Canadian Employment Change is an important leading indicator which provides a snapshot of the health of the employment market. A reading higher than the forecast is bullish for the Canadian dollar. Here are the details and 5 possible outcomes for USD/CAD. Published on Friday at 12:30 GMT. Indicator Background Job creation is one of the most … “USD/CAD: Trading the Canadian Employment Change”

Category: Opinions

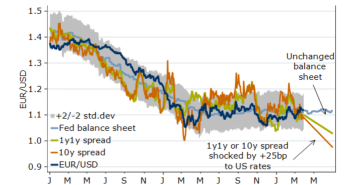

EUR/USD: ‘Torturing The Bears’: What’s Next? – BofA Merrill

EUR/USD is off the highs but also refusing to fall. What’s next? The team at Bank of America Merrill Lynch explains how markets are torturing the bears: Here is their view, courtesy of eFXnews: Themes: the Fed in the driver’s seat. Our last report argued that the March ECB meeting would be the most difficult in recent … “EUR/USD: ‘Torturing The Bears’: What’s Next? – BofA Merrill”

Buy USD Dips Vs AUD, CAD; We Stay Short AUD/USD

The US dollar has retaken some ground but the comeback seems limited, What’s next? The team at Credit Agricole puts the finger on specific currencies: Here is their view, courtesy of eFXnews: Risk sentiment will remain driven by Fed rate expectations and conditions in China. From that angle this week’s main focus will be on Wednesday’s release … “Buy USD Dips Vs AUD, CAD; We Stay Short AUD/USD”

AUD/USD – What’s next?

The Australian dollar reached new highs against the greenback but stalled and is now retreating. Here are two views about the pair, from ANZ and Credit Agricole: Here is their view, courtesy of eFXnews: AUD/USD: Now A Sell – Credit Agricole The AUD has been in demand for most of this year. A combination of improving … “AUD/USD – What’s next?”

EUR/USD: Trading the ISM Non-Manufacturing PMI

The US ISM Non-Manufacturing PMI (Purchasing Managers’ Index) is based on a survey of purchasing managers, excluding those in the manufacturing sector. Respondents are surveyed for their view of the economy and business conditions in the US. A reading which is higher than the market forecast is bullish for the dollar. Here are all the details, and … “EUR/USD: Trading the ISM Non-Manufacturing PMI”

A weak US Dollar Only Postpones ‘The Day Of Reckoning’

The “Day of Reckoning” for the global economy is nigh, says RBS, and the weak USD just postpones it. What’s next? Here is their view: Here is their view, courtesy of eFXnews: The Fed’s shift toward a more growth-friendly stance ought to be helpful in mitigating the downside risks to the world economy in the … “A weak US Dollar Only Postpones ‘The Day Of Reckoning’”

EUR/USD: Trading the US Non-Farm Payrolls

US Nonfarm Employment Change measures the change in the number of newly employed people in the US, excluding workers in the farming industry. A reading which is higher than the market forecast is bullish for the dollar. Here are the details and 5 possible outcomes for EUR/USD. Published on Friday at 12:30 GMT. Indicator Background Job … “EUR/USD: Trading the US Non-Farm Payrolls”

USD/CAD: Trading the Canadian GDP

Canadian GDP is a measurement of the production and growth of the economy. Analysts consider GDP one the most important indicators of economic activity. A reading which is better than the market forecast is bullish for the Canadian dollar. Here are all the details, and 5 possible outcomes for USD/CAD. Published on Thursday at 12:30 … “USD/CAD: Trading the Canadian GDP”

EUR/USD: Dealing With The Fed’s Confusion – Nordea

Yellen went full dovish, once again, and this certainly hurt the US dollar. Was does this mean for EUR/USD? The team at Nordea analyzes: Here is their view, courtesy of eFXnews: The Fed has done its best to propagate confusion recently. Why the Fed chose to walk the dovish path in March is crucial for the … “EUR/USD: Dealing With The Fed’s Confusion – Nordea”

GBP/USD: Bottomed With Oil; Where To Target? – Nordea

The pound has suffered the fears of a Brexit, but rides higher on the dovish words of Yellen. And what about the oil connection? Here is their view, courtesy of eFXnews: The GBP has lost almost 10% since the autumn peak in effective terms and stabilised somewhat in March, supported by global risk sentiment and higher oil … “GBP/USD: Bottomed With Oil; Where To Target? – Nordea”