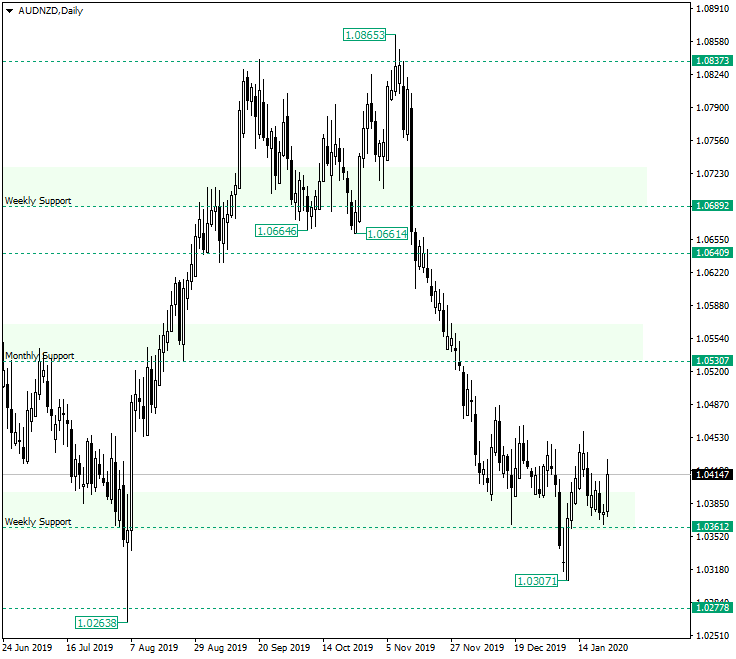

The Australian dollar versus the New Zealand dollar currency pair gives some signs that an appreciation is not that far from the realm of possibility. Is it so, or the bears are trying to persuade the bulls? Long-term perspective The depreciation that started after the price peaked at 1.0865 and confirmed as resistance the level of 1.0837 reached the area of 1.0361. Upon arriving at 1.0361, it tried to bottom, but the bears pushed it further … “AUD/NZD May Try a Turn Towards 1.0530”

Author: admin_mm

Sterling Remains Strongest After CBI Manufacturing Report

The Great Britain pound continued to be the strongest currency on the Forex market thanks to domestic macroeconomic data. Today, a manufacturing report from the Confederation of British Industry was the reason for the sterling’s amazing performance. The CBI reported that business optimism improved sharply in the three months to January, jumping to +23% from -44% in October. The indicators improved with the fastest pace since April 2014. But Tom Crotty, Group Director at INEOS and Chair … “Sterling Remains Strongest After CBI Manufacturing Report”

Chinese Yuan Flat As Virus Outbreak Triggers Growth Concerns

The Chinese yuan is trading relatively flat against a myriad of currency rivals midweek as the nationâs virus outbreak has triggered economic growth concerns. After last weekâs better-than-expected gross domestic product (GDP) figures and the International Monetary Fund (IMF)âs optimistic forecast, the spread of the Wuhan coronavirus could throw a wrench into the countryâs plans to rebound from its slump. On Monday, the IMF revised its GDP forecast for China from … “Chinese Yuan Flat As Virus Outbreak Triggers Growth Concerns”

Aussie Mixed amid Improving Market Sentiment, Disappointing Australian Data

The Australian dollar was mixed today as market participants were digesting news about the coronavirus that has started in China. The Aussie was flat against a range of major currencies, jumped versus the Canadian dollar, and dropped against the Great Britain pound. Macroeconomic reports released in Australia today were poor. On Tuesday, markets were in a risk-off mode as a dangerous coronavirus has broken out in China and started to spread to other countries. But … “Aussie Mixed amid Improving Market Sentiment, Disappointing Australian Data”

Canadian Dollar Rallies on Inflation Report, Crashes on BoC Rate Decision

The Canadian dollar today rallied against its US counterpart in the first half of today’s session driving the USD/CAD to its daily lows boosted by in-line inflation figures. However, the currency pair quickly reversed course after the Bank of Canada announced its rate decision, which was interpreted as being very dovish. The USD/CAD currency pair today fell to a daily low of 1.3036 in the … “Canadian Dollar Rallies on Inflation Report, Crashes on BoC Rate Decision”

