The Canadian dollar was saved from lower ground thanks to the Saudis and their talking up of oil prices. Will this last? Not so fast? Here is their view, courtesy of eFXnews: The rates market is barely pricing in any probability of BoC easing, a major disconnect given still low energy prices and signs of … “Staying Long USD/CAD Targeting 1.40 – Morgan Stanley”

Category: Opinions

GBP/USD: Trading the British Second GDP Nov 2015

British Second GDP, one of the most important economic releases, is published each quarter. GDP measures production and growth of the economy, and is considered by analysts as one the most important indicators of economic activity. A reading which is better than the market forecast is bullish for the pound. Update: It’s 0.5% as expected – GBP/USD still … “GBP/USD: Trading the British Second GDP Nov 2015”

5 Reasons To Stay Short EUR/USD – Citi

EUR/USD dipped to lower ground but bounced back to a higher range. The team at Citi explains why staying short is the way to go, with 5 reasons: Here is their view, courtesy of eFXnews: There are 5 good reasons all round for the EUR to weaken with particular focus on EUR/USD, says CitiFX in a … “5 Reasons To Stay Short EUR/USD – Citi”

EUR/USD On Course To Break 1.0490 – Morgan Stanley

EUR/USD has certainly shown signs of recovery by escaping low ground and looking to rise. However, the team at Morgan Stanley sees the pair en route to break 1.0490: Here is their view, courtesy of eFXnews: The US yield curve has flattened further this week expanding a trend which is now in place for three … “EUR/USD On Course To Break 1.0490 – Morgan Stanley”

EUR/USD: In Thrall Of Fed & ECB; 1.05 Is The

EUR/USD seems to be entrenched in a lower range. What’s next? The team at NAB lays out the battle lines ahead of the Fed and the ECB: Here is their view, courtesy of eFXnews: How much is December Fed rates ‘lift-off’ now in the price of the dollar? How much is intensification of ECB easing … “EUR/USD: In Thrall Of Fed & ECB; 1.05 Is The”

