It’s a very busy week for markets with a buildup to the NFP, OPEC meetings and lots more. The team at CIBC look at the situation in North America: Here is their view, courtesy of eFXnews: CAD: Rate Spreads Taking Over From Oil. No economic news was good news for the Canadian dollar this week, particularly … “CAD: Rate Spreads Taking Over From Oil; USD: Payroll”

Category: Opinions

What I talk about when I talk about EUR/USD

In the special segment for today we discussed some things that stand out in the world’s most popular currency pair: from fundamental matters to technical ones, with many traders having a love-hate relationship. Does the high liquidity support better technical behavior or undermine it? It’s an interesting debate we had on the show. EUR/USD is … “What I talk about when I talk about EUR/USD”

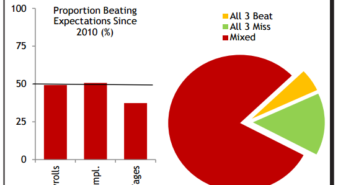

NFP Preview: Mind The Revision Gap

Expectations are somewhat lower for the upcoming Non-Farm Payrolls report. But it’s not only the headline figure and not only the wages. Here is a preview from Bank of America Merrill Lynch, also explaining the US impact: Here is their view, courtesy of eFXnews: In the May employment report, we expect nonfarm payroll growth of … “NFP Preview: Mind The Revision Gap”

Next USD movers: Real yields

The US dollar is looking somewhat balanced and looking for a new direction. What could be the next driver? The team at Morgan Stanley points to real yields, and explains: Here is their view, courtesy of eFXnews: We believe the next catalyst for the USD appreciation will be an increase in real yields, which in … “Next USD movers: Real yields”

EUR/USD -Trading the US Preliminary GDP

US Preliminary GDP is a measurement of the production and growth of the economy. Analysts consider GDP one the most important indicators of economic activity, and publication of Preliminary GDP could have a significant impact on the movement of EUR/USD. A reading which is better than the market forecast is bullish for the dollar. Here are all … “EUR/USD -Trading the US Preliminary GDP”

Fed Will Not Be Deterred From Raising Rates Due To

It’s an election year in the US and the contest is wide open. Will the Fed take an election holiday? No, says the team at Bank of America Merrill Lynch. Here is their view, courtesy of eFXnews: Over recent weeks a number of clients have asked: “will the Fed be deterred from raising rates due … “Fed Will Not Be Deterred From Raising Rates Due To”

Real Fed tightening was much bigger than 25 basis points

Markets are obsessing with the timing of the next rate hike in the US but is it really the true level of tightening? Here is their view, courtesy of eFXnews: Can we be sure the Fed has only tightened 25 basis points? In our view, the 25bp of Fed hikes reveals little about how much the … “Real Fed tightening was much bigger than 25 basis points”

GBP/USD – Trading the Second Estimate GDP

British Second Estimate GDP, one of the most important economic releases, is published each quarter. GDP measures production and growth of the economy, and is considered by analysts as one the most important indicators of economic activity. A reading which is better than the market forecast is bullish for the pound. Update: UK GDP 0.4% q/q but only 2.0% … “GBP/USD – Trading the Second Estimate GDP”

EUR/USD to 1.05 and USD/JPY to 1.25 – Goldman Sachs

The team at Goldman Sachs remain dollar bulls and release upbeat targets for the greenback against its major peers. Here is their view, courtesy of eFXnews: Our big picture views are well known. We are Dollar bulls, since we think the 300 bps tightening cycle our US economists forecast (through 2019) maps into a 15 … “EUR/USD to 1.05 and USD/JPY to 1.25 – Goldman Sachs”

BOC could weigh on CAD – 2 Reasons – BofA Merrill

The Canadian economy is not enjoying the weak Canadian dollar and with reduced oil production, the higher prices of the black gold are not really helpful. But these are not the only reasons for a cautious. There are two more according to the team at Bank of America Merrill Lynch: Here is their view, courtesy of … “BOC could weigh on CAD – 2 Reasons – BofA Merrill”