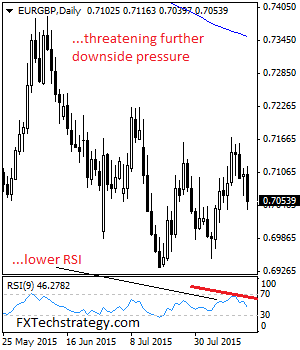

EURGBP: With the cross extending its weakness on Tuesday, risk of further downside pressure is likely. This development leaves support standing at the 0.7050 level where a violation will turn focus to the 0.7000 level. A break below here will expose the 0.6950 level. Further down, support comes in at the 0.6900 level. Its daily … “EURGBP: Declines, Extends Downside Pressure”

Category: Forex Bits

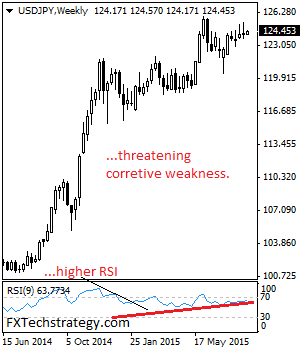

USDJPY: Susceptible, Faces Corrective Weakness Risk

USDJPY: Having capped its strength at the 1.2506 level to close marginally higher the past week, further corrective weakness is envisaged. On the upside, resistance resides at the 124.50 level with a turn above here aiming at the 125.00 level. A break will target the 125.50 level. Further out, resistance comes in at the 126.00 … “USDJPY: Susceptible, Faces Corrective Weakness Risk”

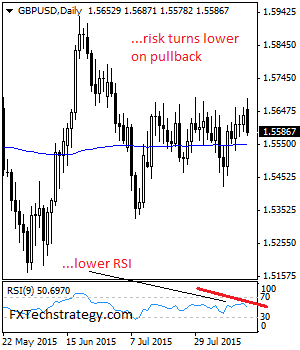

GBPUSD: Loses Upside Momentum, Weakens

GBPUSD: Having GBP reversed its Friday gains during Monday trading session, the risk is more weakness to occur. While holding below its cluster of resistance at the 1.5689/77 zone, further decline is likely towards the 1.5550 level where a break if seen will aim at the 1.5500 level. A turn below here will shift attention … “GBPUSD: Loses Upside Momentum, Weakens”

Admiral Market launches MetaTrader 4 Supreme Edition

MetaTrader 4 remains a very platform for forex traders and always attracts new developments. Admiral Markets has launched a supreme edition of the platform, which promises a simpler and better environment. Here is more information from the press release: In 2015 Admiral Markets was extremely busy implementing new features in MT4 Supreme Edition requested by … “Admiral Market launches MetaTrader 4 Supreme Edition”

China devaluation to cause uncertainty in policy, whilst USD

Kathleen Brooks, Research Director for City Index, joined Nick Batsford and Richard Hunter at Tip TV to discuss the China devaluation, the USD, the US rate hike, oil and equities. China devaluation not great for China Brooks began by noting that she didn’t expect the China devaluation, before adding that the devaluation is unlikely to … “China devaluation to cause uncertainty in policy, whilst USD”

GOLD: Looks To Build On Corrective Recovery

GOLD: Having closed higher the past week, further bullishness is likely though hesitating on Friday.However, beware of a mild price pullback. Support comes in at the 1,110.00 level where a break will aim at the 1,200.00 level. A cut through here will open the door for move lower towards the 1,080.00 level. Below here if … “GOLD: Looks To Build On Corrective Recovery”

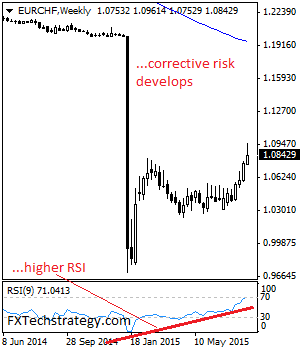

EURCHF: Hesitates, Corrective Threat Develops

EURCHF: The cross may be biased to the upside in the medium term but its price failure taking back more than half of its gains the past week could trigger a full blown correction. Corrective signs are already seen on the daily chart. Support lies at the 1.0800 level where a break will aim at … “EURCHF: Hesitates, Corrective Threat Develops”

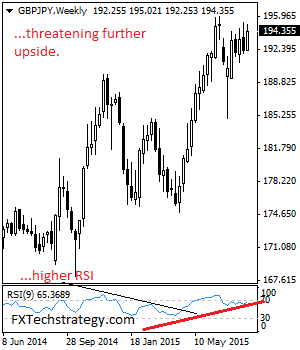

GBPJPY: Bullish, Price Momentum Builds Up On 195.83 Level

GBPJPY: Having GBPJPY closed higher the past week, risk of further bullishness remains on the cards. This if seen will allow the cross to target the 195.83 level, representing its year-to-date high. Further out, resistance lies at the 197.00 level followed by the 198.00 level where a break will aim at the 199.00 level. A … “GBPJPY: Bullish, Price Momentum Builds Up On 195.83 Level”

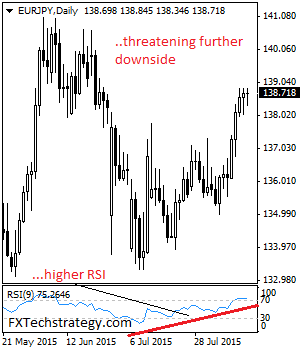

EUR/JPY: Remains On The Offensive With Eyes On 140.00

EURJPY: The cross remains biased to the upside with eyes on its key resistance at the 140.00 level. This is coming on the back of recent bullish offensive following its corrective recovery triggered off the 133.29 level. Resistance lies at the 139.50 level followed by the 139.50 level where a break if seen will threaten … “EUR/JPY: Remains On The Offensive With Eyes On 140.00”

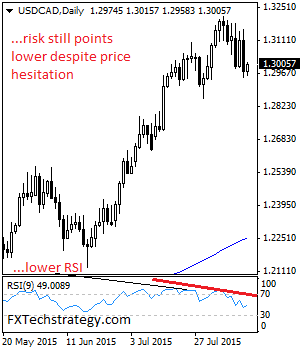

USDCAD: Trades Below Key Resistance, Retains Corrective Pullback Bias

USDCAD: With the pair reversing its Tuesday gains to close lower on Wednesday, risk of a follow through lower is envisaged. Despite its present price hesitation downside threat remains while the pair holds below the 1.3100/49 zone. Resistance resides at the 1.3050 level followed by the 1.3100 level. Further out, the 1.3150 level comes in … “USDCAD: Trades Below Key Resistance, Retains Corrective Pullback Bias”