After the Carney Carnage, the BOJ’s beating of the yen and Draghi’s dovishness, many expect the Fed to send a dovish message and to weaken the dollar. This may not be the case. Here are two opinions: Here is their view, courtesy of eFXnews: SEB: After the fireworks in December, we expect only small changes … “FOMC will NOT be a dove-fest – SEB, BNP Paribas”

Category: Opinions

AUD/USD: Trading the Australian CPI Jan 2015

Australian CPI (Consumer Price Index), which is released each quarter, measures the change in the price of goods and services charged to consumers. A reading which is higher than the market forecast is bullish for the Australian dollar. Here are all the details, and 5 possible outcomes for AUD/USD. Published on Wednesday at 00:30 GMT. … “AUD/USD: Trading the Australian CPI Jan 2015”

BOJ Likely On Hold This Week But…

After the yen strengthened quite a bit, we heard different tunes from the BOJ and the government, willing to act and feeling uncomfortable with the strength of the yen. But will they act? Here is the view from Bank of America Merrill Lynch: Here is their view, courtesy of eFXnews: Main focus on assessment of … “BOJ Likely On Hold This Week But…”

EUR: Hedge Downside, GBP: Correction Ahead – Barclays

We certainly had some moves in markets, with EUR moving down and the pound crashing only to stage a nice recovery. What’s next? Here is the view from Barclays: EUR: Hedge the downside while it is still cheap. Here is their view, courtesy of eFXnews: The EUR weakened last week as the ECB’s Governing Council unanimously … “EUR: Hedge Downside, GBP: Correction Ahead – Barclays”

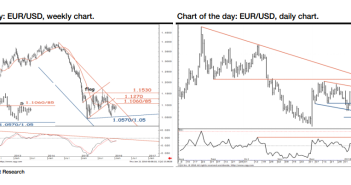

Multiyear Channel Limits In EUR/USD & GBP/AUD – SocGen

Draghi dragged the euro down, but it didn’t go too far. Nevertheless, it is now approaching an interesting technical level and so is GBP/AUD. Here is the view from SocGen: Here is their view, courtesy of eFXnews: Having broken below the flag formation, EUR/USD retested last March lows and it continues to sustain below 20 … “Multiyear Channel Limits In EUR/USD & GBP/AUD – SocGen”

Buy Opportunity in EUR/USD?

Draghi dragged EUR/USD down by talking and detailing about downside risks and basically promising action in March. The downside risk for EUR/USD could be limited, at least in time, and could provide a buy opportunity. In the third week of doom and gloom in financial markets, central banks have begun reacting. First came Carney: the governor … “Buy Opportunity in EUR/USD?”

BoC Surprisingly On Hold: 2 Reasons – Nomura

The BOC surprised with not cutting the rates and also sending a not-so-dovish message, allowing some breathing space for the Canadian dollar. Here are two reasons: Here is their view, courtesy of eFXnews: Against Nomura’s expectations, the Bank of Canada (BoC) left its policy rate at 0.50%. Overall, today’s decision, indicates that the BoC seems … “BoC Surprisingly On Hold: 2 Reasons – Nomura”

GBP Pain – Tough year for Sterling ahead

Paul Wallace, Trading Coach for Trading Beliefs & Founder of London Traders Network, joined Nick Batsford and Mike Ingram on the Tip TV Finance Show to discuss the fortunes of the GBP against the USD, Euro and Yen. Topics Covered: GBP, GBP/USD, EUR/GBP, GBP/JPY Watch the video to find out what is expected from the … “GBP Pain – Tough year for Sterling ahead”

Where will USD/CAD go on a BOC cut?

A consensus is gathering around a rate cut by the Bank of Canada. Can it send USD/CAD further up? Or is priced in, with a “buy the rumor, sell the fact” move coming? Here are two opposing opinions. Which one has you convinced? Here is the view from Bank of America Merrill Lynch: Here is … “Where will USD/CAD go on a BOC cut?”

GBP/USD: Trading the British Wages Jan 2016

British Average Earnings Index, released each month, is a leading indicator of consumer inflation. A reading which is higher than the market forecast is bullish for the pound. Update: UK employment data OK – GBP/USD attempts recovery Here are all the details, and 5 possible outcomes for GBP/USD. Published on Wednesday at 9:30 GMT. Indicator Background The Average Earnings Index … “GBP/USD: Trading the British Wages Jan 2016”