The Great Britain pound recovered a bit today following yesterday’s slump caused by returning Brexit fears. The rebound was nowhere near enough to eliminate the Monday’s losses, though. Macroeconomic data showed a small improvement in Britain’s economy. The sterling slumped at the start of the trading week after Britain and the European Union exchanged comments demonstrating a hardline stance in trade deal negotiations. UK Prime Minister Boris Johnson said that there is … “Great Britain Pound Recovers After Falling on Brexit Fears”

Author: admin_mm

Australian Dollar Trades Higher After RBA Stands Pat

The Australian dollar rose against all other most-traded currencies today after the Reserve Bank of Australia refrained from cutting interest rates and did not signal about a cut in the immediate future. The RBA kept its main interest rate unchanged at 0.75%. Such a decision was widely expected by market participants. The accompanying statement made optimistic remarks about the global economy: The outlook for the global economy remains reasonable. There have … “Australian Dollar Trades Higher After RBA Stands Pat”

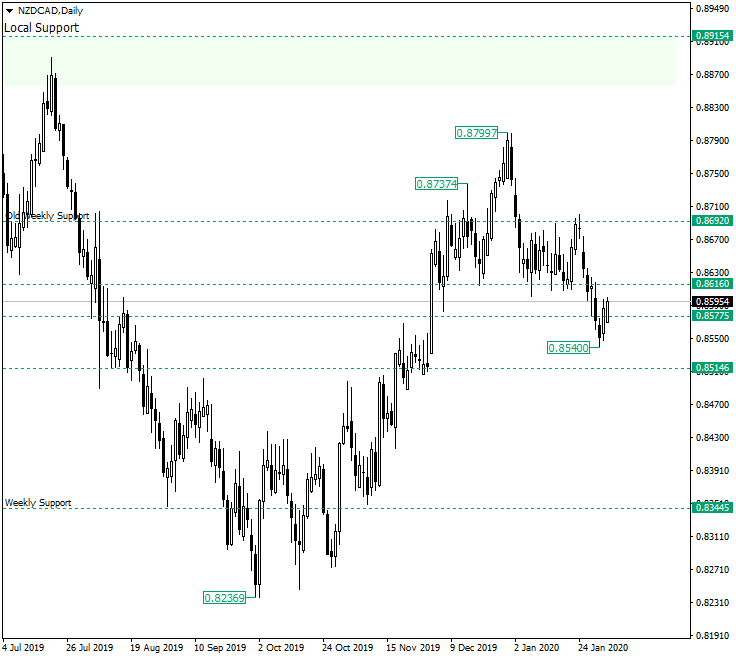

NZD/CAD Continues Towards 0.8514

The New Zealand dollar versus the Canadian dollar currency made its first step towards what may very well be the first target, 0.8540 respectively. Long-term perspective The ascending movement that began after printing the low of 0.8236 tried to reconquer the old weekly support of 0.8692. But the bulls did not succeed in this endeavor, as the only thing they were able to do was to etch the high of 0.8799, which … “NZD/CAD Continues Towards 0.8514”

Chinese Yuan Crashes As Coronavirus Intensifies, Markets Crater

The Chinese yuan is crashing to kick off the trading week, cratering against all major currency rivals. The yuan is taking a beating after the leading stock indexes plunged due to the Wuhan coronavirus intensifying in China. The death toll reached 361 and the total number of people infected with the virus surged to 17,328. Will the worldâs second-largest economy be able to recover? The authorities are responding to the outbreak with monetary and fiscal tools. … “Chinese Yuan Crashes As Coronavirus Intensifies, Markets Crater”

Australian Dollar Gains as No Rate Cut Expected in February

The Australian dollar rose today after the outlook for the monetary policy of the Reserve Bank of Australia improved. The general market sentiment improved as well, also providing support to the Australian currency. The Aussie gained against all other most-traded currencies, though by now it has retreated from the day’s highs. Previously, market participants were expecting that the RBA will cut its main interest rate by 25 basis points to 0.5% tomorrow. … “Australian Dollar Gains as No Rate Cut Expected in February”

