The Japanese yen traded either flat or higher against other most-traded currencies today, but gains were nowhere near enough to reverse yesterday’s losses. Markets calmed down after a bout of fear caused by escalating tensions in the Middle East, limiting demand for safe-haven currencies. Markets were in a risk-off mode yesterday due to escalating tensions between the United States and Iran after the US military killed an Iranian general on Friday. Iran … “Japanese Yen Rises, Gains Limited by Lack of Demand for Safe Haven”

Author: admin_mm

US Dollar Unable to Find Support From Strong PMI Readings

The US dollar is tumbling to kick off the trading week, despite strong data that should support the greenback. The buck might be continuing its fourth-quarter reversal that saw the currency pare most of its stellar gains from the first nine months of 2019. Investors could be cautious due to swelling US-Iran tensions, which have also somewhat seeped into global financial markets. On Monday, the IHS Markit … “US Dollar Unable to Find Support From Strong PMI Readings”

Euro Rallies on German Retail Sales and Euro Area PMIs, Later Falls

The euro today rallied higher against the US dollar in the early European session following the release of upbeat German retail sales data and euro area PMIs. The EUR/USD currency pair later fell as the greenback rallied amid rising US-Iran tensions and the release of upbeat US PMI data by Markit Economics. The EUR/USD currency pair today rallied from a low of 1.1157 in the Asian session to a high of 1.1205 in the mid-European session before giving up … “Euro Rallies on German Retail Sales and Euro Area PMIs, Later Falls”

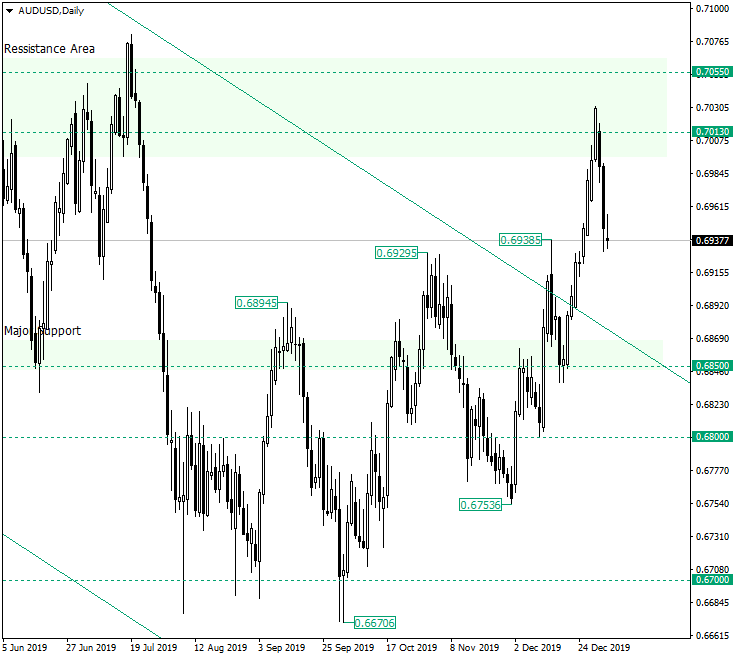

Is the Descending Trend on AUD/USD Really Over?

The Australian dollar versus the US dollar currency pair intruded the resistance trendline of the descending channel but stopped into an important resistance area. How does that impact the evolution of the upcoming period? Long-term perspective After confirming the 0.6700 level as support, the price oscillated in such a manner that, eventually, managed to pierce the upper trendline of the descending channel. Of course, this can frankly be considered as a positive sign for the bulls. But the advancement … “Is the Descending Trend on AUD/USD Really Over?”

Lagarde three acts as ECB head in 2020

ECB President Lagarde may kick off the year with smart caution. German stimulus may allow her to present a more hawkish stance. The strategic review may end in a dovish twist late in the year. “I’m neither a dove nor a hawk, and my ambition is to be this owl” – Christine Lagarde, President of the European … “Lagarde three acts as ECB head in 2020”

US Dollar Sideways as Key Manufacturing Index Slumps to 10-Year Low

The US dollar is trading sideways at the end of the trading week as the manufacturing sector continues to slump at a decade-low. Can the manufacturing industry turn things around in 2020 as the US and China gradually wind down their 18-month trade dispute? From trade certainty to the White Houseâs aim for a weak dollar policy, American manufacturers may have a rebound year. The Institute for Supply Management (ISM)âs manufacturing index fell to 47.2 in December, down from … “US Dollar Sideways as Key Manufacturing Index Slumps to 10-Year Low”

Euro Falls on Risk-Off Mood, Ignores German CPI Data, Later Recovers

The euro today fell against the US dollar driven by the risk-off sentiment that ensued after the US killed a top Iranian general earlier today spooking investors. The EUR/USD currency pair ignored the release of upbeat German inflation data but later recovered as the greenback lost momentum in the American session. The EUR/USD currency pair today fell from an opening high of … “Euro Falls on Risk-Off Mood, Ignores German CPI Data, Later Recovers”

US-Iran tension may end in a war – three reasons and market directions

Qassem Suleimani’s killing is significant as he is a senior state actor. Iran has already proved its sophisticated capabilities in attacking Saudi oil installations. The upcoming Israeli elections and PM Netanyahu’s battle for staying out of prison may add to the escalation. This is the real thing. Tensions simmering in the Middle East tend to … “US-Iran tension may end in a war – three reasons and market directions”

EUR/USD: The case for a surge in 2020, fueled by German change

The German economy is still struggling despite green shoots. Growing political and economic pressure may push Merkel to announce fiscal stimulus. Green investment may be the way out of austerity. EUR/USD has room to rise if governments replace the ECB in the driver seat. Germany has flirted with a recession in 2019 and prospects for … “EUR/USD: The case for a surge in 2020, fueled by German change”

Pound Falls Against the Dollar on US-Iran Tensions and Weak UK PMI

The Sterling pound today fell against the US dollar as tensions between the US and Iran escalated overnight and investors dumped riskier assets such as the pound. The GBP/USD currency pair has given up most of the gains made in December following Boris Johnson‘s landslide election win that saw the pair spike to multi-month highs. … “Pound Falls Against the Dollar on US-Iran Tensions and Weak UK PMI”