Has Brexit already hit the UK economy? Should we brace ourselves for fresh trouble? So far, we had anecdotal evidence and tons of speculation but no key data. This changes now with a special release of preliminary PMIs from Markit. The publication of two forward looking indices at once, earlier than scheduled, has garnered a … “UK PMIs Preview: How bad is Brexit? [Video]”

Category: Opinions

ECB Preview: Will Draghi pre-announce September stimulus? [Video]

The European Central Bank is under pressure: the impact of Brexit on the euro-zone economies, the lack of improvement on inflation, the crisis in banks in his home country and the scarcity of bonds up for buying are all headaches for the Frankfurt based institute. No change in policy is expected, with investors’ eyes already … “ECB Preview: Will Draghi pre-announce September stimulus? [Video]”

ECB to send EUR up or down? Two more opinions

EUR/USD is basically stuck in a range since the Brexit shock. Mario Draghi can send it to a new direction, After our own ECB video preview and 3 additional forecasts, here are the two more: Here is their view, courtesy of eFXnews: EUR Risks Into The ECB – UBS No additional stimulus; focus on UK referendum, … “ECB to send EUR up or down? Two more opinions”

GBP/USD: Trading the UK Retail July 2016

UK Retail Sales is considered one of the most important economic indicators. A reading that is higher than the market forecast is bullish for the British pound. Here are all the details, and 5 possible outcomes for GBP/USD. Published on Thursday at 8:30 GMT. Indicator Background Retail Sales is the primary gauge of consumer spending, a critical component of economic growth. An … “GBP/USD: Trading the UK Retail July 2016”

ECB Meeting: 3 Previews

Mario Draghi and his colleagues are back with a rate decision, the first one after Brexit and amid crises in Italian banks. Here are previews from Citi, RBS and Bank of America Merrill Lynch: Here is their view, courtesy of eFXnews: EUR/USD: Scenarios & Trades Into The ECB – Citi What can we expect from the … “ECB Meeting: 3 Previews”

EUR/USD: Trading the German ZEW Economic Sentiment

German ZEW Economic Sentiment is based on a monthly survey of institutional investors and analysts and their views of the German economy. A reading that is higher than the market forecast is bullish for the euro. Update: German ZEW Sentiment goes negative -6.8 – Brexit driven Here are all the details, and 5 possible outcomes … “EUR/USD: Trading the German ZEW Economic Sentiment”

Will EUR/USD fall this week? 2 opinions

EUR/USD slid towards the end of the week on the news from Turkey, but basically remains entrenched in range. What’s next for the pair? Here are two opinions: Here is their view, courtesy of eFXnews: EUR/USD: A Slow Grind Lower Towards 1.08 En-Route To 1.05 – Deutsche Bank EUR/USD weakened moderately following the Brexit outcome but … “Will EUR/USD fall this week? 2 opinions”

Terror attack could impact GBP more than EUR

A villain murdered more than 80 people celebrating France’s Bastille Day in Nice, southern France. The horrific stampede is clearly an act of terror and it joins previous attacks in Paris and in the Brussels, Belgium. France has extended the state of emergency hours after President Hollande announced the planned removal of this measure. We also heard that … “Terror attack could impact GBP more than EUR”

EUR/USD: Trading the University of Michigan Consumer Sentiment Index

The University of Michigan Consumer Sentiment Index surveys consumer attitudes and expectations about the US economy. An increase in consumer confidence is a positive sign about the health of the economy and is bullish for the US dollar. Here are all the details, and 5 possible outcomes for EUR/USD. Published on Friday at 14:00 GMT. Indicator … “EUR/USD: Trading the University of Michigan Consumer Sentiment Index”

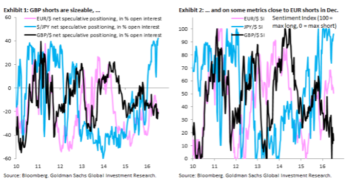

GBP: Positioning & Momentum Signal Ahead Of BoE –

The recent rise in GBP/USD makes us suspect that markets may be pricing a no-cut. What is the positioning? Here is the opinion from Goldman Sachs: Here is their view, courtesy of eFXnews: A persistent preoccupation of the foreign exchange market is positioning, especially ahead of key risk events like tomorrow’s Bank of England meeting. Exhibit 1 … “GBP: Positioning & Momentum Signal Ahead Of BoE –”

![UK PMIs Preview: How bad is Brexit? [Video]](https://investinearth.org/wp-content/uploads/2016/07/Fotolia_52791991_S-351x185.jpg)

![ECB Preview: Will Draghi pre-announce September stimulus? [Video]](https://investinearth.org/wp-content/uploads/2016/07/Fotolia_52150087_S-351x185.jpg)