The ECB will probably use some tools in its shed and the euro may fall, but it will not necessarily be extreme. Here is the view from UOB: Here is their view, courtesy of eFXnews: We remain of the view that the ECB will slash the deposit rate further by 10bps to -0.4%. Whilst this is … “ECB March Meeting: What To Expect From EUR/USD? – UOB”

Category: Opinions

GBP/USD: Trading the UK Manufacturing Production

UK Manufacturing Production, a key indicator, provides analysts and traders with a snapshot of the strength of the UK manufacturing sector. A reading which is higher than the market forecast is bullish for the pound. Here are all the details, and 5 possible outcomes for GBP/USD. Published on Wednesday at 9:30 GMT. Indicator Background The British Manufacturing … “GBP/USD: Trading the UK Manufacturing Production”

USD/CAD: 2 BOC Previews

Here are two previews towards the decision of the Bank of Canada on Wednesday. Is there room for a dovish surprise? Here is their view, courtesy of eFXnews: Room For A Dovish BoC Surprise Next Week; Risk-Reward Favors Short CAD – BofA Merrill The Bank of Canada (BoC) held rates at 0.50% in January, despite expectations … “USD/CAD: 2 BOC Previews”

Trading ECB: Scenarios For EUR/USD – Goldman Sachs

The decision of the ECB is just around the corner. How will it affect the euro? Here is the view from Goldman Sachs: Here is their view, courtesy of eFXnews: We lay out scenarios for EUR/$ for different outcomes on Thursday. Above all, after a year of mixed messages, the ECB needs to signal that it is … “Trading ECB: Scenarios For EUR/USD – Goldman Sachs”

EUR/USD: A Replay Of December? – Credit Suisse

Expectations are becoming sky high towards the upcoming ECB decision on March 10th. Will we see the euro extend its falls like in January 2015 or bounce big time like in December 2015? The team at Credit Suisse has a clear opinion: Here is their view, courtesy of eFXnews: EURUSD’s decline in the past three … “EUR/USD: A Replay Of December? – Credit Suisse”

EUR/USD: Trading the US NFP March 2016

US Nonfarm Employment Change measures the change in the number of newly employed people in the US, excluding workers in the farming industry. A reading which is higher than the market forecast is bullish for the dollar. Here are the details and 5 possible outcomes for EUR/USD. Published on Friday at 13:30 GMT. Indicator Background Job … “EUR/USD: Trading the US NFP March 2016”

The Brexit and Spread Betting: Dynamic Market Interaction

The United Kingdom will be holding a referendum on June 23 to determine whether a Brexit will become a reality or not. Market volatility is approaching a crescendo. Spread betting activity is increasing in the lead up to the Brexit referendum! UK Spread Betting Enterprises Brace for Bumper Start to 2016 Foreign currency brokers and … “The Brexit and Spread Betting: Dynamic Market Interaction”

USD Comeback – 3 Reasons – Credit Agricole

Recent figures in the US haven’t been too bad. Is the greenback making a big comeback? The team at Credit Agricole examines: Here is their view, courtesy of eFXnews: The USD-decoupling trade is staging a return on the back of improving US data, the abatement of global risk aversion and the growing resilience of the … “USD Comeback – 3 Reasons – Credit Agricole”

GBP/USD: Trading the UK Services PMI

UK Services PMI (Purchasing Managers’ Index) is based on a survey of purchasing managers in the services sector. Respondents are surveyed for their view of the economy and business conditions in the UK. A reading which is higher than the market forecast is bullish for the pound. Here are all the details, and 5 possible outcomes for GBP/USD. Published on … “GBP/USD: Trading the UK Services PMI”

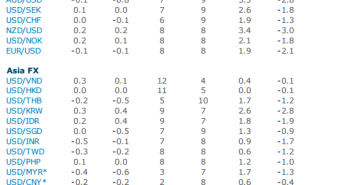

Strongest Seasonal FX Patterns In March – ANZ

Every month has its own tendency, with patterns often repeating themselves. What can we expect from March? Here are the views from ANZ: Here is their view, courtesy of eFXnews: While short USD/CAD and long USD/JPY tend to perform well during the month of March, they are not attractive seasonal plays from a risk/reward perspective, … “Strongest Seasonal FX Patterns In March – ANZ”