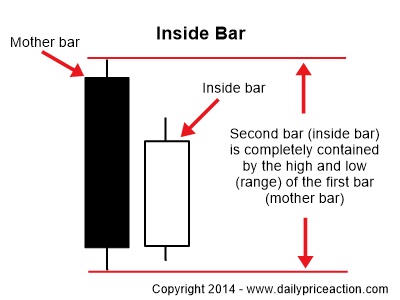

When I first began my Forex journey 6 years ago, I was completely in awe of the number of different strategies and indicators that were out there. It can be seriously overwhelming for a new trader. In the first 3 years I tried just about every indicator and strategy known to man. Nothing was working, … “Price Action or Indicators: Why Not Both?”

Category: Forex Bits

cTrader launched by MB Trading in the US

US forex broker MB Trading is the first US entity to launch Spotware’s cTrader platform. The entrance of Spotware into the US is an important milestone for the software company. For more, here is the press release: (El Segundo, CA) – April 8, 2014 – Manhattan Beach Trading Financial Services, Inc. and MB Trading FX … “cTrader launched by MB Trading in the US”

Weekly overview (31 March-04 April 2014) Negativity in the

Indices: Latest US data published last week revealed that the economy has added 191K new jobs, or fewer than the expected figure of 200K. The unemployment rate also kept its value from a month earlier amid forecasts for a new decline. All these figures led to serious Friday sell-offs which caused the Nasdaq100 to drop by … “Weekly overview (31 March-04 April 2014) Negativity in the”

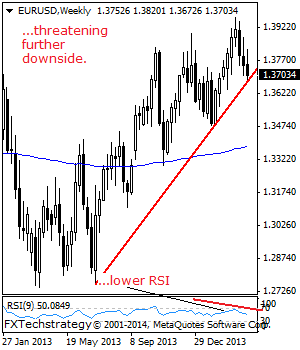

EURUSD: Vulnerable With Caution

With EUR weakening for a third consecutive week, further downside pressure is envisaged. But in order for this occur it will have to break and hold below the 1.3676 level and its rising trendline. However, with a rejection candle seen on Friday, recovery risk could happen this new week. Support lies at the 1.3676 level. … “EURUSD: Vulnerable With Caution”

US jobs data roils markets

US non-farm payrolls add fewer than expected Mario Draghi speaks at press conference, takes dovish stance German industrial orders come back strong Canadian employment rebounds Asian markets were mixed overnight amid mild profit-taking following a week of healthy gains as focus remained squarely on non-farm payrolls from the US. In its announcement on Friday, Fitch ratings … “US jobs data roils markets”

Fundamental analysis in forex

Fundamental news events occur all day long. Traders need to watch out for economic reports, company earnings releases, central bank statements, political developments and a whole a lot more. However, having access to the data and the news events are of no particular use to a trader if they do not know how to analyse … “Fundamental analysis in forex”

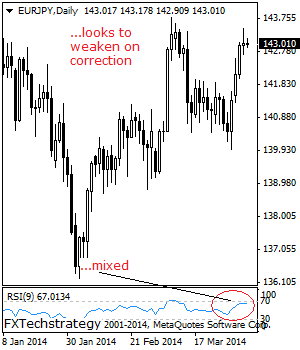

EURJPY: Price Correction Sets In

EURJPY- With the cross halting its weakness on Wednesday, further decline is likely in the days ahead. Resistance resides at the 143.78 level. Further out, resistance comes in at the 144.00 level where a break will turn attention to the 144.50 level and then the 144.00 level. A violation will push it further higher towards … “EURJPY: Price Correction Sets In”

