The Fed minutes showed some desire for a rate hike, but only from a “couple” of members. A move in September is unlikely, but December is still on the cards. Here are two opinions: FOMC Minutes: ‘Clock Is Ticking For Next Fed Hike But Not In September’ – SEB Our conclusion: Members of the FOMC are … “FOMC responses – December a possibility”

Category: Opinions

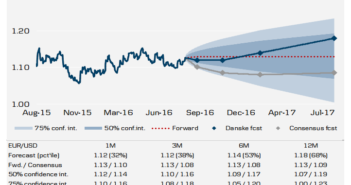

EUR/USD on higher ground – further gains or falls?

EUR/USD is trading around the post-Brexit highs after making a nice break. What’s next for the pair? Here are two opinions: Here is their view, courtesy of eFXnews: EUR/USD Will Reach 1.20 Before It Reaches 1.00 – Danske Growth. US growth surprised on the downside in Q2, but recent labour market data has surprised on the … “EUR/USD on higher ground – further gains or falls?”

AUD/USD:Trading the Australian Employment Change

Australian Employment Change, which is released monthly, provides a snapshot of the health of the Australian labor market. A reading which is higher than the market forecast is bullish for the Australian dollar. Here are the details and 5 possible outcomes for AUD/USD. Published on Thursday at 1:30 GMT. Indicator Background Job creation is one … “AUD/USD:Trading the Australian Employment Change”

RBNZ rate cut does little to weaken the currency

The Reserve Bank of New Zealand’s monetary policy meeting last week saw the central bank cut the OCR by 25 basis points to 2.00%, a new record low and on par with other major central bank policies across the developed economies. The RBNZ’s monetary policy decision also highlighted the fact that central bank policy decisions … “RBNZ rate cut does little to weaken the currency”

AUD Carry Metrics Not Flashing Red Yet; Caution On NZD

The Australian and New Zealand dollars have enjoyed flows despite rate cuts. What is expecting us on the road ahead? Here is the view from Bank of America Merrill Lynch: Here is their view, courtesy of eFXnews: The search for positive yield has become a catch-all phrase to explain the resilience of high-yielding assets globally. … “AUD Carry Metrics Not Flashing Red Yet; Caution On NZD”

EUR/USD: Trading the German ZEW Economic Sentiment

German ZEW Economic Sentiment is based on a monthly survey of institutional investors and analysts and their views of the German economy. A reading that is higher than the market forecast is bullish for the euro. Here are all the details, and 5 possible outcomes for EUR/USD. Published on Tuesday at 9:00 GMT. Indicator Background … “EUR/USD: Trading the German ZEW Economic Sentiment”

EUR/USD: Trading the UoM Consumer Sentiment

The University of Michigan Consumer Sentiment Index surveys consumer attitudes and expectations about the US economy. An increase in consumer confidence is a positive sign about the health of the economy and is bullish for the US dollar. Update: US Consumer Sentiment slightly misses with 90.4 Here are all the details, and 5 possible outcomes for … “EUR/USD: Trading the UoM Consumer Sentiment”

RBNZ cut priced in, but fireworks could still be seen

In our special segment today we focus on the New Zealand dollar, with key events lined up. While a rate cut is priced in, Wheeler and his colleagues certainly have room to surprise with guidance or deeper cuts. In addition, New Zealand awaits key retail sales and employment data, both quarterly reports. The pair could … “RBNZ cut priced in, but fireworks could still be seen”

RBNZ previews: a cut is expected, but how much?

The RBNZ makes its move today and everybody expects a cut. Is it already priced in? Probably. But the RBNZ could go further down the rabbit hole: Here is their view, courtesy of eFXnews: RBNZ Would Need To Cut Rates By 50bp To Move NZD Significantly Lower – Westpac We expect the RBNZ to cut … “RBNZ previews: a cut is expected, but how much?”

USD/JPY: Trading the US JOLTS Jobs Openings

US JOLTS Job Openings measures the change in the number of employment openings, excluding the farm industry. A reading which is higher than the market forecast is bullish for the dollar. Here are the details and 5 possible JOLTS outcomes for USD /JPY. Published on Wednesday at 14:00 GMT. Indicator Background Job creation is one … “USD/JPY: Trading the US JOLTS Jobs Openings”