US Preliminary GDP measures production and growth of the economy and is one of the most important economic indicators. The Preliminary GDP report is the second of three reports released each quarter. A reading which is stronger than the market forecast is bullish for the dollar. Here are all the details, and 5 possible outcomes … “USD/JPY – Trading the US Preliminary GDP”

Category: Opinions

Jackson Hole , the Fed’s September decision and the

The end of August approaches and as many traders take their vacations, central bankers including Fed Chair Janet Yellen, gather in Jackson Hole, Wyoming. Will she hint about a move in September? How will the dollar react? Here are opinions from 3 banks: Here is their view, courtesy of eFXnews: Jackson Hole: Don’t Expect Guidance … “Jackson Hole , the Fed’s September decision and the”

EUR/USD: Trading the German Ifo Business Climate

German Ifo Business Climate is a monthly composite index of about 7,000 businesses, which are surveyed about current business conditions and their expectations concerning economic performance over the next six months. A reading which is higher than the estimate is bullish for the euro. Here are all the details, and 5 possible outcomes for EUR/USD. … “EUR/USD: Trading the German Ifo Business Climate”

US new home sales leap, but we’ve been here before

Sales of new homes in the US jumped to 654K in July. This is a leap of 12.4% month over month in this volatile indicator. However, also in yearly terms, this is very impressive: 31.3%. A level of 580K was expected, similar to the updated figure for June: 582K. In theory, this should be great news: a … “US new home sales leap, but we’ve been here before”

No Fed rate hike before December; a top in the

In an interview with FXStreet, we discussed the stakes of a rate hike in the US, oil prices, the “hated” equity rally and more. You can read the article in its original publication or here below: Which timeline will the Fed follow on their interest rate hike quest?? Contrary to some hawkish statements by some … “No Fed rate hike before December; a top in the”

AUD/USD has its limits – two opinions

The Australian dollar had its flirt with the upside but never went too far. What’s next? Here are two opinions about the next moves and the RBA’s role: Here is their view, courtesy of eFXnews: AUD Will Peak At 0.78 In Q3 Before Reversing Gradually Lower: How To Trade It? – ANZ We forecast that the … “AUD/USD has its limits – two opinions”

ECB Minutes: Speculation for September easing takes root

The ECB’s monetary policy meeting minutes from the July meeting was released last week. Although the event was overshadowed by the FOMC minutes and Fed member speeches, the minutes gave some insights into the future course of action from the ECB. Policy makers warned that following Britain’s vote to leave the European Union; fresh headwinds … “ECB Minutes: Speculation for September easing takes root”

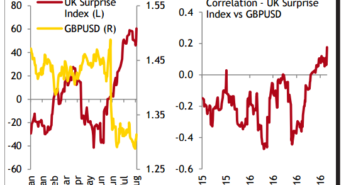

GBP: With record shorts and a failed upwards move –

The pound enjoyed the strong retail sales report as well as other useful data points to rally, but never went too far. With markets positioned against it, will it fall? Here is the view from CIBC and Scotiabank: Here is their view, courtesy of eFXnews: GBP: Fade The Bounce On Last Week’s Positive Data Surprises – … “GBP: With record shorts and a failed upwards move –”

2 reasons not to get caught up in USD bearishness

While some expect the weakness of the USD to continue, the team at Goldman Sachs has different views for the greenback. Here is their view, courtesy of eFXnews: We believe the current level of anxiety over the Dollar is overdone for two reasons. First, Exhibit 1 shows the path of trade-weighted USD versus the majors since … “2 reasons not to get caught up in USD bearishness”

USD/CAD: Buying Dips Trageting A Move Into Mid-1.30s In

The Canadian dollar enjoyed the rising price of oil but this may not last too long. Here is an outlook from BofA: Here is their view, courtesy of eFXnews: We have maintained our CAD negative view although it has rallied a little in the past few days on the back of stronger oil. We continue to expect … “USD/CAD: Buying Dips Trageting A Move Into Mid-1.30s In”