In foreign exchange trading, not all currency pairs behave in the same manner: some are more predictable while others are far less predictable. What does this mean? A predictable currency pair slow down upon approaching a clear line of support or resistance. And in case the pair in question has the necessary momentum, it will … “5 Most Predictable Currency Pairs – Q1 2016”

Category: Forex Bits

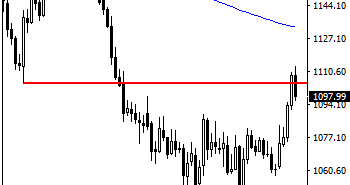

GOLD Eyes Further Upside Pressure On Rally

GOLD: Having closed strongly higher on a rally the past week, GOLD eyes further upside pressure. On the downside, support comes in at the 1098.00 level where a break will turn attention to the 1088.00 level. Further down, a cut through here will open the door for a move lower towards the 1080.00 level. Below … “GOLD Eyes Further Upside Pressure On Rally”

GOLD Faces More Downside Risk On Pullback

GOLD: Having capped its strength at 1113.09 level to weaken during Friday trading session, GOLD faces more downside risk on pullback. Except it retakes the 1113.09 resistance, it should target further weakness. On the downside, support comes in at the 1090.00 level where a break will turn attention to the 1080.00 level. Further down, a … “GOLD Faces More Downside Risk On Pullback”

GBPUSD: Halts Weakness On Rejection Candle

GBPUSD: GBP has halted its weakness to close on a rejection candle on Thursday. This development has set the tone for a recovery higher threats. Support lies at the 1.4550 level where a break will turn attention to the 1.4500 level. Further down, support lies at the 1.4500 level. Below here will set the stage … “GBPUSD: Halts Weakness On Rejection Candle”

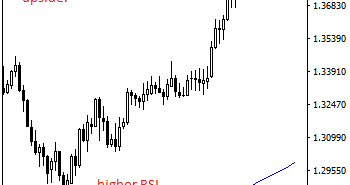

EUR/USD to be range bound; EUR/GBP being forced lower;

Richard Perry, Market Analyst for Hantec Markets, joined Nick Batsford on the Tip TV Finance Show to discuss the outlooks for both EUR/USD and EUR/GBP, as well as a view on gold and a prediction for oil. Topics Covered: EUR/USD, EUR/GBP, US NFP, Gold, Oil

USDCAD Remains Bullish Above The 1.4000 Level

USDCAD remains bullish above the 1.4000 level following a break and hold above that level during Wednesday trading session. This is coming on the back of its Tuesday downside price rejection to close higher. On the upside, resistance resides at the 1.4150 level where a break will target the 1.4200 level. Further out, resistance comes … “USDCAD Remains Bullish Above The 1.4000 Level”

Trading Insights: What is ‘Scalping’?

Dr. Corvin Codirla, Founding Partner of CCFX, and Trading Educator at FXMasterCourse, explained the meaning of ‘scalping’, when he joined Zak Mir on the Tip TV Finance Show.

Admiral Markets launches web-based MT4 offering

Forex Broker Admiral Markets now offers a web based Meta Trader 4 experience for its traders. More details from the official press release: Admiral Markets, Forex and CFD broker now offers a browser-based version of the world’s most popular trading platform – MetaTrader 4. Designed to provide traders with high flexibility, MT4 WebTrader allows hassle-free trading … “Admiral Markets launches web-based MT4 offering”

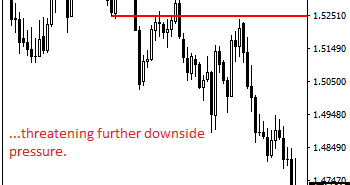

GBPUSD: Risk Of More Weakness On The Cards

GBPUSD: Having GBP continued to hold on to its downside pressure, it leaves risk of more weakness on the cards. Support lies at the 1.4700 level where a break will turn attention to the 1.4650 level. Further down, support lies at the 1.4600 level. Below here will set the stage for more weakness towards the … “GBPUSD: Risk Of More Weakness On The Cards”

USDCHF Rallied On Bullish Offensive With Eyes On 1.0100

USDCHF: Having USDCHF rallied on bullish offensive the past week to reverse its previous week losses, it eyes further strength in the new week. On the downside, support lies at the 0.9950 level. A turn below here will open the door for more weakness towards the 1.9900 level and then the 0.9850 level. Further down, … “USDCHF Rallied On Bullish Offensive With Eyes On 1.0100”