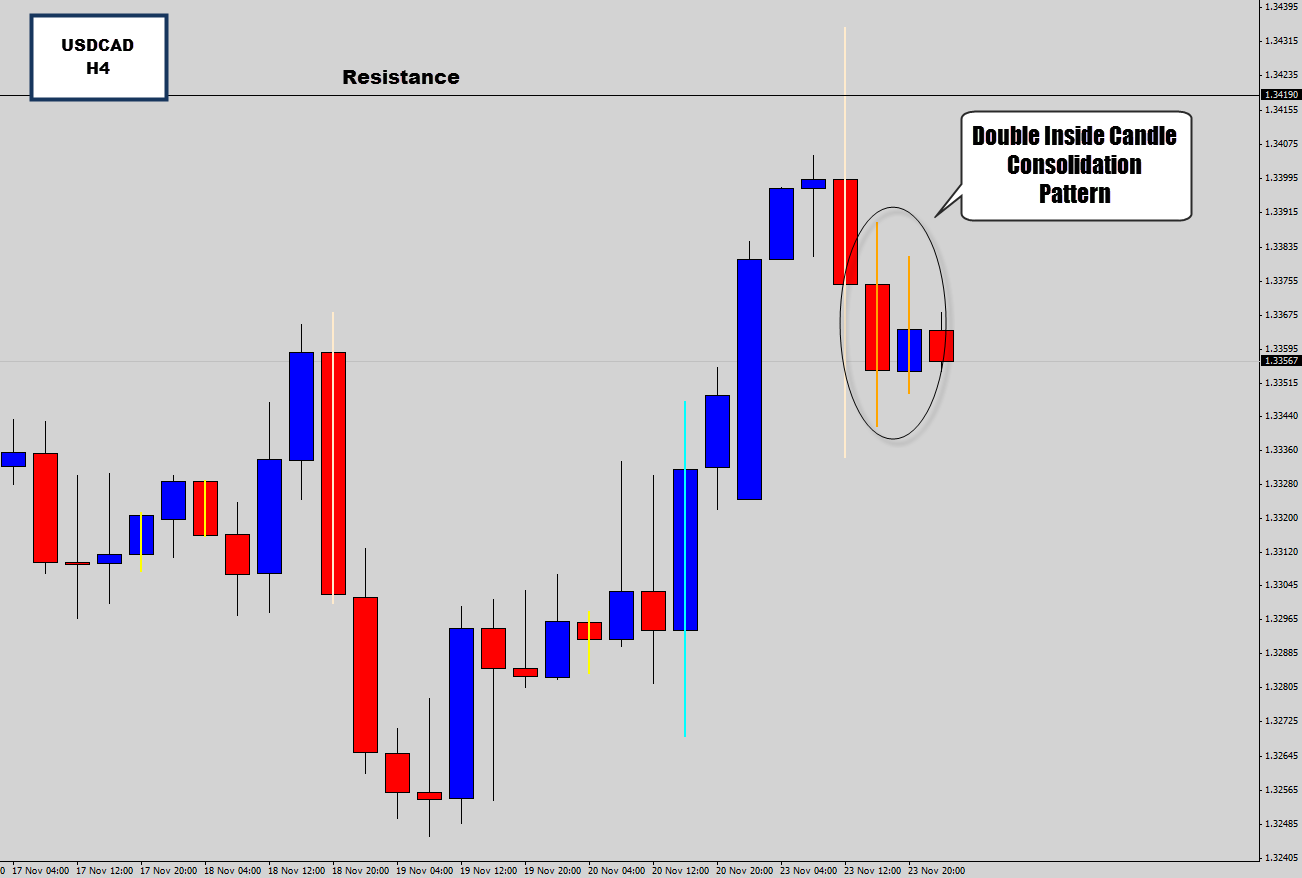

USDCAD Double Inside Day as Price Stalls @ Resistance –

Looking at the USDCAD which has got my attention here as it hits a potential turning point here. Last time the market failed at this level we seen a 500 pip drop on the daily chart. The market tested this level last session, but higher prices were rejected again for a second time at this … “USDCAD Double Inside Day as Price Stalls @ Resistance –”

EUR/USD: Trading the US Preliminary GDP Nov 2015

US Preliminary GDP is a measurement of the production and growth of the economy. Analysts consider GDP one the most important indicators of economic activity, and publication of Preliminary GDP could have a significant impact on the movement of EUR/USD. A reading which is better than the market forecast is bullish for the dollar. Update: US GDP revised … “EUR/USD: Trading the US Preliminary GDP Nov 2015”

Sell EUR/USD On Any Squeeze Higher Into ECB Dec Meeting

EUR/USD is showing fresh weakness in the new trading week. If it rises, the team at Barclays suggests selling the pair, especially as the December decision looms. Here is their view, courtesy of eFXnews: Barclays Capital expects the USD to trade sidelines during the next week as markets wait for policy action coming from the FOMC … “Sell EUR/USD On Any Squeeze Higher Into ECB Dec Meeting”

Fed December rate hike view already factored in EUR/USD,

Ricardo Evangelista, Head of International Desk at ActivTrades, joined today’s Tip TV Finance Show along with Zak Mir, Technical Analyst at Zak’s Traders Cafe, and Bill Hubard, Chief Economist at Bullion Capital, to discuss the euro – dollar divergence trade, and the outlook for the Fed and ECB. Divergence between Euro and Dollar Evangelista mentions … “Fed December rate hike view already factored in EUR/USD,”

EUR/USD: 10 To 15 Big Figure Drop On 1% Drop

EUR/USD certainly lost a lot of ground in the past 18 months, but perhaps there’s lots more. Sebastien Galy at Deutsche Bank analyzes the yield impacts: Here is their view, courtesy of eFXnews: “Even though the rates market prices in the forward path of the Fed, we find that EUR/USD ignores it and prices it … “EUR/USD: 10 To 15 Big Figure Drop On 1% Drop”