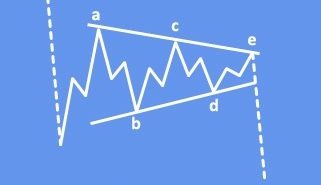

Crude oil jumped towards 63.00 zones and tested the upper side of a 2019 trading range where upside was limited, and a new leg lower started developing. We labeled that same leg down as wave D, as part of a bigger complex correction, which fully developed and pushed the price into the final leg E … “Oil: Interesting Elliott Wave Triangle pattern Points Lower”

Category: Opinions

Five points on trading fundamentals [Webinar]

In this webinar, we discuss the aspects of trading currencies in around news events by understanding what is priced in, identifying currency strength and falls breaks, and more. Even if you are a technical trader, being aware of economic indicators, trends, politics, and everything that we fundamental analysts are focused on will help you get … “Five points on trading fundamentals [Webinar]”

EUR/USD may struggle with Draghi’s last ECB decision

ECB President Draghi is set to defend his legacy in his last rate decision. The bank is unlikely to make policy changes at this juncture. EUR/USD may struggle if Draghi expresses pessimism. “The ECB is ready to do whatever it takes to preserve the euro.” These famous words by the euro, President of the ECB, are the centerpiece of his … “EUR/USD may struggle with Draghi’s last ECB decision”

USD/JPY may extend gains if Brexit passes

USD/JPY has hit four-month highs amid optimism on trade and Brexit. Brexit, US Durable Goods Orders, housing data, and further political developments are eyed. Mid-October’s daily chart is painting a bullish picture. The FX Poll points to short-term gains but falls later on. Brexit has gone global – joining the partial US-Sino deal in boosting … “USD/JPY may extend gains if Brexit passes”

GBP/USD: Will the ayes have it? If not, expect a downfall

GBP/USD has extended its surge after the UK, and the EU struck a new Brexit deal. The crucial Brexit vote in parliament and its follow-up are set to dominate pound trading. Mid-October’s daily chart is pointing to overbought conditions. “We’ve got a great new deal,” tweeted UK Prime Minister Boris Johnson and set alight sterling’s … “GBP/USD: Will the ayes have it? If not, expect a downfall”

Four GBP/USD scenarios after the EU-UK Brexit deal

The UK and the EU reached a Brexit deal and the ball now moves to the UK parliament. There are four different scenarios and outcomes for the pound. Substantial GBP/USD volatility is expected ahead and after the weekend. “We have a deal” – screamed the headlines and GBP/USD shot higher, falling short only 11 pips … “Four GBP/USD scenarios after the EU-UK Brexit deal”

GBP/USD: Five Brexit scenarios with very different outcomes

EU leaders convene in Brussels and aim to hammer out a Brexit deal. The outcome depends on the instant reactions and not only on the deal. Five different scenarios could send GBP/USD to considerably different prices. “Get Brexit done” was the Conservative Party’s conference slogan – but it is easier said than done. To make … “GBP/USD: Five Brexit scenarios with very different outcomes”

USD/JPY has more room to rally if Trump clinches a trade deal

USD/JPY has surged as the US and China were getting closer to a partial trade deal. Trade developments and US retail sales stand out in the upcoming week. Mid-October’s daily chart is painting a marginally bullish picture. The FX Poll is showing falls for the pair in the longer terms. USD/JPY has experienced high volatility … “USD/JPY has more room to rally if Trump clinches a trade deal”

Three scenarios for Brexit and GBP/USD as talks reach critical stage

A Brexit extension is the most likely scenario and would see GBP/USD retreating. A last-minute deal has medium probability and would send sterling soaring. The pound would tumble on the remote chance of a no-deal Brexit. The relative calm in GBP/USD fools no one – the clock is ticking down to Brexit Day, and when news headlines meet nervous … “Three scenarios for Brexit and GBP/USD as talks reach critical stage”

USD: Sept NFP: Still On Healthy Footing; Enough For Fed To Skip October And Cut In December – CIBC

September´s jobs report gave a little bit to everybody. Will the Federal Reserve cut interest rates? Here is their view, courtesy of eFXdata: CIBC Research discusses its reaction to today’s US jobs report for the month of September. “The US labor market appears to still be on relatively healthy footing despite the downside miss on … “USD: Sept NFP: Still On Healthy Footing; Enough For Fed To Skip October And Cut In December – CIBC”

![Five points on trading fundamentals [Webinar]](https://investinearth.org/wp-content/uploads/2019/10/webinar-351x185.png)