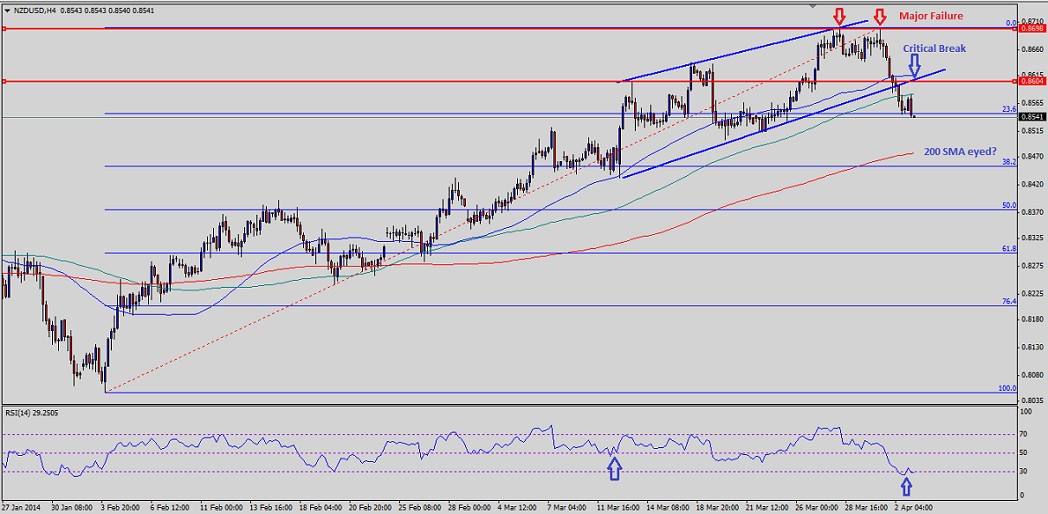

NZDUSD smashed ahead of US jobs data

NZDUSD is trading lower Intraday as the market awaits US jobs data, which will be released during Friday’s NY session. The pair has formed three back-to-back bearish candles on Daily timeframe, which can be considered as a sign of weakness. Even better than expected Chinese HSBC Services PMI was unable to help the pair. Chinese … “NZDUSD smashed ahead of US jobs data”

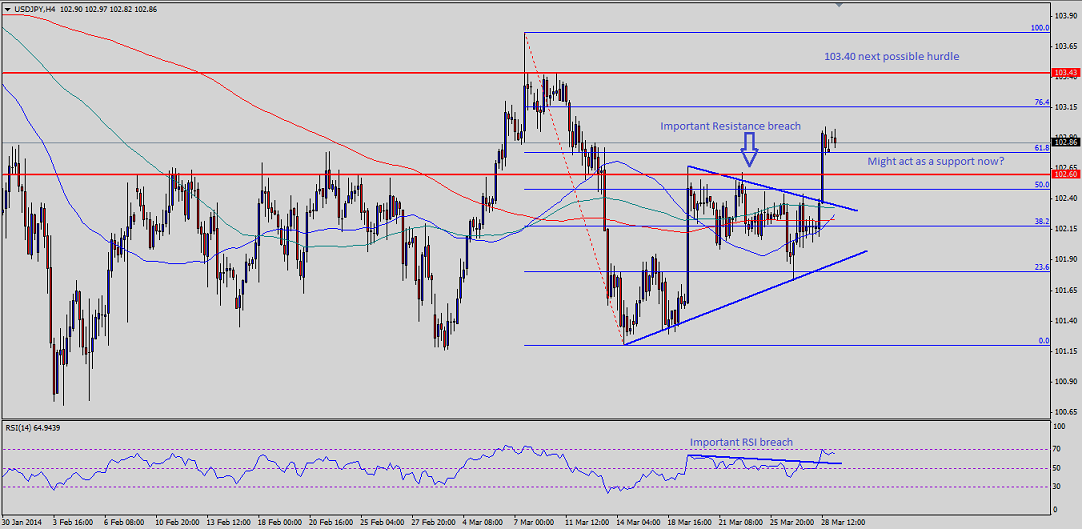

USDJPY broadly unchanged after Japanese Industrial Production data

USDJPY broke an important triangle last Friday, and spiked higher. The pair traded sideways for some time before buyers jumped in order to push the pair above 102.40 and 102.60 resistance levels. Earlier during the Asian session, Japanese industrial production data was published by the Ministry of Economy, Trade and Industry. The outcome was mixed, … “USDJPY broadly unchanged after Japanese Industrial Production data”

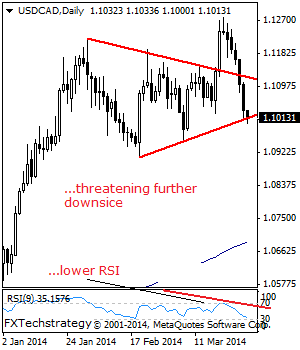

USD/CAD: Further pressure on the cards

USDCAD: The pair weakened further on Thursday leaving further pressure on the cards. Support lies at the 1.1000 level. We expect this big psycho level to hold and turn it higher but if breaks, further declining could occur towards the 1.0950 level and then the 1.0900 level. Bulls may come here and turn the pair … “USD/CAD: Further pressure on the cards”