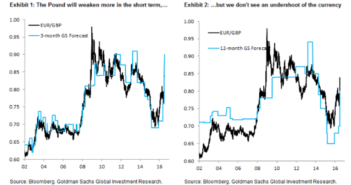

We have seen how GBP/USD crashed under 1.30 and EUR/USD is carried along in a second big wave of post-Brexit selling. The team at Goldman Sachs provides new deep targets: Here is their view, courtesy of eFXnews: Following the Brexit surprise, we revised our Sterling forecasts weaker, but – amid lots of doomsday scenarios for the Pound … “EUR/USD to parity in 12m, GBP/USD to 1.20 in 3m”

Category: Opinions

GBP/JPY One Triggers Another

The most recent Bank of Japan monetary policy meeting adjourned 15 June, just one week before the UK referendum vote. The question must be asked whether the BOJ considered any risk to the Japanese economy either before or after the vote. True, there is an important relation between the Sterling and the Yen as IMF … “GBP/JPY One Triggers Another”

USD/JPY: Trading the ISM Non-Manufacturing PMI

The ISM Non-Manufacturing PMI (Purchasing Managers’ Index) is based on a survey of purchasing managers in the manufacturing sector. Respondents are surveyed for their view of the economy and business conditions in the US. A reading which is higher than the market forecast is bullish for the dollar. Here are all the details, and 5 … “USD/JPY: Trading the ISM Non-Manufacturing PMI”

EUR/USD: En-Route To 1.05 In 3M; Market To Keep Selling

EUR/USD is struggling with Brexit and there is more potential to the downside. And that’s not the only reason. Here is their view, courtesy of eFXnews: We are lowering our 3m EURUSD forecast to 1.05 from 1.17 previously, reflecting the likely growth spillover into the wider European region from the UK’s woes. Our former forecast had … “EUR/USD: En-Route To 1.05 In 3M; Market To Keep Selling”

GBP/USD: Trading the UK Services PMI

UK Services PMI is based on a survey of purchasing managers in the services sector. Respondents are surveyed for their view of the economy and business conditions in the UK. A reading which is higher than the market forecast is bullish for the pound. Here are all the details, and 5 possible outcomes for GBP/USD. Published on Tuesday at 8:30 … “GBP/USD: Trading the UK Services PMI”

GBP/USD forecasts for 1, 3 and 12 months post-Brexit

One week after the big Brexit crash and as a new quarter begins, it is time to lift our heads from the near term and look forward. Here are forecasts for the next month, 3 months and 12 months: GBP/USD in July 2016 Uncertainty has an immediate impact on financial markets and also on business, studies, … “GBP/USD forecasts for 1, 3 and 12 months post-Brexit”

AUD/USD: Trading the Chinese Caixin Manufacturing PMI

Chinese Caixin Manufacturing PMI (Purchasing Managers’ Index) is based on a survey of purchasing managers in the manufacturing sector. Respondents are surveyed for their view of the economy and business conditions in China. A reading which is higher than the market forecast is bullish for the Australian dollar. Here are all the details, and 5 possible … “AUD/USD: Trading the Chinese Caixin Manufacturing PMI”

3 reasons for the extended GBP/USD rally and 3 reasons

GBP/USD is trading back at the 1.35 handle, around 400 pips off the lows seen on Monday. The reaction to Brexit was brutal but the correction is quite spectacular as well. What’s next for the pound? Will it continue higher or is the recovery over? Here are three reasons for the rise and three for the … “3 reasons for the extended GBP/USD rally and 3 reasons”

Will Brexit Break GBP But Make EUR? – Credit Agricole

Brexit has hit the pound hard but the euro is doing quite well. Here is their view, courtesy of eFXnews: Markets have calmed down overnight with GBP and less liquid G10 currencies regaining some lost ground. At the same time, USD and JPY – arguably the biggest winners of the Brexit selloff – have pared … “Will Brexit Break GBP But Make EUR? – Credit Agricole”

Why EUR Is Not A ‘Surrogate’ For Bearish GBP Trades?

Following the big Brexit, EUR/USD fell but at a much lower scale in comparison to the pound. What’s going on? The team at Morgan Stanley explains: Here is their view, courtesy of eFXnews: Looking for bearish ‘quasi GBP’ trades makes sense, but focusing on EUR is wrong. We do not disagree with views citing the risks … “Why EUR Is Not A ‘Surrogate’ For Bearish GBP Trades?”