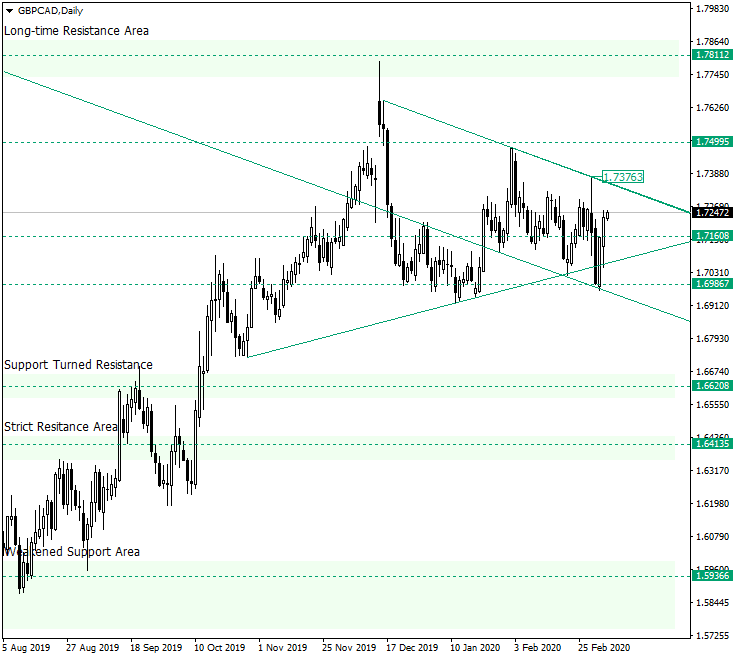

The Great Britain pound versus the Canadian dollar currency seems not to be willing to stray away from its path towards 1.7811. Long-term perspective After confirming the level of 1.5936, the price began an appreciation that, starting with late October 2019, seemed to form a symmetrical triangle. Usually, this chart pattern indicates a continuation, and because in the case of this chart it preceded by an upwards pointing movement, the expectations are for the continuation … “GBP/CAD Still Aiming for 1.7811”

Author: admin_mm

Pound Falls Then Rallies on Weak UK Services PMI and BoE Rumours

The Sterling pound today traded lower against the US dollar earlier in the session as investors stayed away from the pound amid Brexit uncertainty and risk-off market sentiment. However, the GBP/USD currency pair later recovered despite the release of weak UK PMI data by Markit Economics amid rumours that the Bank of England would cut … “Pound Falls Then Rallies on Weak UK Services PMI and BoE Rumours”

Canadian Dollar Mixed As BoC Cuts Interest Rates Amid Covid-19 Fears

The Canadian dollar is trading mixed against multiple currency rivals midweek after the central bank delivered on a cut to interest rates. The Bank of Canada (BoC) joins a growing chorus of institutions that are slashing rates this week in response to the growing concerns over the economic fallout from Covid-19. Will it be enough to fight the outbreak or will more monetary easing be necessary? The BoC lowered rates by 50 basis … “Canadian Dollar Mixed As BoC Cuts Interest Rates Amid Covid-19 Fears”

Australian Dollar Rises for Third Day After GDP Beats Expectations

The Australian dollar continued to rise, logging a third consecutive daily gain. This time, it is easier to explain the currency’s rally as it followed the better-than-expected GDP print released during the trading session. Economic data from China, Australia’s biggest trading partner, was atrocious, but it had a little impact on the movement of the Aussie. The Australian Bureau of Statistics reported that gross domestic product rose by 0.5% in the December quarter … “Australian Dollar Rises for Third Day After GDP Beats Expectations”

Chinese Yuan Pauses After Huge Weekly Acceleration on Bearish Data

The Chinese yuan is hitting the pause button on its recent acceleration against several major currency rivals midweek as many economic reports portray a grim picture of the worldâs second-largest economy. All the data came in worse than what the market had forecast, and with the coronavirus still lingering, experts warn there might be plenty more bearish news in the coming months. The Caixin General Services purchasing managersâ index (PMI) … “Chinese Yuan Pauses After Huge Weekly Acceleration on Bearish Data”

