US Final GDP is a key release and is published each quarter. GDP reports measure production and growth of the economy, and are considered by analysts as one the most important indicators of economic activity. A reading which is higher than the market forecast is bullish for the dollar. Here are all the details, and 5 possible outcomes for … “EUR/USD: Trading the US Final GDP September 2016”

Category: Opinions

GBP: Some Profit-Taking On Shorts Into Quarter-End; We Stay

GBP/USD has been struggling with 1.30, as talk of a “Hard Brexit” talk prevails. What’s next? The next few days could see downside pressure: Here is their view, courtesy of eFXnews: There is no doubt that uncertainty has increased and we’d agree that business investment is likely to be a major drag on UK economic growth. … “GBP: Some Profit-Taking On Shorts Into Quarter-End; We Stay”

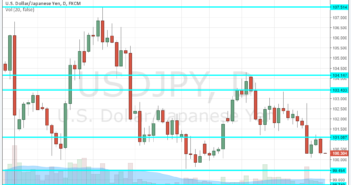

USD Vulnerable To The Downside Vs JPY In The Run

The US election season is getting into high-gear with one presidential debate behind us and two more to go. And markets are beginning to watch. The team at BTMU explains the risks in USD/JPY: Here is their view, courtesy of eFXnews: The yen has weakened modestly in the Asian trading session following yesterday’s first US Presidential debate. … “USD Vulnerable To The Downside Vs JPY In The Run”

EUR/USD: Struggle Between Bulls And Bears Drags On: Levels

EUR/USD is grinding higher but still struggles for a new direction. The team at JP Morgan describes the battle between the bulls on the bears: Here is their view, courtesy of eFXnews: Since EUR/USD bottomed at 1.0462 in March 2015 it formed a broad consolidation triangle (A-B-C-D-E, green) which could be complete as the market stalled … “EUR/USD: Struggle Between Bulls And Bears Drags On: Levels”

Debate preview: 3 reasons why Clinton could win and

The US elections are set to get much more attention, for voters and markets. The first presidential debate between Hillary Clinton and Donald Trump will be held on Monday, September 26th at 9 PM Eastern, that’s 1:00 GMT. While the event happens during the Asian session, it could have ramifications for the next few sessions, especially … “Debate preview: 3 reasons why Clinton could win and”

3 reasons to watch USD/JPY for a real debate reaction

The US presidential campaigns are moving one step up with the first debate between Hillary Clinton and Donald Trump. With the race tightening towards Trump, there is a lot at stake. Clinton represents continuation vs. the Donald Disruption: a gray, mainstream candidate that will continue the current path while the challenger is disruption, and we do not … “3 reasons to watch USD/JPY for a real debate reaction”

USD and the first Presidential Debate – Barclays

The first US presidential debate is coming up. We noted why 3 reasons why Clinton could win and markets will like it, but anything is possible. Here is the view from Barclays: Here is their view, courtesy of eFXnews: The USD will likely trade sideways after losing some ground since the FOMC decision last week. Despite not hiking interest rates in … “USD and the first Presidential Debate – Barclays”

Why the Algiers gathering will NOT help oil prices

Once again, OPEC members are discussing a potential deal to lift oil prices. A total cut seems to be off the cards, but some freeze in production levels could be possible in the gathering on the sidelines of a conference in Algiers. Given the past, there are many reasons to doubt this. Here is what’s going on. Algiers … “Why the Algiers gathering will NOT help oil prices”

3 Reasons Why JPY Will Weaken M-Term On BoJ New

The Bank of Japan did not make huge changes in the short run, but made long-term changes. Will markets acknowledge it in the medium-term? Here are three reasons, according to Nomura: Here is their view, courtesy of eFXnews: The BOJ’s new policy framework aims to improve the sustainability of its easing, as the Bank acknowledges the … “3 Reasons Why JPY Will Weaken M-Term On BoJ New”

USD/JPY: Trading the US CB Consumer Confidence Index

US CB Consumer Confidence Index is based on a monthly survey of about 5,000 households regarding their opinion of the economy. Its release often has a strong impact on market prices. A higher reading than the market forecast is bullish for the dollar. Here are all the details, and 5 possible outcomes for USD/JPY. Published on … “USD/JPY: Trading the US CB Consumer Confidence Index”