The Mexican peso slipped against multiple currency rivals to kick off the trading week as weak industrial output, fixed investment, and consumer confidence impacted the currency. Despite the disappointing numbers, the central bank anticipates the economy to record a strong first quarter. Is this enough to lift the peso? Consumer confidence clocked in at 43.4 last month, unchanged from December. The bearish consumer sentiment remained at the lowest level since July as businesses and households … “Mexican Peso Slides As Industrial Output, Fixed Investment Drop”

Author: admin_mm

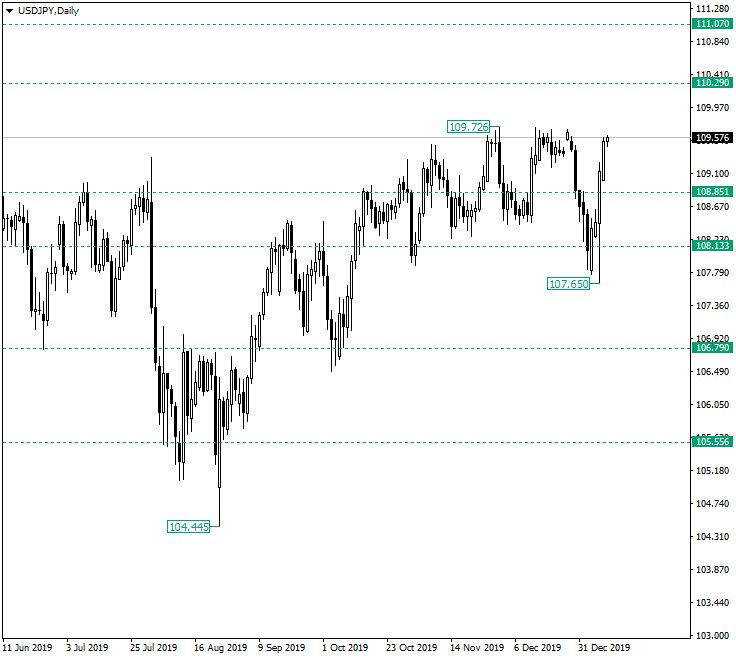

Is USD/JPY bound for a downside correction? Eyeing the American consumer

USD/JPY’s advance has reversed amid trade headlines and mixed US data. Mid-East tensions, trade developments, and US consumer data are all of interest. Early January’s chart is painting a moderately bullish picture. The FX Poll is showing that experts are divided on the next moves. Walking the walk or only talking the talk? Mid-East tensions … “Is USD/JPY bound for a downside correction? Eyeing the American consumer”

