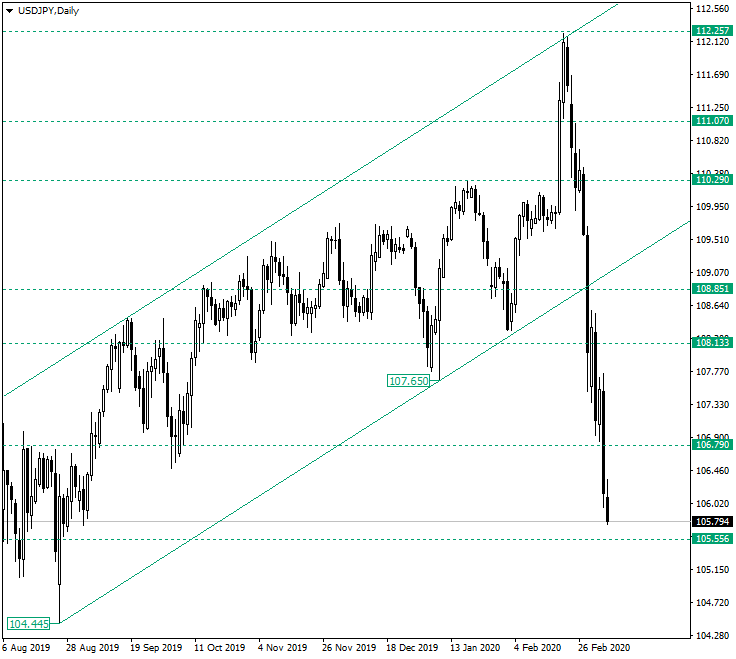

USD/JPY Still to Tumble from 105.55?

The US dollar pound versus the Japanese yen currency pair continued the movement towards the south. Are there any chances for a pause? Long-term perspective The ascending trend that started from the low of 104.44 extended until the resistance level of 112.25. From there, after confirming the double resistance made possible by the upper line of the channel and the 112.25 level, the price started a depreciation. What initially seemed to be a corrective wave, that was … “USD/JPY Still to Tumble from 105.55?”

Euro Rallies as Coronavirus Fears in the US Push the Dollar Lower

The euro today rallied higher against the US dollar as authorities in California declared a state of emergency amid rising coronavirus cases. The EUR/USD currency pair benefitted from the risk-off investor sentiment and the greenback’s losses despite a mostly empty European docket. The EUR/USD currency pair today rallied from a low of 1.1119 in the early European session to a high of 1.1200 in the early American session despite the risk-off market mood. The currency pair traded sideways … “Euro Rallies as Coronavirus Fears in the US Push the Dollar Lower”

Japanese Yen Jumps on Safe-Haven Demand, Capped by Poor Data

The Japanese yen is strengthening against a handful of currency rivals on Thursday as investors pour into safe-haven assets amid the coronavirus outbreak. Japan, which has experienced an uptick in Covid-19 cases, reported disappointing manufacturing and non-manufacturing data that might force the country into a recession. The big test over the medium-term is if Tokyo … “Japanese Yen Jumps on Safe-Haven Demand, Capped by Poor Data”