The lack of volatility in EUR/USD of late does not necessarily mean it will stay so for too long. The team at Goldman Sachs describes a “dollar story” for the pair heading into year-end, and sets cascading targets going forward: Here is their view, courtesy of eFXnews: Motivation for Our FX View: We continue to believe … “EUR/USD parity in 12 months – Goldman Sachs”

Category: Opinions

AUD: To Receive Short-Term Lift & RBA Unlikely To Stop

The Australian dollar had a positive quarter, making the biggest gain against the greenback among its peers. More gains could follow, at least in the short-term, says the team at Morgan Stanley. Here is their view, courtesy of eFXnews: AUD to receive short-term lift. To be clear, this is not because we are bullish on … “AUD: To Receive Short-Term Lift & RBA Unlikely To Stop”

GBP/USD: Trading the UK Services PMI

UK Services PMI is based on a survey of purchasing managers in the services sector. Respondents are surveyed for their view of the economy and business conditions in the UK. A reading which is higher than the market forecast is bullish for the pound. Here are all the details, and 5 possible outcomes for GBP/USD. Published on Wednesday at 8:30 … “GBP/USD: Trading the UK Services PMI”

Another Frustrating Year For EUR Bears: What’s Next? –

EUR/USD has been stuck in a range for quite some time, frustrating many traders. The team at Bank of America Merrill Lynch analyzes the frustration and assesses what’s next: Here is their view, courtesy of eFXnews: Another frustrating year for EUR bears Our year-ahead outlook for the Euro had warned of more frustration for EUR/USD … “Another Frustrating Year For EUR Bears: What’s Next? –”

We Expect Clinton To Win In November, Fed To Hike

Clinton’s victory in the first debate is beginning to show in the post-debate polls. Will this lead to a victory on November 8th? Here is the view from Credit Agricole about implications for the dollar as well: Here is their view, courtesy of eFXnews: While pre-election jitters could hurt USD, we expect a Hillary Clinton win in November … “We Expect Clinton To Win In November, Fed To Hike”

USD To Fall Another 3-4% From Current Levels – Morgan

The US dollar is looking for a new direction after the Fed left rates unchanged but hinted for a hike, and as uncertainty prevails after the first presidential debate. The team at Morgan Stanley sees downside risk for the greenback: Here is their view, courtesy of eFXnews: Flatter curve, weaker USD. We project the USD to … “USD To Fall Another 3-4% From Current Levels – Morgan”

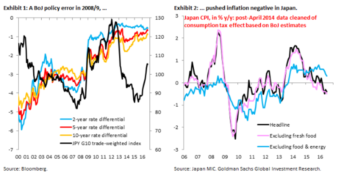

USD/JPY: This Is ‘The (Y)ENd Game’ – Goldman Sachs

The Bank of Japan said its word: targeting long-term interest rates. But what does it actually mean? The team at Goldman Sachs sees the Japanese currency coming under pressure: Here is their view, courtesy of eFXnews: We are thinking about last week’s actions from the BoJ along two dimensions. First, we continue to see the substantive … “USD/JPY: This Is ‘The (Y)ENd Game’ – Goldman Sachs”

USD/CAD To Test 1.30 N-Term; GBP/USD Fair Value Is

Both USD/CAD and GBP/USD trade at similar levels. But their directions may be different. The loonie enjoyed the recent OPEC agreement and the pound suffers from the Hard Brexit talk. What’s next? Here is the view from BNP Paribas: Here is their view, courtesy of eFXnews: Crude prices are holding onto gains from late Wednesday, setting … “USD/CAD To Test 1.30 N-Term; GBP/USD Fair Value Is”

USD/CAD: Trading the Canadian GDP

Canadian GDP is a measurement of the production and growth of the economy. Analysts consider GDP one the most important indicators of economic activity. A reading which is better than the market forecast is bullish for the Canadian dollar. Here are all the details, and 5 possible outcomes for USD/CAD. Published on Friday at 12:30 … “USD/CAD: Trading the Canadian GDP”

OPEC Agreement To Prove Difficult To Carry Out; Oil

After the historic agreement to curb oil production has been announced, oil prices advanced. However, the skeptics are coming out quite quickly. Here is the opinion from Danske: Here is their view, courtesy of eFXnews: Following three days of negotiations in Algiers, OPEC may have reached agreement over a strategy to support a stabilisation of the … “OPEC Agreement To Prove Difficult To Carry Out; Oil”