Gold’s woes continue on Monday and into Tuesday as its price continues to drop as the US dollar strength story continues. This year, gold prices are lower by approximately by 9%.The dollar is climbing ahead of the much-anticipated Federal Reserve interest rate decision tomorrow. The FOMC will begin its deliberations today and market participants are … “Gold Uncertainty Spurs Wait-and-See from Purchasers”

Category: Forex Bits

Admiral Markets launches 6 new features for MT4 Supreme

The UK branch of Admiral Markets continues expanding its offering with 6 new features to its MT4 Supreme platform. Here is all the information from the official press release: Admiral Markets UK has added 6 new cost-free features to MT4 Supreme’s arsenal of 60 features, indicators and Expert Advisors. Available for the company’s live and … “Admiral Markets launches 6 new features for MT4 Supreme”

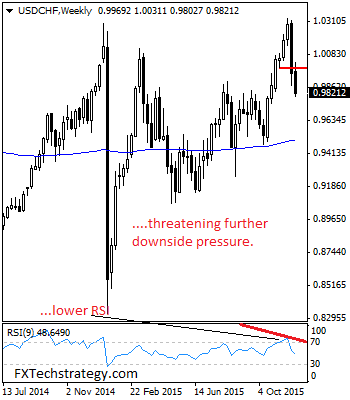

USDCHF Weakened For Second Week In A Row

USDCHF: Having USDCHF weakened for second week in a row, it now looks to extend that weakness in the new week. The present bearishness is coming on the back of its downside pressure triggered from the 1.0319 level on Nov 30th 2015. On the downside, support lies at the 0.9750 level. A turn below here … “USDCHF Weakened For Second Week In A Row”

Euro: 1.05 Support at Risk

Since the summer, market volatility has largely slowed and when we see market scenarios like these some currencies tend to perform better than others. Specifically, stability in the financial markets tends to benefit the US Dollars as forex investors are looking for safe haven stability from the world’s larger economies. This general rule has held … “Euro: 1.05 Support at Risk”

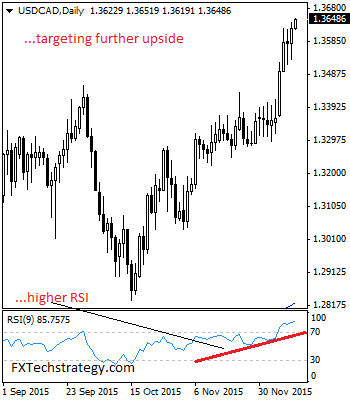

USDCAD Looks To Build Up On Its Bull Strength

USDCAD: Having continued to retain its bull pressure, USDCAD looks to build up on its bull strength. It continues to maintain its upside risk closing higher on Thursday and following during Friday trading session. On the upside, resistance resides at the 1.3700 level where a break will target the 1.3750 level. Further out, resistance comes … “USDCAD Looks To Build Up On Its Bull Strength”

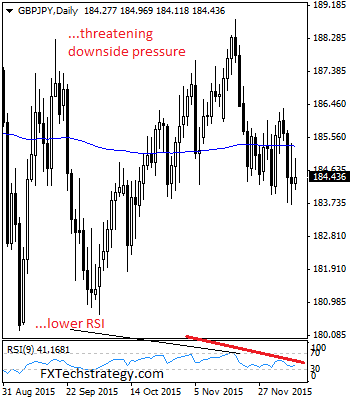

GBPJPY: Price Weakness Seen On Loss Upside Momentum

GBPJPY: With price weakness seen on loss upside momentum, further bear pressure is envisaged in the days ahead. This view remains valid as long as GBPJPY trades and holds below the 185.38/186.34 resistance zone. On the downside, support comes in at the 184.00 level where a violation will aim at the 183.00 level. A break … “GBPJPY: Price Weakness Seen On Loss Upside Momentum”

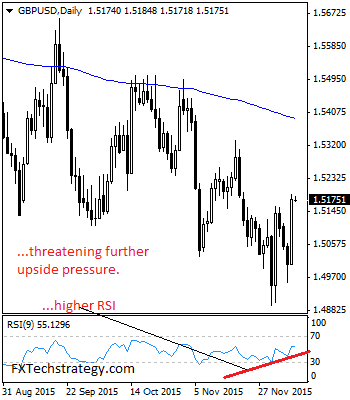

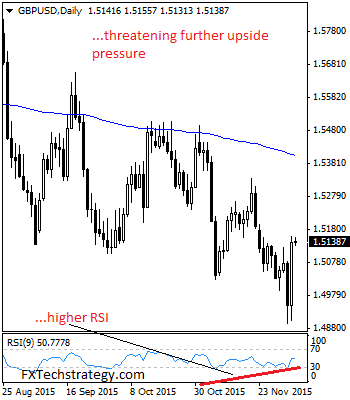

GBPUSD Faces Further Bullish Offensive

GBPUSD: Having rallied strongly to reverse its three-day weakness to close higher on Wednesday, GBPUSD faces further bullish offensive. This development leaves more upside threats likely towards the 1.5200 level. Support lies at the 1.5100 level where a break will turn attention to the 1.5050 level. Further down, support lies at the 1.5000 level. Below … “GBPUSD Faces Further Bullish Offensive”

GBPUSD Rallied On Bullish Momentum

GBPUSD: Having GBPUSD rallied on bullish momentum on Thursday, it now targets the 1.5200 level on further bullish offensive. With that said, resistance stands at the 1.5200 levels with a turn above here allowing more strength to build up towards the 1.5250 level. Further out, resistance resides at the 1.5300 level followed by the 1.5350 … “GBPUSD Rallied On Bullish Momentum”

GBPJPY Threatens Short Term Trend Resumption

GBPJPY: With price failure occurring on Tuesday, GBPJPY threatens short term trend resumption. If it continues to hold below the 186.01 level, we look for a move lower with eyes on the 184.24 level. On the upside, resistance is seen at the 186.00 level followed by the 187.00 level. A cut through that level will … “GBPJPY Threatens Short Term Trend Resumption”

USDJPY Corrective Pullback Risk Remains In Place

USDJPY: Having continued to maintain below the 123.74/99 zone and weakening on Tuesday, USDJPY corrective pullback risk remains in place. On the downside, support comes in at the 122.50 level where a break if seen will aim at the 122.00 level. A cut through here will turn focus to the 121.50 level and possibly lower … “USDJPY Corrective Pullback Risk Remains In Place”