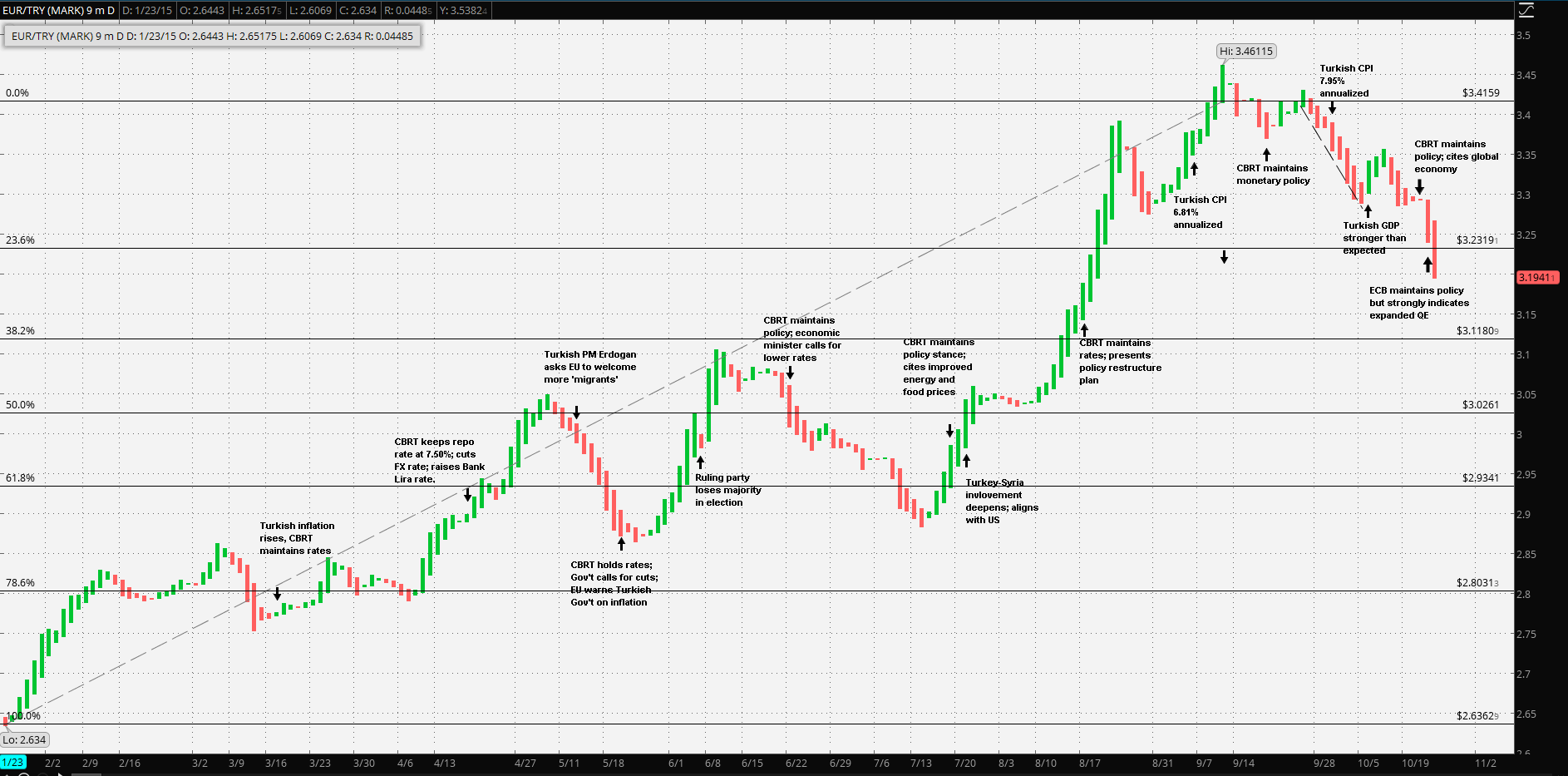

According to the press release of 22 September, the Central Bank of the Republic of Turkey’s (CBRT) Monetary Policy Committee decided to keep the overnight funding rate at 10.75% and the borrowing rate at 7.25. The CBRT’s MPC also noted that “…Loan growth continues at reasonable levels in response to the tight monetary policy stance… … “EUR/TRY: Ex Aequo”

