Once you’re ready to get started with spread betting online, you will need to adopt a winning strategy. Follow these tips for a successful spread betting career. Top 5 Strategies for Successful Spread Betting Online Like anything that involves strategy, Planning is required. Before you attempt to engage in financial spread betting, be sure that … “Beginner’s Tips for Successful Spread Betting Online”

Category: Forex Bits

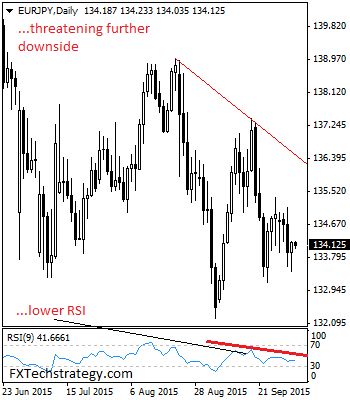

EURJPY: Bear Pressure Builds Up On Price Failure

EURJPY: The cross closed on a rejection candle after a failed intra day attempts on the upside. We now look for EURJPY to decline further. This view remains valid as long as it holds and trades below the 135.71/136.33 zone. Resistance is seen at the 135.50 level where a break will turn attention to the … “EURJPY: Bear Pressure Builds Up On Price Failure”

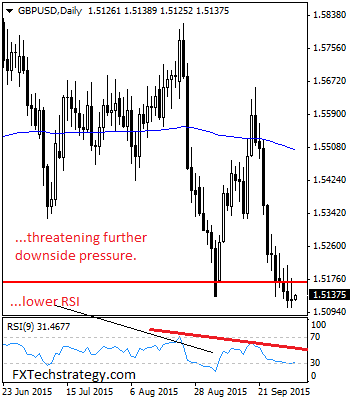

GBPUSD Sees Bear Threats, Targets The 1.5166/33 Zone

GBPUSD: GBP faces downside pressure following its rejection candle print on Friday. This was formed after unsustained rally and the pair looks to weaken further having given away most of its intra day gains during Monday trading session. It looks to take out the 1.5166/33 zone, its strong support. If this occurs, further weakness is … “GBPUSD Sees Bear Threats, Targets The 1.5166/33 Zone”

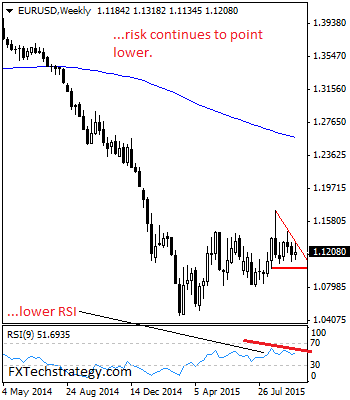

EURUSD: Vulnerable Below The 1.1295/1.1318 Zone

EURUSD: Having EUR taken back almost all of its past week gains to close slightly lower, risk of a follow through to the downside is now developing. While the 1.1295/80 zone holds as overhead resistance, we look for weakness to occur. Support lies at the 1.1150 level where a violation will aim at the 1.1086 … “EURUSD: Vulnerable Below The 1.1295/1.1318 Zone”

GBPJPY Faces Bear Threats But With Caution

GBPJPY: The cross may remain weak and vulnerable to the downside but could head higher while holding above the 180.22/33 support area. Bull pressure is envisaged above that zone. On the downside, support comes in at the 181.00 level where a violation will aim at the 180.00 level. A break below here will target the … “GBPJPY Faces Bear Threats But With Caution”

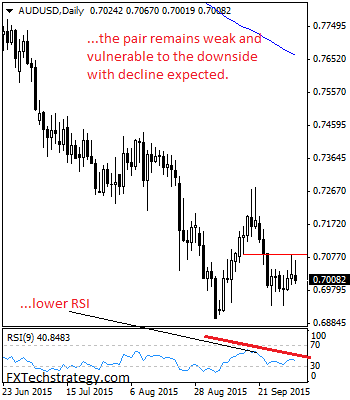

AUDUSD: Upside Price Rejection Leaves Risk Lower

AUDUSD: The pair rejected upside offensive to close marginally higher on a rejection candle on Thursday. It is now seen following through lower on bear pressure. On the downside, support resides at the 0.6950 level where a breach will aim at the 0.6900 level. Below that level will set the stage for a run at … “AUDUSD: Upside Price Rejection Leaves Risk Lower”

JustForex presents WebTrader

JustForex launches a new web based platform which is intended to be simplified and answer needs of traders around the globe. Here is more information from the official press release: Aiming to meet the requirements of forex traders all over the world JustForex1 presents its new product – web trading platform WebTrader. We intend to … “JustForex presents WebTrader”

GBPUSD Looks To Overcome Key Support

GBPUSD: GBP will have to break and hold below its support located at the 1.5133 level to trigger further weakness. That level continues to hold as support for almost the whole week. Support comes in at 1.5100 level with a follow-through lower seeing it targeting more weakness towards the 1.5050 level. A break if seen … “GBPUSD Looks To Overcome Key Support”

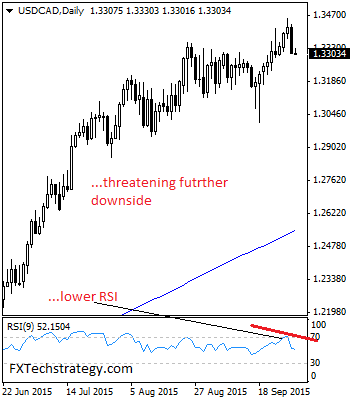

USDCAD Drops Lower On Corrective Weakness

USDCAD: USDCAD sold off strongly on Wednesday leaving risk of further decline on the cards. With that said, we look for more weakness to occur in the days ahead. On the downside, support lies at the 1.3250 level followed by the 1.3200 level. Further down, support resides at the 1.3150 level and then the 1.3100 … “USDCAD Drops Lower On Corrective Weakness”

Admiral Markets offers CFDs on German bunds on US

Admiral Markets, which focuses on forex trading, expands its product range by offering CFD trading on German bunds and on US Treasury Notes. Here are more details from the press release: How It Works The first instrument is quoted in the MetaTrader 4 platform as #USTNote and is a CFD with the reference instrument in a … “Admiral Markets offers CFDs on German bunds on US”