Cyprus based forex broker Orbex celebrates the success of its financial investment seminars in Malaysia. Here is information from the official press release: Orbex international investment firm has held seminars in Kuala Lumpur and Johor Bahru (Malaysia) dedicated to educating local investors on international investment opportunities and educating on market analysis tactics. The two events … “Orbex gains traction at the Malaysia Financial Investments Seminars”

Category: Forex Bits

AUDUSD Triggers Corrective Recovery, Trades Above 0.6938/36 Zone

AUDUSD: The pair has triggered a recovery higher following a rejection of downside prices with two long-tailed candles on Sept 24/29 2015. This suggests a temporary bottom is now in place. While the 0.6938/36 zone remains as supports, we are likely to see further move higher. On the downside, support resides at the 0.6950 level … “AUDUSD Triggers Corrective Recovery, Trades Above 0.6938/36 Zone”

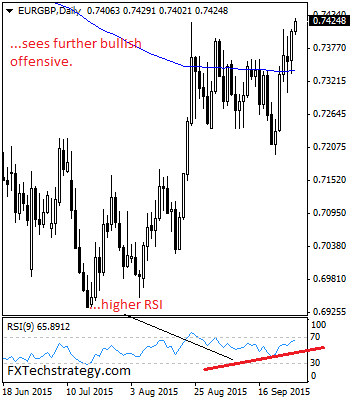

EURGBP- Remains On The Offensive, Aims At 0.7482 Level

EURGBP- With the cross remaining on the offensive, we look for more strength to build up. While it holds above the 0.7360 zone, expect more strength possibly towards the 0.7482/0.7500 region. On the upside, resistance lies at the 0.7450 level where a violation if seen will turn risk towards the 0.7500 level. On further upside, … “EURGBP- Remains On The Offensive, Aims At 0.7482 Level”

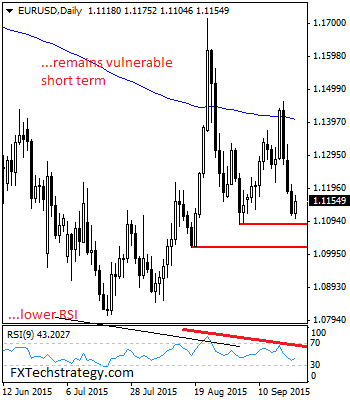

EURUSD: Maintains Broader Downside Bias With Eyes On 1.1086

EURUSD: Having EUR closed lower the past week we expect more weakness to follow. But this comes with a warning that as long as it trades and holds above the 1.1086 level, we may see it headed higher in the new week. Support lies at the 1.1150 level where a violation will aim at the … “EURUSD: Maintains Broader Downside Bias With Eyes On 1.1086”

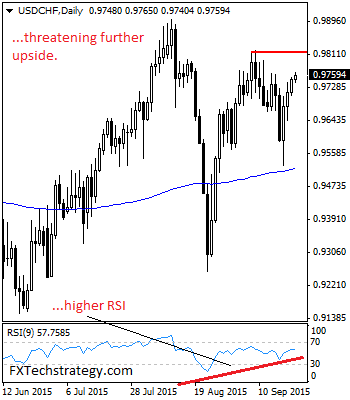

USDCHF Retains Bullish Offensive But With Caution

USDCHF: The pair followed through higher the past week on the back of its previous week long-tailed candle formation. This keeps the immediate outlook higher. However, its immediate challenge is to break and hold above the 0.9823 level. That level was rejected at the end of the week suggesting more price hesitation or even a … “USDCHF Retains Bullish Offensive But With Caution”

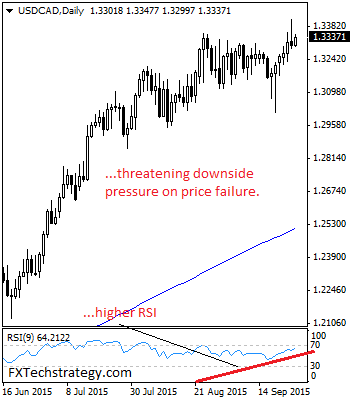

USDCAD Rejects Higher Prices, Prints Negative Candle

USDCAD: With USDCAD turning off its intra day high at 1.3416 level to close lower on Thursday, further downside pressure is likely. While the 1.3416 level caps, our view on the pair remains lower. Resistance resides at the 1.3400 level where a break will target the 1.3450 level. Further out, resistance comes in at the … “USDCAD Rejects Higher Prices, Prints Negative Candle”

Tradable features TradingView Charts – can be traded directly

TradingView, which provides a social charting platform, and Tradable, which enables aps for traders, have collaborated to enable traders a smooth trading experience. Here is more data from the official press release: 24 September 2015 – embargoed until 8.30am BST – Tradable has added the TradingView Chart app to its App Store, allowing Forex traders to trade … “Tradable features TradingView Charts – can be traded directly”

EURUSD: Price Hesitation Sets In Ahead Of 1.1086 Level

EURUSD: With EUR now seen recovering ahead of its key support at the 1.1086 level, some kind of a correction could occur. But as long as that move is capped by the 1.1259/58 zone, its short term weakness triggered from the 1.1459 level remains intact. Support lies at the 1.1100 level where a violation will … “EURUSD: Price Hesitation Sets In Ahead Of 1.1086 Level”

USD/CHF On The Upbeat, Pressure Builds Up On The 0.9823

USDCHF: The pair remains on the offensive and looks to recapture its key resistance located at the 0.9823 level. On the upside, resistance lies at the 0.9900 level with a breach targeting the 0.9950 level. A breather may occur here and turn the pair lower. But if taken out, expect a push further higher towards … “USD/CHF On The Upbeat, Pressure Builds Up On The 0.9823”

EUR/USD down on divergence, watch out for China [Short

This is the wrap up of the full morning show we published earlier. EUR/USD remains in focus on monetary policy divergence, with officials pulling the strings in different directions: the dollar is strengthening on reassuring talk of a December hike while the euro suffers from QE talk. The moves of these currencies are not limited … “EUR/USD down on divergence, watch out for China [Short”