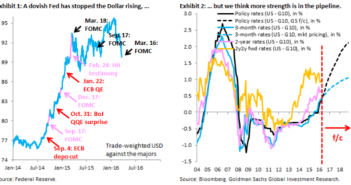

CIBC is not alone, thinking the dollar’s fall was an overreaction. While the road to recovery may be hard, the team at Goldman Sachs sees the greenback rising: Here is their view, courtesy of eFXnews: Over the past year, the Fed has repeatedly arrested the Dollar rise and this week’s FOMC, with the shift in rhetoric … “‘Going Up Is Hard To Do, But Dollar Will Go”

Category: Opinions

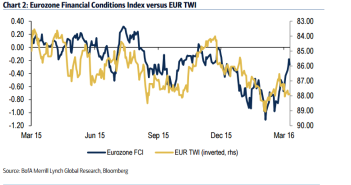

EUR/USD: ‘That Was The Week That Was’ – BofA Merrill

EUR/USD had another exciting week, with significant moves, this time inspired by the biggest central bank. Here is a digest of the events: Here is their view, courtesy of eFXnews: That was the week that was It has now been a week since the ECB delivered its latest package of measures and so far, the initial … “EUR/USD: ‘That Was The Week That Was’ – BofA Merrill”

USD: The Pain Trade – Morgan Stanley

The fallout from the dovish Fed decision continues and some see a long term change to the downside. What’s next? Here is the analysis from Morgan Stanley: Here is their view, courtesy of eFXnews: More short-term USD weakness. “The dovish Fed – discouraging USD bulls – has led to a de-positioning move supporting the once … “USD: The Pain Trade – Morgan Stanley”

Is The USD Rally Over For Good Or Over For Now? – SocGen

The Fed took the extreme dovish path, hitting the dollar hard. Is this is an even more significant change? The team at SocGen weighs in: Here is their view, courtesy of eFXnews: The term ‘Currency Wars’ was used by Brazil’s erstwhile Finance Minister, Guido Mantega, in September 2010 in response to moves by some (Asian) countries … “Is The USD Rally Over For Good Or Over For Now? – SocGen”

EUR/USD: Trading the UoM Consumer Sentiment Index

The University of Michigan Consumer Sentiment Index surveys consumer attitudes and expectations about the US economy. An increase in consumer confidence is a positive sign about the health of the economy and is bullish for the US dollar. Here are all the details, and 5 possible outcomes for EUR/USD. Published on Friday at 14:00 GMT. Indicator … “EUR/USD: Trading the UoM Consumer Sentiment Index”

‘Marching In Place’: What’s Next For The USD Post-FOMC?

The Fed went dovish (here are 5 points) and the dollar certainly tumbled. What’s next for the greenback? Here is the view from Bank of America Merrill Lynch: Here is their view, courtesy of eFXnews: FOMC maintains a dovish stance. The Federal Open Market Committee (FOMC) not only did not hike today as widely expected, but … “‘Marching In Place’: What’s Next For The USD Post-FOMC?”

5 Dovish Points in the Fed Decision

The dollar totally tanked on the Fed decision. Was it the dot plot that crashed the greenback? Not exactly, that’s only one reason in a generally dovish statement that seems to contradict quite a few recent developments. What does the Fed know that we don’t? Here are 5 dovish points in the decision that explain the downfall … “5 Dovish Points in the Fed Decision”

Two more FOMC previews – Get ready

The Fed decision is coming shortly. Here are last minute views from Deutsche Bank and Credit Agricole. Stay tuned for our live coverage. Here goes. Here is their view, courtesy of eFXnews: How The FX Market Will Likely React To Today’s FOMC? – Credit Agricole The outcome of the March Fed meeting is the main event … “Two more FOMC previews – Get ready”

Long USD Into FOMC: Here Is The Best Risk-Reward Trade

The big event of the week is coming today: the Fed decision. While no rate hike is expected, markets seem to be sitting on the edge of the chair in anticipation. What’s next? Goldman Sachs have a clear view: Here is their view, courtesy of eFXnews: With the US economy continuing to grow above trend, … “Long USD Into FOMC: Here Is The Best Risk-Reward Trade”

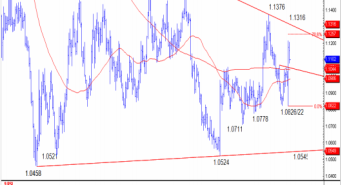

EUR/USD: Point Of Breakout Key: Levels & Targets –

EUR/USD is trading in a very narrow range ahead of the Fed, still digesting Draghi. What do the charts tell us? Here is the view from Credit Suisse: Here is their view, courtesy of eFXnews: EUR/USD spotlight remains on the “point of breakout” and 200- day average at 1.1068/44, notes Credit Suisse. “We look for this … “EUR/USD: Point Of Breakout Key: Levels & Targets –”