Euro Struggles to Rally Amid Davos Forum and Coronavirus Threat

The euro today struggled to rally against the US dollar as the World Economic Forum drags on in Davos, Switzerland. The EUR/USD currency pair today fell to new 2020 lows before recouping its losses as investors grappled with the emerging risk posed by the Coronavirus. The EUR/USD currency pair today fell to a low of … “Euro Struggles to Rally Amid Davos Forum and Coronavirus Threat”

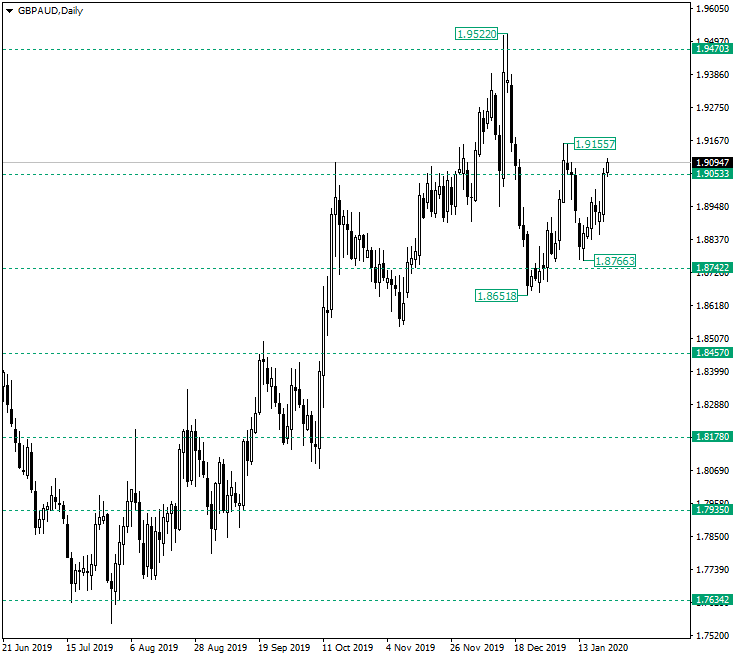

GBP/AUD May Have the Green Lights for 1.9470

The Great Britain pound versus the Australian dollar currency pair extended above 1.9053. Is this the new direction or it’s just the bears preparing to short? Long-term perspective After starting at 1.7634 and extending until l.9470, the ascending trend was challenged by a strong retracement, limited between the 1.9522 high and 1.8651 low, respectively. But the bulls guarded the support of 1.8742, facilitating an upward movement towards 1.9053. But the bears were not … “GBP/AUD May Have the Green Lights for 1.9470”

Great Britain Pound Strongest After Employment Report

The Great Britain pound was the strongest major currency on the Forex market today. The reason for the sterling’s stellar performance was the employment report, which showed record employment among Britons. Britain’s Office for National Statistics released an employment report for the September-November period of 2019. It showed that employment rose by 208,000, exceeding market expectations. As a result, the employment rate was at the record 76.3% level. The unemployment rate remained stable at 3.8%. Annual … “Great Britain Pound Strongest After Employment Report”

Swiss Franc Rallies on Slew of Bad News, Loses Gains Later

The Swiss franc rallied today amid the negative sentiment among investors. The franc is considered a safe currency, meaning that traders prefer to buy it in times of fear and uncertainty. And on Tuesday, there were plenty of news to spook speculators. Currently, though, the Swissie has lost its gains against most other rivals. The main topic of today’s news headlines was an epidemic of a pneumonia-like coronavirus that has broken out in China. … “Swiss Franc Rallies on Slew of Bad News, Loses Gains Later”

Japanese Yen Mixed As BoJ Leaves Rates Unchanged, Industrial Output Weakens

The Japanese yen is mixed on Tuesday after the central bank announced that it was leaving interest rates unchanged and raising its economic growth forecasts for 2020 and 2021. Tokyo also reported disappointing industrial production and capacity utilization data, despite the federal government spending billions in stimulus. As widely expected by financial markets, the Bank of Japan (BoJ) left its key short-term interest rate unchanged at -0.1% and maintained the target … “Japanese Yen Mixed As BoJ Leaves Rates Unchanged, Industrial Output Weakens”