Category: Opinions

[EURCAD] Keep an Eye on this Important Level for Sell

One of the charts I will be watching closely within the next few weeks is the EURCAD. This market has emerged out of consolidation by breaking below the bottom support containment line. Now price has broken free, we can expect this market to get moving. Once of the best positions to trade from is when … “[EURCAD] Keep an Eye on this Important Level for Sell”

GBP/USD: Trading the British Preliminary GDP Oct 2015

British Preliminary GDP, one of the most important economic releases, is published each quarter. GDP measures production and growth of the economy, and is considered by analysts as one the most important indicators of economic activity. A reading which is better than the market forecast is bullish for the pound. Update: UK GDP disappoints with 0.5% … “GBP/USD: Trading the British Preliminary GDP Oct 2015”

Draghi drill down, lonely loonie, silver investment and more

We begin by drilling down Draghi’s 5 drags on the euro and continue with what’s going on with the Canadian dollar and the downside pressures. We then take a deep dive into silver ETFs, ETNs and other investment paths of the precious metal before talking about the upcoming events. You are welcome to listen, subscribe and provide feedback. Draghi drag: Expectations … “Draghi drill down, lonely loonie, silver investment and more”

ECB Wants A Weaker Euro And Will Likely Get It – BTMU

The initial market reaction to Draghi’s verbal shots was certainly powerful: EUR/USD lost over 200 pips and also uptrend support is history. What’s next? There’s a good chance that more is coming, according to BTMU: Here is their view, courtesy of eFXnews: The euro has declined sharply following today’s ECB monetary policy meeting driven by … “ECB Wants A Weaker Euro And Will Likely Get It – BTMU”

A Race to the Bottom

Two and a half years ago I had written an article for this publication entitled “The USD – why is it so High?” Yet here we are in 2015 and the situation hasn’t changed; in fact it gotten much worse. There is a race to the bottom in terms of currencies and no one wants … “A Race to the Bottom”

Draghi eyeing up the full menu – but will he

Draghi hinted at more action in December, talking down the EUR, but does QE actually work for the markets?, watch today’s discussion with Michael Hunter, Market Reporter for Financial Times. Key points Draghi hinting at more action in December French industrial data getting better, bodes well for Eurozone? QE doesn’t work, seen in Japan Draghi … “Draghi eyeing up the full menu – but will he”

FOMC ahead: Fed needs to move on from the outdated

The Federal Reserve has to give markets something for a December hike in next week’s FOMC, says Jeremy Stretch, Head of G10 FX Strategy at CIBC, as he speaks on the US rate hike scenario and Fed communication in today’s Tip TV Finance Show. Yellen: Problem with communication Stretch notes that Yellen’s communication to the … “FOMC ahead: Fed needs to move on from the outdated”

Draghi opens door for EUR/USD at 1.05 – Goldman Sachs

The ECB is dead serious to fight deflation with Draghi using his top verbal skills and showcasing the best of his weaponry to hit the euro hard. This may be only the beginning. The team at Goldman Sachs lays out scenarios for EUR/USD reaching down to 1.05: Here is their view, courtesy of eFXnews: “ECB … “Draghi opens door for EUR/USD at 1.05 – Goldman Sachs”

EUR/USD Moving Parts – Full Presentation

The world’s most popular pair attracts many traders and it has many moving parts on both sides of the Atlantic. We begin by discussing the long term fundamentals that move EUR/USD, discuss the recent developments and discuss the future of the pair. This is a recording of a presentation I gave on October 7th in … “EUR/USD Moving Parts – Full Presentation”

![[EURCAD] Keep an Eye on this Important Level for Sell](https://investinearth.org/wp-content/uploads/2015/10/eurcad-daily.png)