There’s a reason they call him Dr. Doom. Nouriel Roubini, who foresaw the 2008 financial crisis, has a tough prescription for the euro – a 30% cut in value, to get it closer to parity with the US dollar. Without this devaluation, Roubini sees the euro-zone as doomed. A drop in the value of the … “Roubini: EUR/USD Parity Needed to Avoid Euro-zone Doom”

Category: Forex Bits

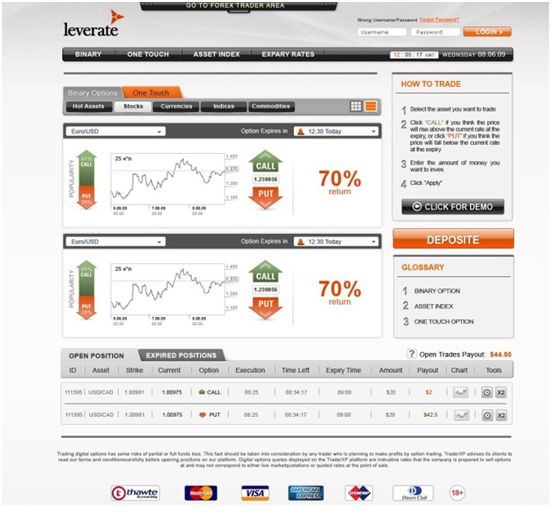

CySEC License Obtained by PIM Prime Investments (Leverate)

PIM Prime Investments Ltd. a subsidiary of Leverate rerceived an official licence from CySEC, the regulatory body in Cyprus. Leverate provides software solutions for brokers. The move continues the expansion of Leverate, which is partially owned by Saxo Bank. The firm recently opened datacenters in London. For more details about this licence, the full press release is … “CySEC License Obtained by PIM Prime Investments (Leverate)”

French and German Pension Liabilities – 3 Times GDP

With peripheral countries facing tough bond payments every month, it’s too easy to miss the longer term – the retirement. France and Germany have big liabilities, reaching 3 times their GDP. This is a time bomb with a large fuse, but it’s out there. According to a research by the Research Center for Generational Contract in Freiburg … “French and German Pension Liabilities – 3 Times GDP”

Archer International Consultants Introduces Corporate Solutions For Start Up

Archer International Consultants announces a product for start up forex brokers. The company specializes in forex company formations, opening of bank accounts and more. It now enables an easier way to open companies in various countries, and with different regulations. For more details, see the press release below: Archer International Consultants Launches Supreme Corporate Solutions … “Archer International Consultants Introduces Corporate Solutions For Start Up”

Germany’s Negative Yields – Another Reflection of Distrust in

For the first time, Germany’s bond auction yielded negative yields. Its 6 month bond auction resulted in 3.9 billion euros in fresh funds, with a yield of -0.012%. This means that investors are willing to take a loss in order to hold on to the precious German papers. This emphasizes the loss of trust in … “Germany’s Negative Yields – Another Reflection of Distrust in”

Draghi Pushing for Full QE – Report

According to a report, the president of the European Central Bank is pushing for a full blown and direct Quantitative Easing program, bending the arms of the Germans. This long awaited move could In recent days, the ECB accelerated its SMP bond buying program especially with Italian bonds. This was a response to rising yields, … “Draghi Pushing for Full QE – Report”

FXCM Receives a $75 Million Credit Line from Bank of

US Forex broker FXCM announces a credit line of $75 million from Bank of America (BAC). This credit line could be doubled in the future, and will enable the company to expand its operations and perform further mergers and acquisitions. FXCM already had some M&A action following its IPO around a year ago and continues … “FXCM Receives a $75 Million Credit Line from Bank of”

FXCM Saw More Tradeable Accounts, Higher Retail Volume, Lower

US forex broker FXCM released its trading metrics for the month of November 2011. This includes separate figures for retail and institutional clients. The number of retail tradeable accounts continued rising and reached 192,772. Also trading volume among retail customers continued rising and reached $345 billion. Regarding institutional trading, the broker saw a drop in … “FXCM Saw More Tradeable Accounts, Higher Retail Volume, Lower”

Bloomberg UTV to Feature Analysis from XTB India

XTB India announces that its analysis will now be available on Bloomberg UTV on the “Minting Money” shows. This is another step forward for the broker. A few months ago, XTB India launched its xStation platform. This additional recognition helps it advance. For more details, here is the official press release: Announcement of XTB India’s … “Bloomberg UTV to Feature Analysis from XTB India”

For 46 Million Americans, There’s No Recovery

Recent US indicators have been positive, and this finally includes also employment figures: jobs are created at a steady pace and unemployment is dropping. The job figures also revealed a drop of many Americans from the work force, and another figure reflects the drop of too many Americans from mainstream society. No less than 46,268,257 Americans … “For 46 Million Americans, There’s No Recovery”