The US dollar has been on the back foot against safe haven currencies and gaining only a bit against commodity currencies and the pound. Yet this may turn around, perhaps after some time. The team at Deutsche Bank explains: Here is their view, courtesy of eFXnews: Policy divergence (hiking Fed, other central banks easing) was to … “USD Strength To Resume Even If This May Not Be”

Category: Opinions

GBP/USD: Trading the British Manufacturing Feb 2016

British Manufacturing Production, a key indicator, provides analysts and traders with a snapshot of the health of the UK manufacturing sector. A reading which is higher than the market forecast is bullish for the pound. Here are all the details, and 5 possible outcomes for GBP/USD. Published on Wednesday at 9:30 GMT. Indicator Background The … “GBP/USD: Trading the British Manufacturing Feb 2016”

USD: History Repeats Itself So Elegantly – Deutsche Bank

The current moves in the US dollar seem to resemble a behavior in the not-so-distant past. What can we learn going forward? ?he team at Deutsche Bank explains: Here is their view, courtesy of eFXnews: The bullets and charts below show how history is partly repeating itself in interesting ways.Figure 1 shows the current DXY … “USD: History Repeats Itself So Elegantly – Deutsche Bank”

AUD/JPY: Constant/Variable

The Bank of Japan surprised markets with the 29 January press release in which a 3 tier negative rate policy was introduced. In a general sense, the implications were serious. The BOJ negative rate was unprecedented. It was also an indication of a continuing global “disinflationary trend” in spite of easing policies having been in … “AUD/JPY: Constant/Variable”

Are wages all the rage or is it profit taking?

It is quite uncommon to see the US dollar rising across the board on a significantly worse than expected Non-Farm Payrolls. Jobs advanced by 151K, worse than 190K expected and well below the average of recent months. The dollar initially dropped, with EUR/USD reaching 1.1244, USD/JPY continuing its reversal of the BOJ move and other currencies … “Are wages all the rage or is it profit taking?”

EUR/USD: Trading the US NFP Feb 2016

US Nonfarm Employment Change measures the change in the number of newly employed people in the US, excluding workers in the farming industry. A reading which is higher than the market forecast is bullish for the dollar. Here are the details and 5 possible outcomes for EUR/USD. Published on Friday at 13:30 GMT. Indicator Background Job … “EUR/USD: Trading the US NFP Feb 2016”

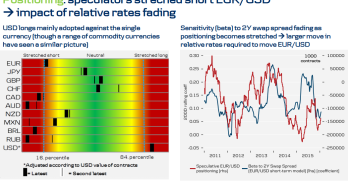

EUR/USD Set To Rally In 2016, Now Is The Time

EUR/USD is certainly already on the move, thanks to the big dollar dive. To be fair, this assessment from Danske was released before the move. Here is their reasoning: Here is their view, courtesy of eFXnews: One argument for a lower EUR/USD: – Relative rates: still in favour of USD… …but several arguments for a higher EUR/USD: … “EUR/USD Set To Rally In 2016, Now Is The Time”

Buy AUD/USD suggest February seasonal patterns

Seasonality cannot always be explained but it’s certainly another pattern to look out for. The team at ANZ show that February is a good month for going long Aussie against the USD: Here is their view, courtesy of eFXnews: Long AUD/USD is the best seasonal FX trade for the month of February, notes Australia and … “Buy AUD/USD suggest February seasonal patterns”

GBP/USD: Trading the British Services PMI Feb 2016

British Services PMI (Purchasing Managers’ Index) is based on a survey of purchasing managers in the services sector. Respondents are surveyed for their view of the economy and business conditions in the UK. A reading which is higher than the market forecast is bullish for the pound. Here are all the details, and 5 possible outcomes for GBP/USD. Published on … “GBP/USD: Trading the British Services PMI Feb 2016”

EUR/USD: Opposing Forces: Where To Target? – BTMU

Euro/dollar has been one of the most frustrating currency pairs in the new year, with ranges just becoming tighter and tighter. Where will it go from here? The team at BTMU explains: Here is their view, courtesy of eFXnews: The EUR/USD rate did not repeat the sharp declines of January 2015 in 2016 with a … “EUR/USD: Opposing Forces: Where To Target? – BTMU”