Spotware Systems, the software provider behind various eFX STP solutions has announced various updates to its products. Here are the details via the official press release: Spotware Systems announce the release of several new features available throughout their Suite of Platforms, including cTrader, cTrader Web and cMirror. These updates include the ability for the user to … “cTrader, cTrader Web and cMirror receive upgrades”

Category: Forex Bits

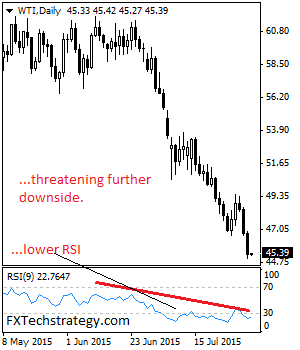

CRUDE OIL: Extends Weakness, Eyes Further Downside Pressure

CRUDE OIL: With outlook for the commodity continuing to point lower, further weakness remains on the cards. This development leaves Crude Oil targeting support located at the 45.00 level where a break will expose the 44.00 level. A break below here will aim at the 43.00 level and then the 42.00 level. Below here will … “CRUDE OIL: Extends Weakness, Eyes Further Downside Pressure”

MarketsPulse powers new 15 second trading, 100% payout by

MarketsPulse, which provides software for binary options, has come up with a new product which offers fast trading. This is now offered by DMM Option. Here are more details from the official press release: London- Specialists in binary option solutions for premium brokers since 2008, MarketsPulse (marketspulse.com), unveils its new 15 second option type with 100 … “MarketsPulse powers new 15 second trading, 100% payout by”

Forex On The Go offers MT4 White Label Trading via

More and more traders are moving into mobile and the company that stands behind one of the most downloadable platforms, Forex On The Go, is releasing new major products. Here are all the details from the official press release: August 4th, 2015: Forex On The Go, the makers of one of the most downloaded mobile Forex … “Forex On The Go offers MT4 White Label Trading via”

