Australian Employment Change, which is released monthly, provides a snapshot of the health of the Australian labor market. A reading which is higher than the market forecast is bullish for the Australian dollar. Here are the details and 5 possible outcomes for AUD/USD. Published on Thursday at 1:30 GMT. Indicator Background Job creation is one … “AUD/USD: Trading the Australian Employment Change”

Category: Opinions

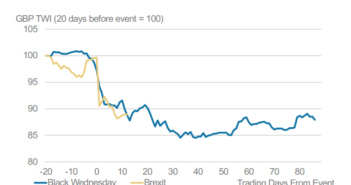

New government, new direction for the pound?

UK PM Theresa May has entered Downing 10 and appointed Phillip Hammond as Chancellor of the Exchequer. Until they both get used to their new roles, the pound moves mostly on the BOE. Here are two opinions on the next direction of the pound: Here is their view, courtesy of eFXnews: GBP/USD Squeeze Won’t Go … “New government, new direction for the pound?”

Sterling Nears 1.33; What’s Next? – JP Morgan, BofA

GBP/USD continued its recovery following the sudden political certainty in the UK. But after a 450 rally, what’s next? Here are 3 opinions: Here is their view, courtesy of eFXnews: Sterling has marched steadily higher in recent sessions, as the market’s worst fears about the UK voting to leave the European Union have faded. Nevertheless, … “Sterling Nears 1.33; What’s Next? – JP Morgan, BofA”

Bond guru Gundlach: 80% chance of making 10% in gold

Bond guru and head of DoubleLine Capital gave an interview with Barrons over the weekend. Sharing his thoughts on a variety of factors ranging from the Brexit fallout to the upcoming US elections, Gundlach maintained his views that gold prices are more likely to go higher. He said, “Gold miners have a very high probability—if … “Bond guru Gundlach: 80% chance of making 10% in gold”

GBP/USD prospects are not so good – 3 opinions

GBP/USD fell for a third week in a row but there may be more in the pipeline, all because of Brexit. Here are three opinions about the prospects for cable: Here is their view, courtesy of eFXnews: ‘Wishful Thinking’ Ideas Won’t Save GBP; En-Route To 1.22 – Credit Suisse In the week that has followed, the … “GBP/USD prospects are not so good – 3 opinions”

Does EUR/USD need a bank run to break out of range?

EUR/USD certainly dropped on the shocking result of the EU Referendum. A peak to trough move of over 500 was clearly a big move and seemed proportionate to the 1700 move in GBP/USD. However, since that big night, EUR/USD is trading in a much narrower range. The post-Brexit range is lower than the pre-Brexit one, but remains … “Does EUR/USD need a bank run to break out of range?”

EUR/USD: Trading the US Nonfarm Payrolls

US Nonfarm Employment Change measures the change in the number of newly employed people in the US, excluding workers in the farming industry. A reading which is higher than the market forecast is bullish for the dollar. Here are the details and 5 possible outcomes for EUR/USD. Update: Non-Farm Payrolls leap 287K – dollar surges … “EUR/USD: Trading the US Nonfarm Payrolls”

So when will the Fed ever hike? 4 opinions

The Fed’s June decision was cautious and also Yellen was dovish. We managed to forget about everything on Brexit. The Fed’s meeting minutes shed some light on the thinking in the FOMC, but what does this mean for a rate hike? Here are 4 opinions: Here is their view, courtesy of eFXnews: FOMC Minutes: A Look … “So when will the Fed ever hike? 4 opinions”

Under 1.30: what’s next for GBP/USD? Two opinions

GBP/USD broke down below 1.30 but did not go too far after the initial shock. More to come or is it the end of the crash? Don’t Fade GBP Decline Yet; BoE To Trigger Another Sell-Off Next Week – BNPP GBPUSD hit the 1.30 tactical target we established in the immediate aftermath of the referendum, … “Under 1.30: what’s next for GBP/USD? Two opinions”

EUR/USD: En-Route To 1.05 On Brexit Contagion – BofA

After GBP/USD crashed under 1.30 the euro could also follow lower over Brexit. Here is the forecast by Bank of America Merrill Lynch: Here is their view, courtesy of eFXnews: The implications of the UK referendum result are hard to nail down, but we expect them to be negative in most scenarios. We would expect Brexit to … “EUR/USD: En-Route To 1.05 On Brexit Contagion – BofA”