Marc Ostwald, Strategist for ADM Investor Services, joined Zak Mir and Alan Green on the Tip TV Finance Show to discuss what is expected from the ECB Meeting next week, as well as the overall manufacturing state of the global economy, and a focus on the US. Topics Covered: ECB, Interest Rates, QE, Inflation, Manufacturing, … “ECB Meeting: Markets expecting a further rate cut and”

Category: Opinions

AUD/USD: Trading the Australian GDP

Australian GDP is the primary gauge of the production and growth of the economy. It is considered by analysts as one the most important indicators of economic activity, and a reading which is higher than expected is bullish for the Australian dollar. Here are all the details, and 5 possible outcomes for AUD/USD. Published on Wednesday at10:30 … “AUD/USD: Trading the Australian GDP”

GBP/NOK: A Sterling Example

Norges Bank last lowered its Key policy rate 25 basis point to 0.75% in June of 2015 citing “…Developments in the Norwegian economy have been slightly weaker than expected and the economic outlook has deteriorated somewhat… …output growth has edged down and reporting enterprises expect growth to remain weak over the next half-year…” Norway’s economy … “GBP/NOK: A Sterling Example”

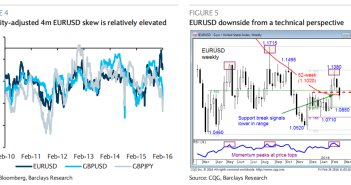

EUR/USD: A Sell; USD/JPY: Targeting 100 – Barclays

What’s next for major pairs? Here are detailed ideas from Barclays: Here is their view, courtesy of eFXnews: EUR: EURUSD – A cheaper alternative to hedge EU referendum risks. We recommend owning EURUSD downside options as a cheaper way to hedge against the EU Referendum risk. We continue to argue that the referendum is at least … “EUR/USD: A Sell; USD/JPY: Targeting 100 – Barclays”

5 Tools the ECB has left

It’s ECB week. We know they are going to do something, but what can they actually announce? Here is the toolbox according to Danske: Here is their view, courtesy of eFXnews: We look at what is left in the ECB’s toolbox, how the remaining tools would support inflation and how they would affect markets across … “5 Tools the ECB has left”

EUR/USD: ‘Disorderly Times’: Where To Target? – Credit Suisse

EUR/USD seems to have found a temporary calm within the 1.0960 to 1.1070 levels, but this may change soon. What’s next in these disorderly times? The team at Credit Suisse weighs in: Here is their view, courtesy of eFXnews: …Many market participants are excited about the 10 March ECB meeting. They hope that a central bank … “EUR/USD: ‘Disorderly Times’: Where To Target? – Credit Suisse”

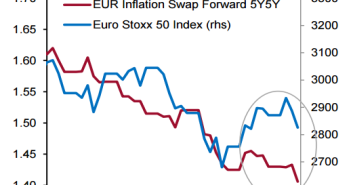

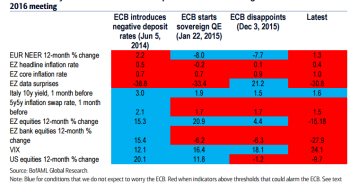

Buying The EUR Dip Tactically Around The ECB March

Tension is clearly growing towards the March meeting of the European Central Bank, with even some hawkish members talking about their readiness to act. How should one trade it? Here is the word from Bank of America Merrill Lynch: Here is their view, courtesy of eFXnews: We argue the March ECB meeting could be the … “Buying The EUR Dip Tactically Around The ECB March”

EUR/USD: Trading the US Preliminary GDP

US Preliminary GDP is a measurement of the production and growth of the economy. Analysts consider GDP one the most important indicators of economic activity, and publication of Preliminary GDP could have a significant impact on the movement of EUR/USD. A reading which is better than the market forecast is bullish for the dollar. Here are all … “EUR/USD: Trading the US Preliminary GDP”

USD/JPY: Trading the US New Home Sales Feb 2016

US New Home Sales indicator is released monthly, and provides analysts with important data the health and direction of the housing sector. A higher reading than the market prediction is bullish for the dollar. Here are all the details, and 5 possible outcomes for USD/JPY. Published on Wednesday at 15:00 GMT. Indicator Background US New … “USD/JPY: Trading the US New Home Sales Feb 2016”

What’s Left In Mario’s Cart? What’s Next For EUR? – CIBC

March 10th is a date circled on many calendars: it’s the ECB meeting, What does Mario Draghi have in store? Where will EUR/USD be next? Here is a preview from CIBC: Here is their view, courtesy of eFXnews: ECB President Mario Draghi has already unleashed a sizeable wave of central bank stimulus, but it hasn’t … “What’s Left In Mario’s Cart? What’s Next For EUR? – CIBC”