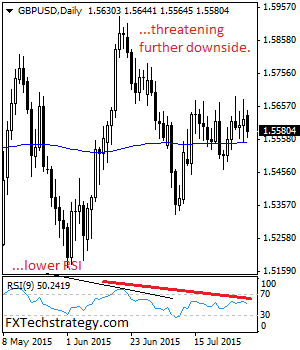

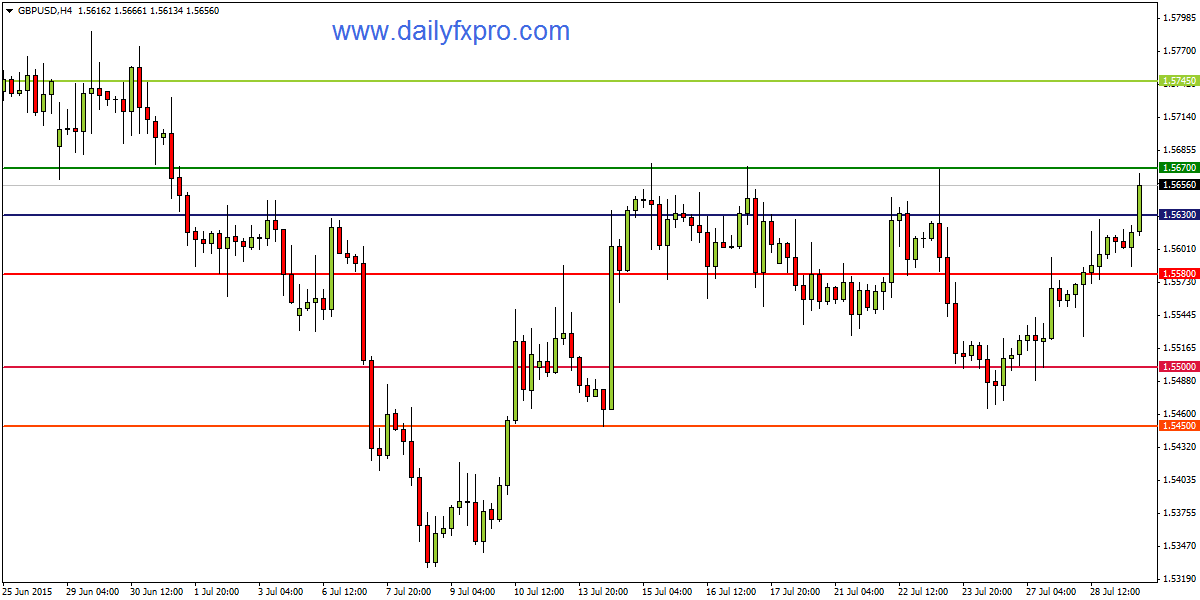

GBPUSD: Risk Points Lower On Correction

GBPUSD: GBP continues to look vulnerable to the downside on correction with more decline envisaged. On the downside, support lies at the 1.5550 level where a break if seen will aim at the 1.5500 level. A break of here will turn attention to the 1.5450 level. Further down, support lies at the 1.5400 level. Its … “GBPUSD: Risk Points Lower On Correction”

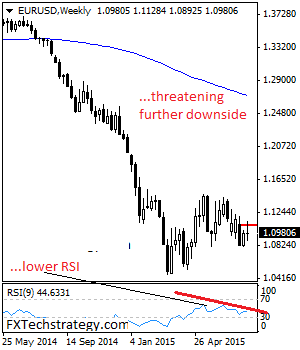

EURUSD: Loses Upside Momentum, Faces Downside Risk

EURUSD: Having EUR reversed its entire past week gains to close flat, it now faces risk of a move lower in the new week. Support lies at the 1.0900 level where a violation will aim at the 1.0850 level. A break of here will aim at the 1.0600 level with a turn below that level … “EURUSD: Loses Upside Momentum, Faces Downside Risk”

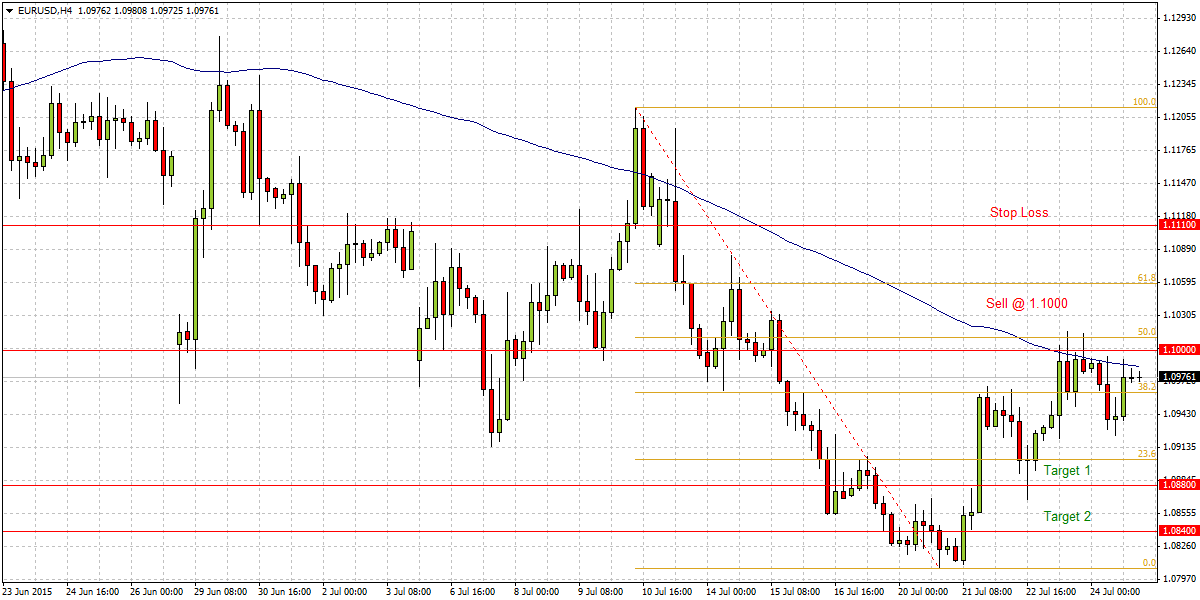

Will EUR/USD move above 1.1000 or stay below that level

The pair closed below 100-SMA on 4 hr chart. There is a very strong resistance around 1.1000 and at the same time it is also seen as a strong psychological resistance. The short term downtrend from 1.1210 to 1.0800 the retracement of 50% Fibonacci is also seen around 1.1010 and will also add additional resistance … “Will EUR/USD move above 1.1000 or stay below that level”

