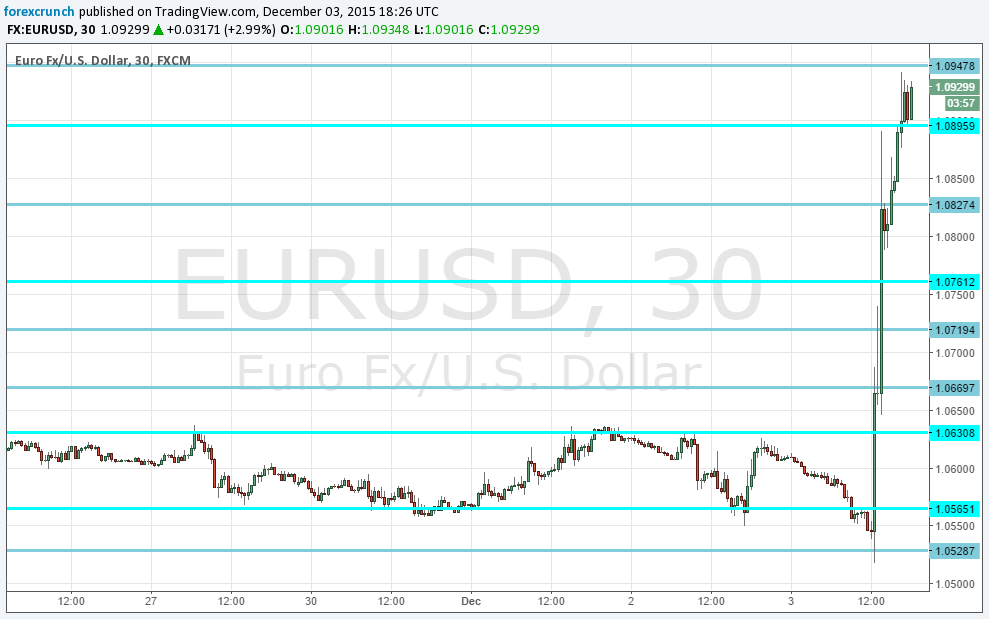

EUR/USD is holding on to high ground reached after the Draghi disappointment. The team at SocGen explores the next moves: Here is their view, courtesy of eFXnews: After breaching below the flag formation, EUR/USD has retested March lows of 1.05/1.04 which more importantly correspond with the multi decadal channel lower limit, notes SocGen. “Currently a … “EUR/USD: Recovery Or Reversal? Levels & Targets – SocGen”

Category: Opinions

What’s Next For EUR After Draghi Fails To Meet ‘Too

EUR/USD rallied hard, over 400 pips on Draghi’s disappointment (see 10 points). What’s next? The team at CIBC examines: Here is their view, courtesy of eFXnews: Expectations were set high in advance of this week’s ECB meeting, notes CIBC World Markets. “Too high. Even though Mario Draghi announced an extension to QE, the measures were … “What’s Next For EUR After Draghi Fails To Meet ‘Too”

ECB QE: Are reinvestments worth an extra €20 billion/month?

The president of the ECB certainly did not like the market reaction to the new measures he introduced. He can probably blame himself, at least partially, for creating huge expectations and not meeting them. Draghi did some damage control, especially in explaining the magnitude of re-investing proceeds and also admitted, in the video below, that he was … “ECB QE: Are reinvestments worth an extra €20 billion/month?”

3 things that can push EUR/USD back down

EUR/USD had an incredible range of 460 pips on the ECB’s upset, nearly reaching 1.10 on these 10 points. Draghi and his colleagues had created huge expectations but eventually showed a lack of vigilance, to say the least. From here, we are seeing a correction. This may be temporary, before the next move higher. But what can … “3 things that can push EUR/USD back down”

10 Points on 400 Pips in EUR/USD

Draghi didn’t deliver: The president of the European Central Bank created huge expectations for further easing and delivered very very little. This caused a massive rally in EUR/USD, lifting it around 400 pips in a dramatic day that will be remembered for a long time. Here are 10 points on this huge move. Will it extend further or … “10 Points on 400 Pips in EUR/USD”

ECB Preview: Short euro and long bunds opportunities

Key Points The ECB is expected to announce massive monetary easing on December 3rd. ECB President Mario Draghi has already under-promised and under-delivered EUR/USD has potential of a significant fall regardless of Fed hike expectations German bunds still have value despite elevated prices Background The European Central Bank is missing its single inflation target of … “ECB Preview: Short euro and long bunds opportunities”

EUR/USD: Trading the US NFP Dec 2015

US Nonfarm Employment Change measures the change in the number of newly employed people in the US, excluding workers in the farming industry. A reading which is higher than the market forecast is bullish for the dollar. Here are the details and 5 possible outcomes for EUR/USD. Published on Friday at 13:30 GMT. Indicator Background Job … “EUR/USD: Trading the US NFP Dec 2015”

4 Reasons To Stay Bearish EUR/USD Into ECB Meeting –

EUR/USD has been flip-flopping on ECB rumors and other events towards the all important ECB decision. Here are 4 reasons to stay bearish on the pair into the meeting: Here is their view, courtesy of eFXnews: With the ECB’s much-anticipated 3 December meeting is finally upon us, Credit Suisse European economists expect a 10bp cut … “4 Reasons To Stay Bearish EUR/USD Into ECB Meeting –”

A Cheat Sheet For Trading The ECB Meeting – UBS

As the ECB meeting approaches rapidly (see all the updates here) , we bring a quick cheat sheet from UBS. Here are all the scenarios: Here is their view, courtesy of eFXnews: As the ECB is poised to ease policy at tomorrow’s meeting and has a range of tools available to it, UBS looked at the … “A Cheat Sheet For Trading The ECB Meeting – UBS”

GBP/USD: Trading the British Services PMI Dec. 2015

The British Services PMI (Purchasing Managers’ Index) is based on a survey of purchasing managers in the services sector. Respondents are surveyed for their view of the economy and business conditions in the UK. A reading which is higher than the market forecast is bullish for the pound. Here are all the details, and 5 possible outcomes for GBP/USD. Published … “GBP/USD: Trading the British Services PMI Dec. 2015”