Following Draghi’s 5 blows to the euro, we have seen a huge fall in EUR/USD that extended below uptrend support. How low can it go? The team at Deutsche Bank brings up 4 important points: Here is their view, courtesy of eFXnews: “The implications could be very bearish for the euro and have important implications … “EUR: How Low Could Draghi Go? 4 Takes – Deutsche Bank”

Category: Opinions

Draghi’s 5 blows to EUR/USD

Draghi delivered dovishness. He more than delivered and this dragged down the euro quite strongly. This kind of message was not priced in, to say the least. Here are 5 highlights of what he said to bring the common currency to its knees and some levels to watch. The ECB was expected to hint about an extension … “Draghi’s 5 blows to EUR/USD”

EUR/USD: Trading the German Flash Manufacturing PMI

German Flash Manufacturing PMI (Purchasing Manager Index) is based on a survey of purchasing managers in the manufacturing sector. Respondents are surveyed for their view of the economy and business conditions. A reading which is higher than expected is bullish for the euro. Update: German manufacturing PMI at 51.6 as expected Here are all the details, and … “EUR/USD: Trading the German Flash Manufacturing PMI”

GBP/USD: Trading the British Retail Sales Oct 2015

British Retail Sales is considered one of the most important economic indicators. A reading that is higher than the market forecast is bullish for the British pound. Here are all the details, and 5 possible outcomes for GBP/USD. Published on Thursday at 8:30 GMT. Indicator Background Retail Sales is the primary gauge of consumer spending, a critical component of economic … “GBP/USD: Trading the British Retail Sales Oct 2015”

Canada’s Changing Of The Guard And Its Economic Implications

Justin Trudeau was swept into power in Canada, winning an outright majority and beating the decade long PM Stephen Harper. This implies changes of policy: Avery Shenfeld of CIBC World Markets explains: Here is their view, courtesy of eFXnews: The ballot counting will continue late into the night, but Canada’s federal election looks to be … “Canada’s Changing Of The Guard And Its Economic Implications”

