The commodity price collapse was well underway in early March when the PBOC reported GDP annualized growth had fallen to 7%, the lowest read in six years . This was on the heels of two PBOC benchmark rate cuts in the last 5 months. At the previous Reserve Bank of Australia monetary policy meeting, 8 … “GBP/AUD Worlds Apart”

Category: Opinions

The Fed was dovish and the rest will follow –

The US dollar was hit hard following the Fed’s decision not to raise rates and to maintain a dovish tone via its forecasts and lack of confidence in general. No rush to raise rates meant a rush to sell the dollar, even if markets were leaning towards a “no hike” decision. But wait, the main reason … “The Fed was dovish and the rest will follow –”

Fed preview: hawkish talk or dovish hike? 4 scenarios

September 17th is right around the corner and tension in markets is rising. Will the Fed raise rates or not? It is a very hard decision for the world’s No. 1 central bank. And it’s not the only factor, as this decision is accompanied by a press conference and updated Fed forecasts. Updates Fed does not hike … “Fed preview: hawkish talk or dovish hike? 4 scenarios”

Fed: Is a Presser in October going to be the

According to market pricing and recently also according to a small majority of economists, the Federal Reserve will not raise rates today. This leaves the question open on the tone: a hawkish stance or a dovish one? Here are our 4 detailed scenarios. Updates Fed does not hike – USD initially slides Yellen live blog And what … “Fed: Is a Presser in October going to be the”

Is a Fed “no hike” already priced in?

So far, there was a divide between economists and pricing in markets: while markets reflected a chance of between 20% and 30% for a rate hike, various surveys of economists have shown a majority for a rate hike in the September 17th meeting. Updates Fed does not hike – USD initially slides Yellen live blog … “Is a Fed “no hike” already priced in?”

Fed decision: buy USD/CAD on a hike, buy AUD/JPY on

The Fed decision is coming soon, and markets remain tense. While there are at least 4 scenarios, the initial reaction will come down to the question of the rates: to hike or not to hike? The team at Citi suggests two different trades with two different currency pairs: Here is their view, courtesy of eFXnews: The … “Fed decision: buy USD/CAD on a hike, buy AUD/JPY on”

GBP/USD: Trading the British Wages Sep 2015

British Average Earnings Index, released each month, is a leading of consumer inflation. A reading which is higher than the market forecast is bullish for the pound. Here are all the details, and 5 possible outcomes for GBP/USD. Published on Wednesday at 8:30 GMT. Indicator Background The Average Earnings Index is closely watched by analysts, and as a … “GBP/USD: Trading the British Wages Sep 2015”

