GBP/USD has been able to overcome Brexit concerns and move higher after the cabinet reshuffle. A busy week including inflation, employment, retail sales, and PMIs awaits pound traders. Mid-February’s daily chart is more bullish. but points to a critical double-top. The FX Poll is showing a bullish bias on all timeframes. Keep calm and carry … “After the reshuffle, GBP/USD now faces the hard data”

Category: Opinions

Macron Gap may result in 50-100 pip fall in EUR/USD

EUR/USD has been extending its slide amid economic divergence and other factors. It is nearing the chart gap created by French President Macron’s victory in April 2017. The slow grind lower may turn into an avalanche. Is EUR/USD moving too slowly? The world’s most popular currency pair has been stuck for months and even when … “Macron Gap may result in 50-100 pip fall in EUR/USD”

Four carry trade currency pairs in 2020

Volatility in forex markets remains depressed amid ample liquidity. The carry trade provides opportunities for those with patience. CAD/CHF, USD/CHF, EUR/CAD, and even EUR/USD serve as potential positions. No trend, no trade? Not so fast, as markets with low volatility still provide opportunities. Volatility in foreign exchange markets has been falling, with EUR/USD – arguably the most popular … “Four carry trade currency pairs in 2020”

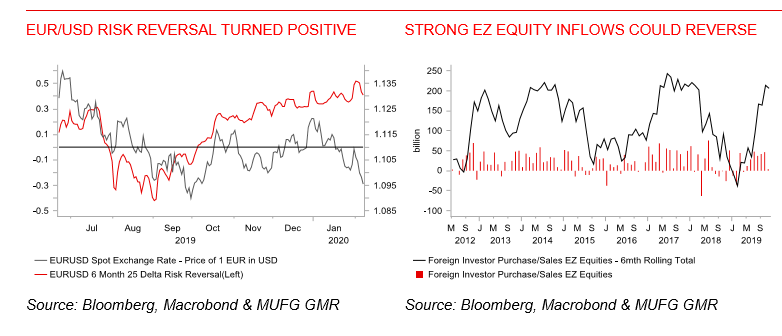

EUR/USD: Elevated N-Term Risks Of Further EUR Weakness – MUFG

EUR/USD is hovering around 1.09 and waiting for the next hammer to fall. Where next? Here is their view, courtesy of eFXdata: MUFG Research discusses EUR/USD outlook and adopts a tactical bearish bias in the near-term. “The data from the euro-zone today have certainly shifted out short-term view for the euro given the scale of weakness … “EUR/USD: Elevated N-Term Risks Of Further EUR Weakness – MUFG”

Dollar may rise and fall now that Trump’s approval rating hits multi-year highs

President Trump’s approval rating is near the levels seen just after his inauguration. The Senate acquittal, messy Democratic Party primaries, and a strong economy are behind the rise. The US dollar has room to rise for a limited time, with Trump potentially sending it lower. Making the dollar great again? Paraphrasing President Donald Trump’s 2016 election … “Dollar may rise and fall now that Trump’s approval rating hits multi-year highs”

Top five assets to run to in coronavirus times

The coronavirus outbreak has triggered demand for safe-haven assets. A similar pattern has been seen with the Iran crisis and may reoccur throughout 2020. Five financial assets stand out in these times of trouble. Whether it originates in Wuhan or Iran, financial markets always have something to worry about – but the demand for safe-haven … “Top five assets to run to in coronavirus times”

Expert Josip Heit Shares His Thoughts On Why Bitcoin Is Seen As Digital Gold

Until now, the world has heavily relied on traditional banknotes as a medium of exchange, however, blockchain technology seems to be on the verge of changing this. And Josip Heit was one of the first people who realized the potential of blockchain. On January 9, 2009, an enigmatic internet persona hiding behind the pseudonym Satoshi … “Expert Josip Heit Shares His Thoughts On Why Bitcoin Is Seen As Digital Gold”

The Pound Trades on the Defensive as the Potential for a Rate Cut is Gaining Momentum

The British pound has been trading defensively, as calls for the BoE to reduce interest rates continue to grow louder. The region is feeling the effects of lower inflation as well as declining growth as Brexit has taken its toll on the British economy. UK GDP, Industrial Production and Consumer prices all came in weaker … “The Pound Trades on the Defensive as the Potential for a Rate Cut is Gaining Momentum”

USD: Fed To Maintain A Cautious Outlook; What’s Next For USD? – MUFG

After three consecutive cuts, the Fed is expected to hold its rates unchanged. What does this mean for the US dollar? Here is their view, courtesy of eFXdata: MUFG Research discusses its expectations for tomorrow’s FOMC policy meeting and for the Fed policy trajectory throughout the year. “The emergence of the coronavirus and building signs … “USD: Fed To Maintain A Cautious Outlook; What’s Next For USD? – MUFG”

AUD: Market Reaction To A SARS-Like Even Would Be Very Different Now Than In 2003 – ANZ

The Australian dollar, a risk currency, has been on the back foot as the coronavirus outbreak is worsening. However, the reaction to this disease will likely be different than the previous such event. Here is their view, courtesy of eFXdata: ANZ Research revisit the impact of SARS on AUD rates in 2003. The outbreak of a … “AUD: Market Reaction To A SARS-Like Even Would Be Very Different Now Than In 2003 – ANZ”