The better market mood has helped both antipodean currencies but the road is certainly bumpy. What do the technical lines say? Here is the view from NAB: Here is their view, courtesy of eFXnews: The corrective bounces of recent weeks have challenged the integrity of the downtrend but not broken its structure. Dual trend line resistance … “AUD/USD: Base Of Triangle; NZD/USD: Trendline Resistance – NAB”

Category: Opinions

AUD/USD: Trading the Australian jobs Feb 2016

Australian Employment Change, which is released monthly, provides a snapshot of the health of the Australian labor market. A reading which is higher than the market forecast is bullish for the Australian dollar. Here are the details and 5 possible outcomes for AUD/USD. Published on Thursday at 00:30 GMT. Indicator Background Job creation is one … “AUD/USD: Trading the Australian jobs Feb 2016”

EUR/USD: Trading the German ZEW Economic Sentiment

German ZEW Economic Sentiment is based on a monthly survey of institutional investors and analysts and their views of the German economy. A reading that is higher than the market forecast is bullish for the euro. Here are all the details, and 5 possible outcomes for EUR/USD. Published on Tuesday at 10:00 GMT. Indicator Background … “EUR/USD: Trading the German ZEW Economic Sentiment”

Is bad news good news now?

Since the beginning of the European session on Friday, the market mood has certainly improved. And now it seems that nothing can stop markets, even significantly bad news. Or perhaps the faith in central banks is returning and bad news is becoming good news? Some of this correction can be explained by a correction to the exaggerated doom … “Is bad news good news now?”

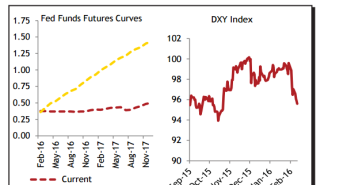

Traders, Beware Of A Near-Term Reversal In The US Dollar

The US dollar has been on its back foot for quite a while, suffering from weakness in the US economy among other issues. Can this turn around though? Here is an explanation from CIBC: Here is their view, courtesy of eFXnews: The fed funds futures curve is now essentially flat, with market-based expectations pointing to … “Traders, Beware Of A Near-Term Reversal In The US Dollar”

ECB To Ease In March, Fed On Hold Till September,

Does EUR/USD have more room to rise? It took a break for now, but could certainly resume its upward move. Here is the explanation from Danske: Here is their view, courtesy of eFXnews: We now expect the ECB to accompany a 10bp rate cut in March with the introduction of a two-tier deposit rate system … “ECB To Ease In March, Fed On Hold Till September,”

JPY Intervention: ‘Hard To Justify And May Ultimately Fail’

A sharp and short lived spike on Thursday, February 11th seemed like the work of the Bank of Japan. And according to recent talk by governor Kuroda, they are “watching”. Can they succeed with intervention? Not so fast. Here is the opinion from HSBC: Here is their view, courtesy of eFXnews: Direct FX intervention remains a major threat on … “JPY Intervention: ‘Hard To Justify And May Ultimately Fail’”

Are markets losing faith in central banks?

Central banks have been ever-powerful in markets: support for stocks via the Bernanke Put, Draghi’s “Whatever it Takes” and Kurdoa’s Shock and Awe QQE are prime examples. They not only gave boosts to stock markets but also pushed down the currencies, thus making exports more competitive. Yet recently, it seems that these very powerful institutions with their … “Are markets losing faith in central banks?”

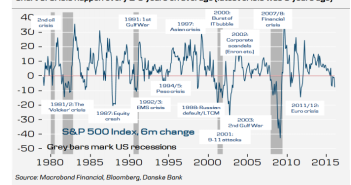

Turning Bearish On USD For First Time Since Mid-2014 –

The US dollar is finding less love these days, especially against the yen. The team at Creidt Suisse turns bearish on the greenback for the first time since mid 2014 and explains: Here is their view, courtesy of eFXnews: Risk aversion in markets continues to play out, with our technical team now targeting an S&P 500 level … “Turning Bearish On USD For First Time Since Mid-2014 –”

Little Italy is getting little again

The Italian debt poses great danger to the economy – Watch today’s discussion on the Italian economy, and the financial markets with Nicole Elliott, Private Investor and Technical Analyst, joined by Mike Ingram, Strategist at BGC Partners, and Zak Mir, Technical Analyst at Zak’s Traders Café. Key points: Bullish or Bearish – Sort out your … “Little Italy is getting little again”