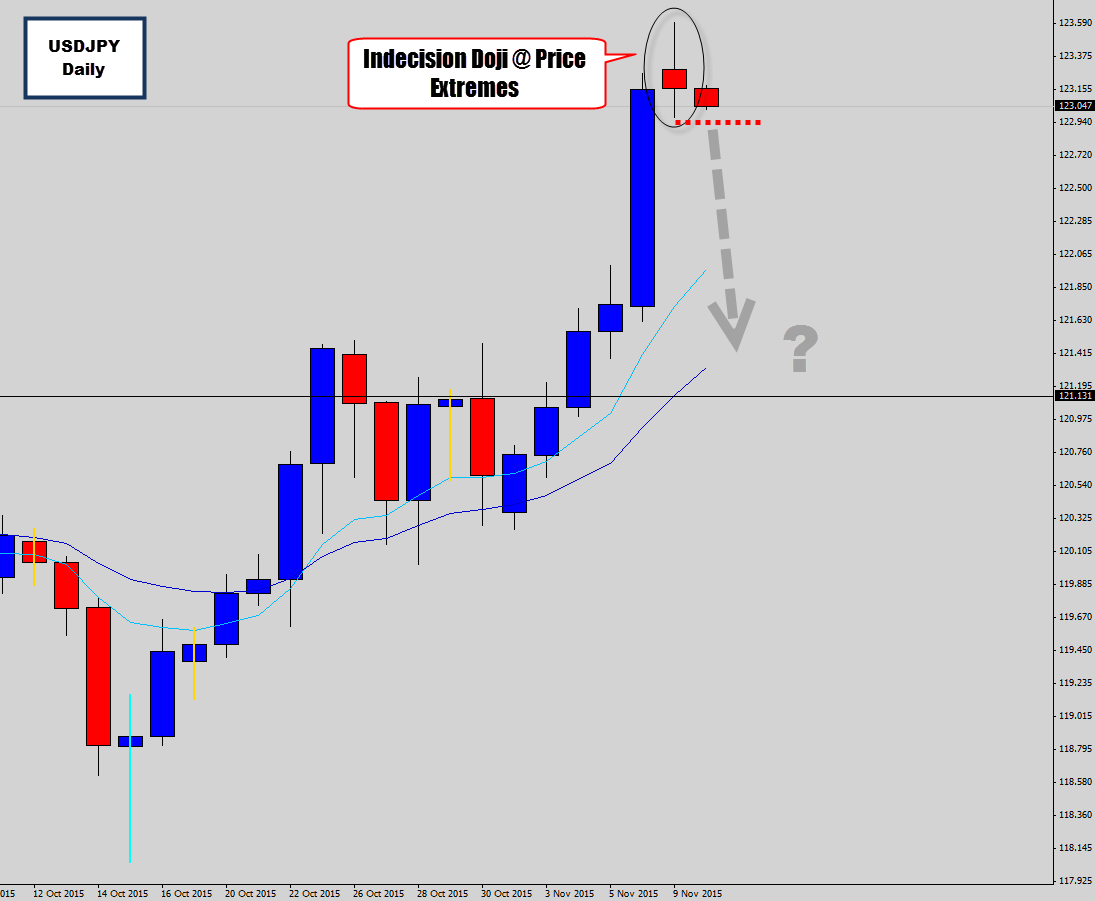

USDJPY launched upwards last week, especially after the NFP data was released towards the end of week. This caused some nice moves in many markets, including this one – which was influenced heavy by the USD strength. In the War Room we do a lot of mean value analysis, which is the study of price … “USDJPY Mean Reversion Setup – Waiting for Doji Breakout”

Category: Opinions

AUD/NZD: Differences

In the statement following the recent Monetary Policy Board meeting of the Reserve Bank of Australia, Governor Glenn Stevens announced the continuation of the RBA policy stance held since the May 2015 meeting. The statement was more telling than the cash rate being held at 2.00%. As far as central bank statements go, the board … “AUD/NZD: Differences”

Trading the euro printing machine – MM #75

This show is all about the ECB’s policy: what’s going on and preparing you for the huge December decision with two trade ideas: EUR/USD and German bunds. You are welcome to listen, subscribe and provide feedback. What the ECB did so far: A negative deposit rate and QE have helped but not enough. We discuss the … “Trading the euro printing machine – MM #75”

Is USD Still At Buy At Current Levels? – BNPP

The US dollar raged across the board following the excellent NFP report. Can it continue rising? The team at BNP Paribas weighs in: Here is their view, courtesy of eFXnews: BNP Paribas positioning analysis signals USD positioning was very light heading into last Friday’s jobs release, implying plenty of scope for positions to build in … “Is USD Still At Buy At Current Levels? – BNPP”

EUR/USD: To 1.05, Parity, And Beyond – Goldman Sachs

After the overwhelmingly strong NFP report, EUR/USD has dropped quite a bit. There may be lots more to come. Here is the view from Goldman Sachs: Here is their view, courtesy of eFXnews: In a note to clients today, Goldman Sachs follows-up on its high-conviction call that the period of indecision for the Dollar from the March … “EUR/USD: To 1.05, Parity, And Beyond – Goldman Sachs”

EUR/USD: Trading the US NFP Nov 2016

US Nonfarm Employment Change measures the change in the number of newly employed people in the US, excluding workers in the farming industry. A reading which is higher than the market forecast is bullish for the dollar. Here are the details and 5 possible outcomes for EUR/USD. Published on Friday at 13:30 GMT. Indicator Background Job … “EUR/USD: Trading the US NFP Nov 2016”

EUR/USD – 1.08 key for parity, AUD/USD divergence trade;

In today’s Forex Forecas, we offer the technical outlook for AUD/USD, EUR/USD, GBP/USD and Gold prices, with Craig Erlam, Senior Market Analyst for Oanda. AUD/USD: favouring the downside Erlam maintains a bearish bias on the AUD/USD, explaining that the Aussie remains in its long-term bearish trend. Breaking above 0.73 will signal a big fundamental change. … “EUR/USD – 1.08 key for parity, AUD/USD divergence trade;”

GBP/USD: Trading the British Services PMI Nov. 2015

The British Services PMI (Purchasing Managers’ Index) is based on a survey of purchasing managers in the services sector. Respondents are surveyed for their view of the economy and business conditions in the UK. A reading which is higher than the market forecast is bullish for the pound. Update: UK Services PMI rises to 54.9 – GBP/USD rises Here are all … “GBP/USD: Trading the British Services PMI Nov. 2015”

Prospects & Targets For CAD Into 2016 – Soc Gen

The Canadian dollar was certainly not a winner in 2015. A lot has to do with oil. What lies ahead for the loonie? The team at SocGen weighs in: Here is their view, courtesy of eFXnews: The outlook for the Canadian dollar (CAD) into mid-2016 is for further depreciation against the US dollar, but likely outperformance … “Prospects & Targets For CAD Into 2016 – Soc Gen”

NZD/USD: Trading the New Zealand Employment Change

New Zealand Employment Change is released on a quarterly basis. It is one of the most important New Zealand indicators and an unexpected reading can have a strong effect on the movement of NZD/USD. A reading which is higher than the market forecast is bullish for the New Zealand dollar. Here are the details and 5 possible outcomes for NZD/USD. Published on … “NZD/USD: Trading the New Zealand Employment Change”