British Manufacturing Production, a key indicator, provides analysts and traders with a snapshot of the health of the UK manufacturing sector. A reading which is higher than the market forecast is bullish for the pound. Here are all the details, and 5 possible outcomes for GBP/USD. Published on Wednesday at 8:30 GMT. Indicator Background British … “GBP/USD: Trading the British Manufacturing Oct 2015”

Category: Opinions

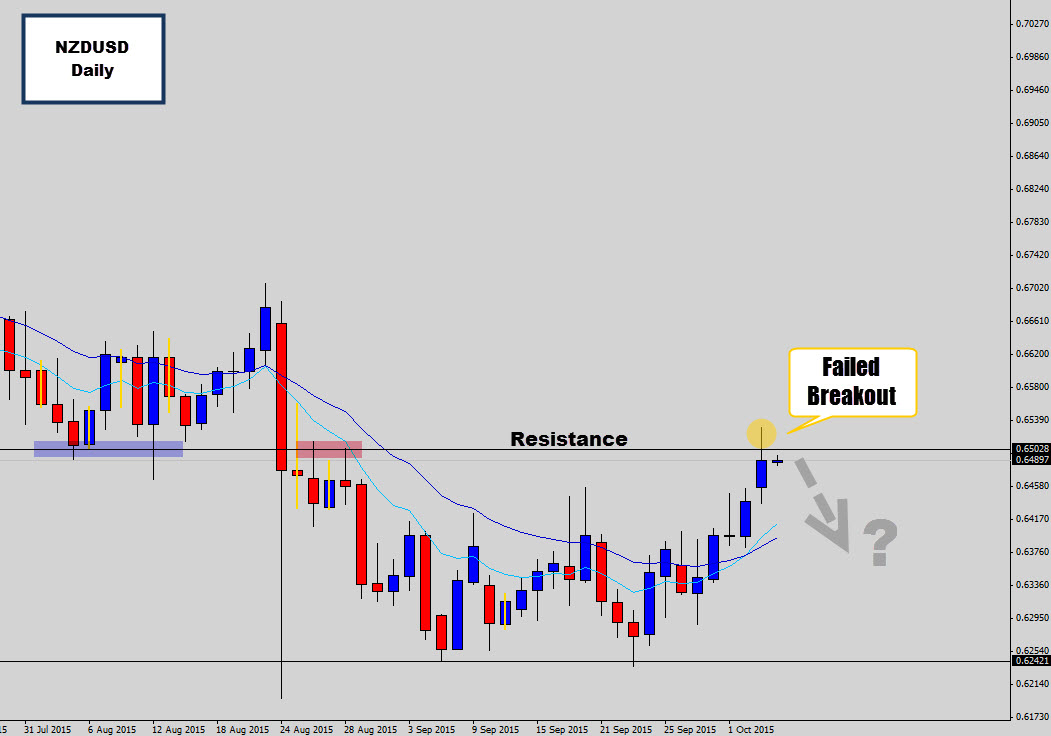

NZDUSD Fakeout Signal Through Resistance – Potential Sell Opportunity

We’ve see the New Zealand dollar make a small comeback – regaining some recent losses. The market rallied off the market floor into a major resistance level. Last session, the market attempted to breakout above resistance, but the move failed and daily candle closed back below the resistance level. This is a sign of weakness, … “NZDUSD Fakeout Signal Through Resistance – Potential Sell Opportunity”

NFP Nightmare, Judging Japan and Natural Gas – MM #70

We start by confronting the catastrophe called NFP and its implications. We then continue to Japan’s worsening outlook and easing prospects, follow with natural gas as autumn leaves settle in and preview the big events coming up. You are welcome to listen, subscribe and provide feedback. NFP Nightmare: It’s hard to find a silver lining in the … “NFP Nightmare, Judging Japan and Natural Gas – MM #70”

Why USD will beat EUR and JPY despite the NFP

The Non-Farm Payrolls report was disappointing and with no real silver lining. Nevertheless, the team at Goldman Sachs sees gains for the US dollar and provides two reasons: Here is their view, courtesy of eFXnews: There were no redeeming features to last week’s employment data, notes Goldman Sachs. “Even the decline in labor market slack … “Why USD will beat EUR and JPY despite the NFP”

Stalling Dollar Creates New Opportunities in GOLD/USD

Forex markets have seen some interesting trends recently, with the US Dollar maintaining most of its position of dominance throughout the year. There is strong fundamental reasoning behind this activity as the US continues to show the most progress in recovery after global financial markets hit their troughs in 2009. Labor markets have shown sustainable … “Stalling Dollar Creates New Opportunities in GOLD/USD”

5 Most Predictable Currency Pairs – Q4 2015

Currency pairs differ quite a lot in their volume of trade, range of movement and predictability. A predictable currency pair pays respect to clear lines of support and resistance, either slowing down and retreating when approaching them or making a clear break and leaving only dust behind them. At the other end of the spectrum … “5 Most Predictable Currency Pairs – Q4 2015”

EUR/USD: Trading the US NFP Oct 2015

US Nonfarm Employment Change measures the change in the number of newly employed people in the US, excluding workers in the farming industry. A reading which is higher than the market forecast is bullish for the dollar. Here are the details and 5 possible outcomes for EUR/USD. Update: Non-Farm Payrolls only 142K – USD Dives Published … “EUR/USD: Trading the US NFP Oct 2015”

GBP/USD: Trading the UK Manufacturing PMI

The British Manufacturing PMI (Purchasing Managers’ Index) is based on a survey of purchasing managers in the manufacturing sector. Respondents are surveyed for their view of the economy and business conditions in the UK. A reading which is higher than the market forecast is bullish for the pound. Here are all the details, and 5 possible outcomes for … “GBP/USD: Trading the UK Manufacturing PMI”

Canada, Catalonia, Copper and more – MM #69

After starting off with the recent market moving events in the US, we take deeper dives into these CCCs, all are stories which will continue dominating the scene. We sign off with previewing the important events along the road. You are welcome to listen, subscribe and provide feedback. Recent US developments: The US dollar found reasons to rise … “Canada, Catalonia, Copper and more – MM #69”

EUR/SEK: The Downside of Success

While the world’s attention has been focused on ECB this year, Sweden has kept a ‘low profile’. However, Sweden seems to be caught in the same persistent disinflation as the rest of the EU, Eurozone or not. What then distinguishes the Swedish Krona from the Euro? According to Eurostat, Sweden’s real GDP year over year … “EUR/SEK: The Downside of Success”