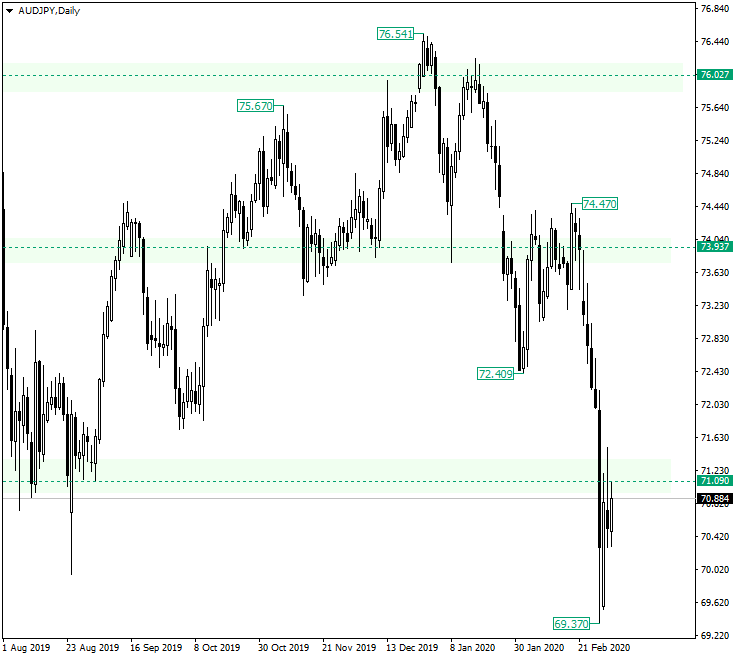

AUD/JPY Slipped Under 71.09. Where to Now?

The Australian dollar versus the Japanese yen currency pair is consolidating just under the 71.09 level. Long-term perspective After confirming the level of 71.09 as support late in August 2019, the price began an ascending trend that managed to conquer the 73.93 level but failed to do so with the next resistance level, 76.02, respectively, peaking at 76.54. After the second strand, in the middle of January 2020, the price depreciated strongly, piercing the support … “AUD/JPY Slipped Under 71.09. Where to Now?”

Risk Aversion, Better-than-Expected GDP Unable to Help Swiss Franc

The Swiss franc was surprisingly soft today even though the deadly coronavirus infection continued to spread across the globe, spooking investors and increasing demand for safe-haven assets. Positive macroeconomic reports released in Switzerland on Monday and Tuesday did little to help the currency. The Swissie was soft against almost all currencies, except for the Canadian dollar, which fell today despite rising prices for crude oil, and the US dollar, which collapsed after … “Risk Aversion, Better-than-Expected GDP Unable to Help Swiss Franc”

Euro Recovers From Daily Lows on Fed Emergency Rate Cut

The euro today spiked higher against the US dollar in the early American session after the Federal Reserve announced an emergency interest rate cut of 50 basis points. The EUR/USD currency pair extended its positive streak for the fourth consecutive day having embarked on a significant rally since 21st February when the greenback turned bearish. … “Euro Recovers From Daily Lows on Fed Emergency Rate Cut”

Australian Dollar Jumps After RBA Cuts Interest Rates

Fundamentals looked extremely grim to the Australian dollar today. An interest rate cut by Australia’s central bank, unfavorable domestic economic reports, persisting risk aversion on markets — all those factors should have driven the currency down. But instead, the Aussie jumped against almost all of its major rivals, except for the Japanese yen. The Reserve Bank of Australia cut its main interest rate by 25 basis points to 0.5% at Tuesday’s … “Australian Dollar Jumps After RBA Cuts Interest Rates”

US Dollar Slumps As Federal Reserve Cuts Interest Rates

The US dollar is slumping on Tuesday as the Federal Reserve announced an emergency cut to interest rates. With financial markets tanking and plenty of economic uncertainty surrounding the coronavirus, the central bank cut its benchmark rate by 50 basis points. Stocks fell after an initial bump, but the greenback was largely unaffected by the … “US Dollar Slumps As Federal Reserve Cuts Interest Rates”