The US dollar enjoyed a few positive figures and the tables have turned in its favor. Is there more room to the upside? Here is their view, courtesy of eFXnews: The Fed’s Rosengren said last night that the market is ‘too pessimistic’ about the US economy and the likelihood of the central bank removing accommodation is higher … “The USD Has Bottomed – Danske”

Category: Opinions

Should we worry about the US labor market?

Within the two mandates of the Federal Reserve, inflation was the weak spot and jobs were the bright spot. A very steady and solid in the amount jobs moved the focus in recent jobs reports to wages, often seen as the source of core inflation, the inflation the Fed cares about. With an unemployment rate around 5% and a … “Should we worry about the US labor market?”

EUR/USD: Trading the German Preliminary GDP

German Preliminary GDP is a measurement of the production and growth of the economy and is considered one the most important economic indicators. A reading which is better than the market forecast is bullish for the euro. Here are all the details, and 5 possible outcomes for EUR/USD. Published on Friday at 6:00 GMT. Indicator Background German … “EUR/USD: Trading the German Preliminary GDP”

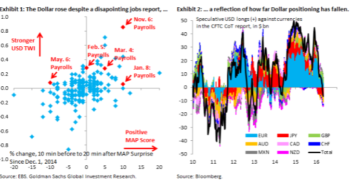

The USD Has Bottomed; Stay Long USD/JPY – Goldman Sachs

The US dollar had an impressive “Turnaround Tuesday” and managed to beat its rivals. The team at Goldman Sachs sees more gains ahead, and eyes one specific pair. Here is their view, courtesy of eFXnews: Last week’s disappointment on payrolls offers an important insight on positioning. As Exhibit 1 shows, even though the data were a … “The USD Has Bottomed; Stay Long USD/JPY – Goldman Sachs”

FX Traders, Now’s ‘Not The Time To Give Up Currency

Foreign exchange trading sees fluctuations according to volatility and other market conditions. The team at Duetsche Bank has encouraging words for traders: Here is their view, courtesy of eFXnews: The international press is replete with stories of poor investor returns and discretionary fund closures this year. Reuters reports1 that Q1 2016 marked the first quarter of outflows … “FX Traders, Now’s ‘Not The Time To Give Up Currency”

USD/CAD: Trading the US Crude Oil Inventories

US Crude Oil Inventories measures the change in the number of barrels held in inventory. The report is published each week. A reading which is higher than the market forecast is bullish for USD/CAD. Here are all the details, and 5 possible outcomes for USD/CAD. Published on Wednesday at 14:30 GMT. Indicator Background As Canada is … “USD/CAD: Trading the US Crude Oil Inventories”

Gold investors are the most happiest this year

Back in the fourth quarter of 2015, when the Federal Reserve was contemplating hiking rates, many expected gold prices to fall. The bearish sentiment picked as gold prices fell nearly 10% between September 12 2015 and November 23 2015 on increasing chatter about the historic Fed rate hike. By December 2015, gold prices hit lows … “Gold investors are the most happiest this year”

AUD/USD: ‘Sell In May’ Seasonal Trade Is Unfolding –

The Australian dollar was hit by the RBA, but this is not the only thing in play: Here is their view, courtesy of eFXnews: Last week, we discussed the prospects of market conditions gradually turning less favourable for Asian currencies going into May. Indeed, the USD has turned around, as the “Sell in May” seasonal phenomenon is … “AUD/USD: ‘Sell In May’ Seasonal Trade Is Unfolding –”

Fed will take any excuse not to raise interest rates

In an interview on FXStreet, I spoke about the diminishing odds for a rate hike in June, the frustrating EUR/USD range, the next moves in GBP/USD with respect to the odds of a Brexit, the upcoming moves of USD/JPY and more. EURUSD remained practically unchanged after Non-Farm Payroll release. Where do you see the pair going … “Fed will take any excuse not to raise interest rates”

EUR/USD: Trading the US Nonfarm Employment Change

US Nonfarm Employment Change measures the change in the number of newly employed people in the US, excluding workers in the farming industry. A reading which is higher than the market forecast is bullish for the dollar. Here are the details and 5 possible outcomes for EUR/USD. Published on Friday at 12:30 GMT. Indicator Background Job … “EUR/USD: Trading the US Nonfarm Employment Change”