Expert Josip Heit Shares His Thoughts On Why Bitcoin Is Seen As Digital Gold

Until now, the world has heavily relied on traditional banknotes as a medium of exchange, however, blockchain technology seems to be on the verge of changing this. And Josip Heit was one of the first people who realized the potential of blockchain. On January 9, 2009, an enigmatic internet persona hiding behind the pseudonym Satoshi … “Expert Josip Heit Shares His Thoughts On Why Bitcoin Is Seen As Digital Gold”

The Pound Trades on the Defensive as the Potential for a Rate Cut is Gaining Momentum

The British pound has been trading defensively, as calls for the BoE to reduce interest rates continue to grow louder. The region is feeling the effects of lower inflation as well as declining growth as Brexit has taken its toll on the British economy. UK GDP, Industrial Production and Consumer prices all came in weaker … “The Pound Trades on the Defensive as the Potential for a Rate Cut is Gaining Momentum”

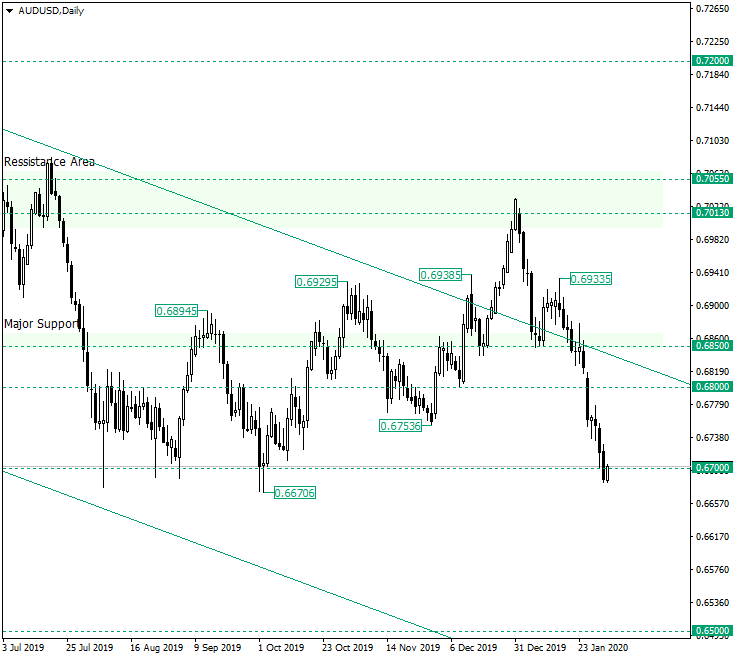

Will the Sellers Hit the Breaks on AUD/USD at 0.6700?

The Australian dollar versus the US dollar currency pair dropped sharply. Is it now the moment to expect profit booking? Long-term perspective After the price went under the neckline of the head and shoulders pattern marked by the peaks of 0.6983 and 0.6933, respectively, a strong depreciation came. The reasons behind this are represented mainly by the impossibility of the bulls to keep the price above 0.6850, which in turn is a major support, and by the fact that oscillating under … “Will the Sellers Hit the Breaks on AUD/USD at 0.6700?”

US Dollar Forecast of February 3-7, 2020

The US dollar demonstrated a rather good performance in January thanks to the risk aversion caused by the Wuhan coronavirus. But what to expect from the greenback during the first week of February and what factors will be driving it? The week will be full of important events in the United States. One of them will be Monday’s Iowa caucuses, which will help to decide candidates for the US presidential election. While Donald Trump will … “US Dollar Forecast of February 3-7, 2020”

Canadian Dollar Slides As Coronavirus Fears Hurt Energy Prices

The Canadian dollar is weakening against most major currency rivals to finish the trading week, despite the national economy beating market forecasts in November. The loonieâs fall is being mostly driven by a drop in energy prices caused by demand concerns amid the Wuhan coronavirus. The nationâs fiscal picture and inflation also rose more than what the market had projected. According to Statistics Canada, the gross domestic product (GDP) rose 0.1% … “Canadian Dollar Slides As Coronavirus Fears Hurt Energy Prices”