NZDUSD has recovered 78.6% of its losses from the April-June 2013 High-Low range. The pair has benefited from the recent institutional inflow against its major counterparts such as EUR, GBP high-betas. The post-FOMC surge higher seems to be overdone but likely to sustain within weekly price range. As the Buy Climax starts to fade, current … “Is the Kiwi’s Move Overdone?”

Category: Forex Bits

British Council: Study Stint Overseas “Essential” to UK Competitiveness

UK employers are increasingly attracted to British students who have studied abroad, according to the British Council. Despite the UK now boasting six of the world’s top 20 universities, the British Council believe that in order to maintain and improve a skilled workforce it is vital that students get exposure to overseas university education. The … “British Council: Study Stint Overseas “Essential” to UK Competitiveness”

MarketsPulse launches enhanced capabilities for binary options brokers

Binary options platform provider MarketsPulse has launched its new CRM version, that features enhanced capabilities for brokers. All the details are in the press release below: MarketsPulse CRM tailored for Binary Options now updates sales & retention teams in realtime on more actions traders make. Toronto – MarketsPulse (marketspulse.com), a global binary options platform provider, … “MarketsPulse launches enhanced capabilities for binary options brokers”

GOLD: Weak, Vulnerable.

GOLD: The commodity remains vulnerable having followed through lower the past week. Support stands at the 1,300.00 level with a violation targeting the 1,272.12 level. A turn below here will turn attention to the 1,250.00 level and next the 1,215.00 level. Its weekly RSI is bearish and pointing lower supporting this view. Conversely, the commodity … “GOLD: Weak, Vulnerable.”

Leverate’s LXFeed gets a performance boost

Software provider Leverate has redeveloped its LXFeed data feed from the ground up with multicast architecture resulting in an even faster feed. These kind of improvements do not include shiny screenshots, but are certainly useful for traders. Leverate recently opened an R&D center in Kiev. For more about this performance boost, here is the press … “Leverate’s LXFeed gets a performance boost”

Microsoft Nokia deal unlikely to impact EUR/USD

Software giant Microsoft will buy the mobile department of the Finnish company Nokia for around 7.2 billion dollars. This is big news in the world of smartphones and for anyone interested in these industries. However, the buying of a euro-zone company by a US company is unlikely to have a positive impact on EUR/USD, even … “Microsoft Nokia deal unlikely to impact EUR/USD”

GOLD: Pulls Back, Backs Off Higher Prices

GOLD: Despite a back off higher prices to close marginally lower the past, GOLD continues to hold on to its broader upside bias. This leaves the commodity aiming at further upside towards the 1,450.00 level, its psycho level on ending its present correction. A cut through here will aim at the 1,500.00 level, its psycho … “GOLD: Pulls Back, Backs Off Higher Prices”

MarketsPulse Re-certified: ISO-9001:2008 Quality Management System

Binary options provider MarketsPulse is re-certified with the ISO-9001 2008 quality management system certification, following a previous certification. Here are more details: LONDON– MarketsPulse, a global binary options platform provider, was recently reissued the ISO-9001:2008 certifying that the company continues to meet the highest level of quality in software development and customer satisfaction standards defined … “MarketsPulse Re-certified: ISO-9001:2008 Quality Management System”

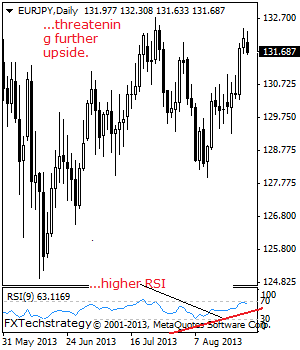

EURJPY: Faces Broader Upside Risk

EURJPY- With the cross bullish and closing higher the past week, we expect more gains to follow in the new week. Despite its present price hesitation, the above view remains intact. Resistance resides at the 132.74 level where a break will aim at the 133.81 level. Above here will pave the way for a run … “EURJPY: Faces Broader Upside Risk”

GOLD: Sees Further Bullish Momentum.

GOLD: With GOLD returning above the 1,348 level, further bullish offensive is likely. This leaves the commodity targeting further upside towards the 1,450.00 level, its psycho level. A cut through here will aim at the 1,500.00 level, its psycho level. A cap may occur here and turn it lower but if that fails, more upside … “GOLD: Sees Further Bullish Momentum.”