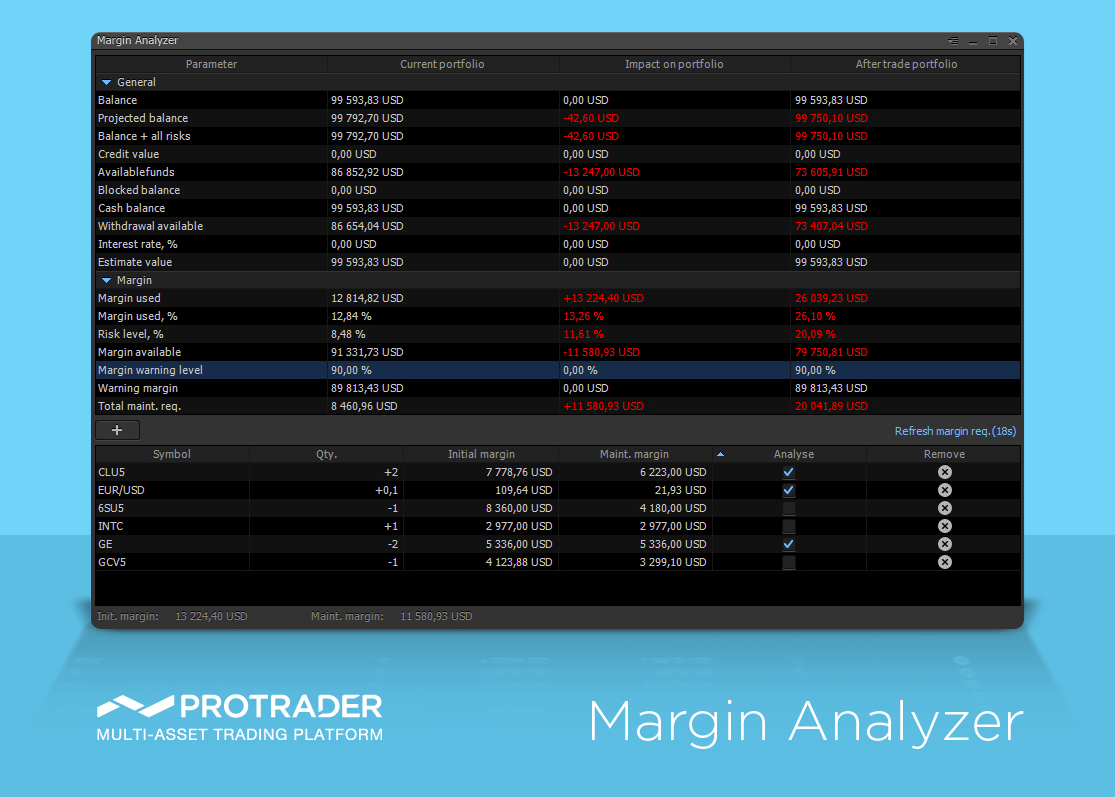

Protrader’s new Margin Analyzer Panel enhances risk management functionality

Risk management has become more sophisticated in the new Margin Analyzer tool within Protrader. Here is the official press release from PFSOFT: PFSOFT has announced a new advanced tool for professional traders and asset managers in the Protrader trading platform called Margin Analyzer. This panel allows customers to manage the level of risk and create more efficient … “Protrader’s new Margin Analyzer Panel enhances risk management functionality”

Important levels and technicals of GBPUSD

GBPUSD has cleared major resistance 1.5630 after the release of better than expected Lending and Mortgage Approvals data of UK. The pair has broken major resistance i.e 1.5630 the break above this level would extend gains till 1.5670 the next resistance and the second resistance 1.5745 in the short term. Until there is a break … “Important levels and technicals of GBPUSD”

Gold looks down, bearish descending triangle July 25 2015

There has now been a clear trigger of a bearish descending triangle formation in Gold (XAU/USD), as can be seen in the monthly chart below. Initially, there was a false breakout last November (dropped below $1,180.20), and another test of support of the pattern in March of this year. Each time Gold managed to rally … “Gold looks down, bearish descending triangle July 25 2015”