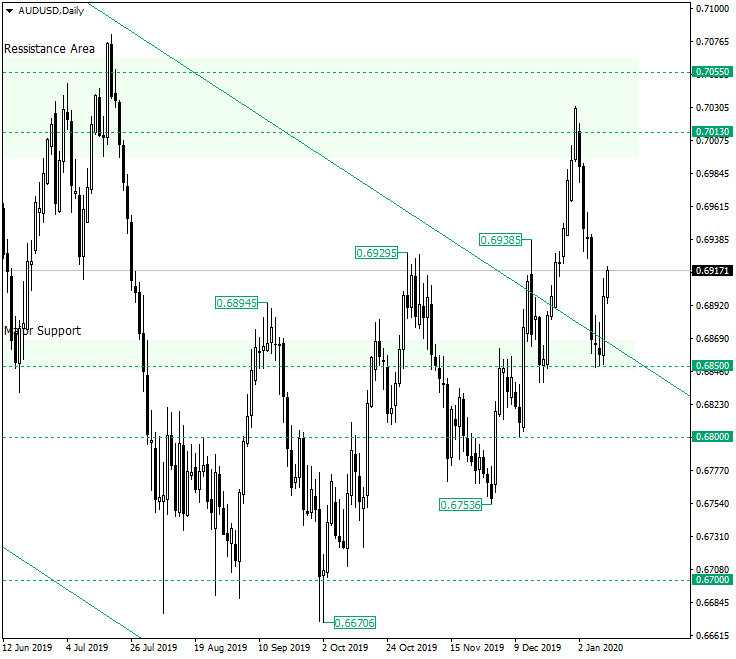

AUD/USD Might Be in Bearish Hands, Heading for 0.6700

The Australian dollar versus the US dollar currency pair seems to be undecided. Is it so, or are the bears preparing a surprise? Long-term perspective After printing the low of 0.6670 and confirming the 0.6700 psychological level as support, the price started an ascending trend. Along its way, the price managed to conquer the major support of 0.6850 after a second run — the first attempt was a failure, as it printed the high of 0.6929 and then got back … “AUD/USD Might Be in Bearish Hands, Heading for 0.6700”

CAD Mixed on Amazing Employment Data, Falling Crude Oil

The Canadian dollar did not show a clear trend today, being under the influence of mixed fundamentals. Domestic employment data was surprisingly good but the drop of crude oil prices was weighing on the currency. Statistics Canada reported that Canadian employers added 35,200 jobs in December after shedding as much as 71,200 in November. The figure was above the analysts’ consensus forecast of a 24,900 increase. Furthermore, the unemployment rate dropped from … “CAD Mixed on Amazing Employment Data, Falling Crude Oil”

US Dollar Mixed Amid Soft December Jobs Report

The US dollar is mixed against its currency rivals at the end of the trading week, buoyed by a tepid jobs report that fell short of the market forecasts. The December labor report suggested that job creation may be tapering off in a robust economy. Last month, the US economy added 145,000 new jobs, down … “US Dollar Mixed Amid Soft December Jobs Report”

Japanese Yen Soft as Market Sentiment Favors Risk

The Japanese yen was weak today as the market sentiment continued to favor riskier currencies, not safer ones. Domestic macroeconomic data provided the currency no help, coming out withing expectations and signaling about the persisting weakness of the Japanese economy. Investors were in a positive mood after the United States signaled that they will respond to the Iranian attack on US military bases with sanctions, not military actions. Meanwhile, Iran … “Japanese Yen Soft as Market Sentiment Favors Risk”

Australian Dollar Gets Boost from Market Sentiment & Retail Sales

The Australian dollar together with its New Zealand counterpart were the strongest currencies on the Forex markets today thanks to the positive market sentiment. The Aussie got an additional boost from good domestic macroeconomic data as retail sales rose much more than was expected. Markets were in a risk-on mode as there were no signs of further escalation in the US-Iran conflict and investors, who had been previously spooked by the threat of a war, … “Australian Dollar Gets Boost from Market Sentiment & Retail Sales”

Pound Rallies on Brexit Bill Passage, Later Falls on Dovish BoE Stance

The pound today rallied briefly against the US dollar during the Asian session after the UK Parliament approved the government’s Brexit withdrawal Bill last night. The GBP/USD currency pair’s rally was short-lived as it later fell in the early London session as after the European Union announced a series of meetings to discuss Brexit. The … “Pound Rallies on Brexit Bill Passage, Later Falls on Dovish BoE Stance”

The Bulls Conquered USD/JPY and May Aim for 111.07

The US dollar versus the Japanese yen currency pair allowed a full-fledged bullish appreciation. Are they exhausted or is this just the beginning? Long-term perspective The appreciation that started after the low of 104.44 extended until the 109.72 area, from where a sideways movement commenced. The bears tried to turn this pause into their next big drop, as with the beginning of 2020 they took out the previous lows and breached the 108.13 … “The Bulls Conquered USD/JPY and May Aim for 111.07”

AUD/USD: A Buy On Dips In The 0.6800/50 Zone; AUD/NZD: Attractive Entry Levels For Longs – TD

The Australian dollar has been on the back foot amid geopolitical tensions. Where next? Here is their view, courtesy of eFXdata: TD Research discusses AUD outlook and adopts a buy-on dips bias in AUD/USD, and AUD/NZD. TD is long AUD/NZD* strategically as one of its top trades for 2020. “AUD remains topical following the collapse … “AUD/USD: A Buy On Dips In The 0.6800/50 Zone; AUD/NZD: Attractive Entry Levels For Longs – TD”