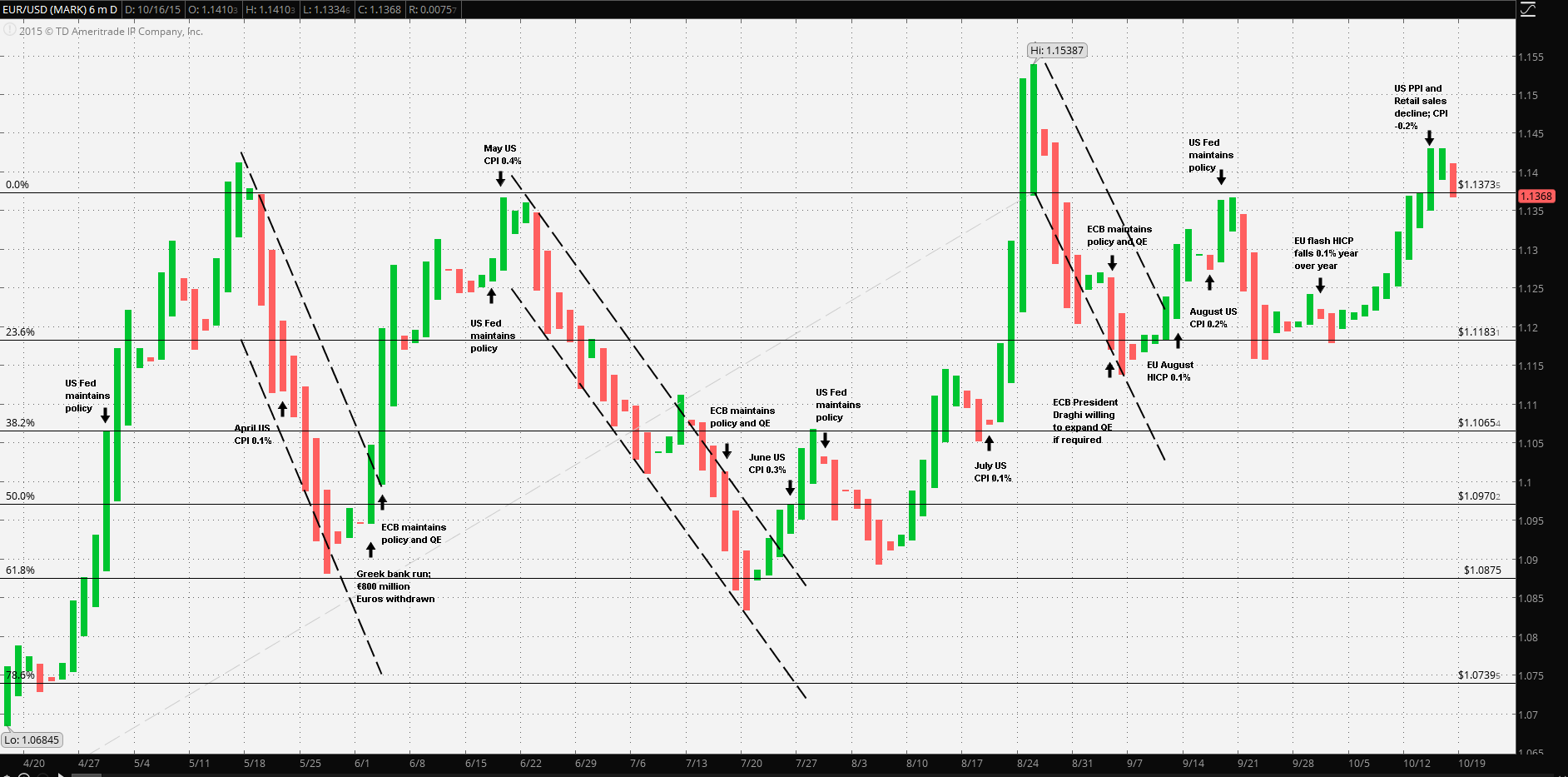

EUR/USD: The Best Laid Plans…

In June of 2014, the ECB began increasing its monetary easing policy by first lowering the overnight deposit rate to -0.10% followed by a second reduction in September of 2014 to -0.20%, where they have remained since. The results of the low rate policy, plus the implementation of the monthly target of €60 billion … “EUR/USD: The Best Laid Plans…”

Varoufakis: 4 problems, 4 solutions – analyzed – #72

We start with analyzing the 4 problems and 4 solutions that Varoufakis presented in Barcelona, continue with the data dependent dollar drive and finish with a preview of the interesting week. You are welcome to listen, subscribe and provide feedback. Yanis Varoufakis in Barcelona: We attended a talk with the ex-finance minister of Greece that is touring Europe. Apart … “Varoufakis: 4 problems, 4 solutions – analyzed – #72”

Euro Set For Prolonged Weakness

Investors that are focused on the currency markets have noticed some interesting trends so far this year. For the most part, the US Dollar has been bought against many of its commonly traded counterparts. This activity has been propelled by the increasingly high probability that the Federal Reserve will be the first major central … “Euro Set For Prolonged Weakness”

BOJ not really keen on pulling the trigger

Quantitative Easing is already big in Japan. The original QQE program from April 2013 shocked markets and so did the second one in October 2014, also thanks to the Japanese government. Tension is growing towards the October 30th decision with many analysts contemplating QE3 in Japan. Yet this might not come so fast. This is when … “BOJ not really keen on pulling the trigger”

Waiting for the Next Buy Signal on NZDUSD

The NZDUSD this year was a very bearish market, and we just recently seen it sell off aggressively – almost reaching the 60c level. Since then the market triple bottomed and has now exploded upwards, recovering from recent losses very quickly. Price is moving too aggressively to work with on the daily chart, so I … “Waiting for the Next Buy Signal on NZDUSD”