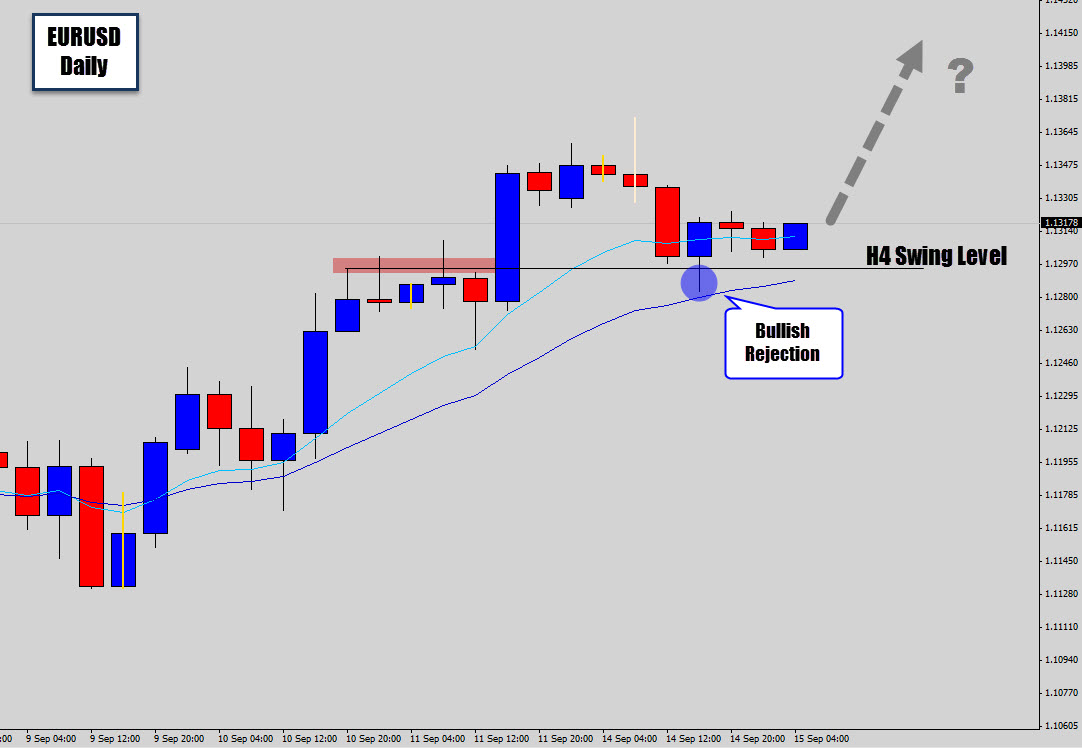

EURUSD 4 Hour Bullish Rejection Candle Swing Trade

Looking at a bullish rejection candle that has formed on the 4 hour time frame of the EURUSD. I call these ones ‘thick body’ rejection candles because in this case, the candle signal has a thick bullish body – which gives the setup a little more bullish presence. The candlestick buy signal formed right on … “EURUSD 4 Hour Bullish Rejection Candle Swing Trade”

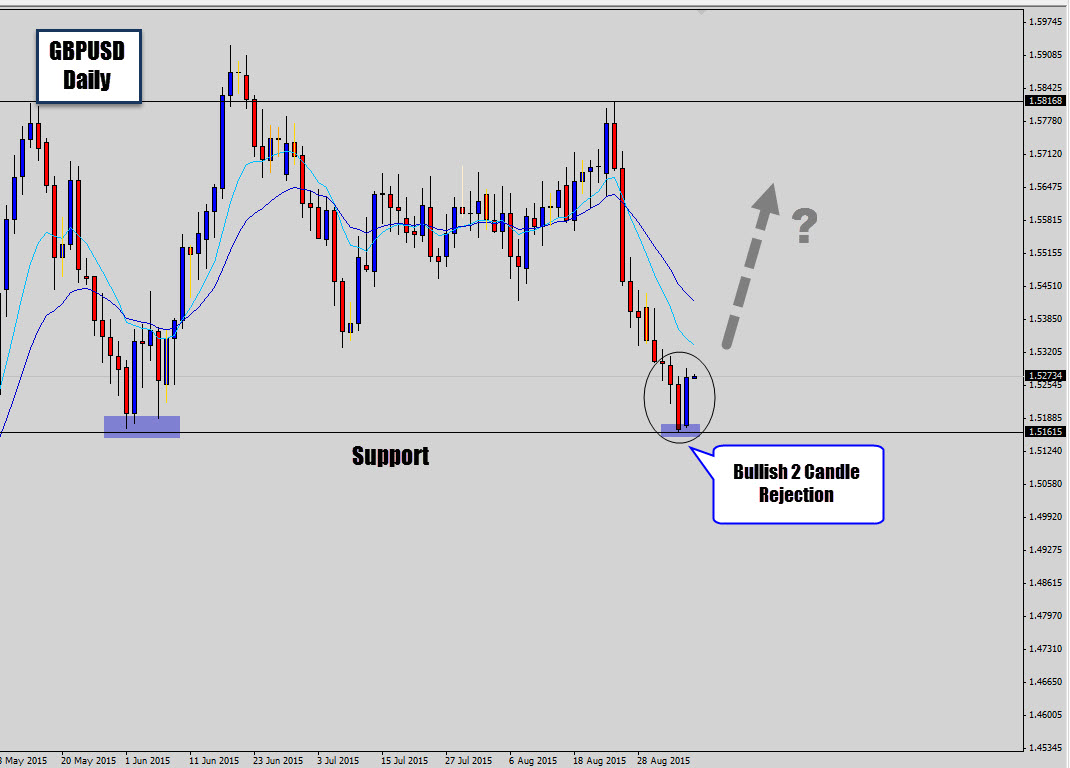

GBPUSD Bullish Candlestick Reversal Pattern on Daily Chart

The GBPUSD has recently suffered a hard drop of 8 days of intense selling, moving price from a larger range structure top, sharply to the bottom support. During the 8 day sell off we haven’t seen any bullish closing days! Now the market has reached a major support level, the bulls have finally decided to step in … “GBPUSD Bullish Candlestick Reversal Pattern on Daily Chart”

Fed Up With The USD Or Not Just Yet? – Credit Agricole

How will the Fed decision impact the US dollar. It doesn’t depend solely on the rate hike. Here is the view from Credit Agricole, which also sees an upside for the USD against the euro and the yen: Here is their view, courtesy of eFXnews: The September FOMC decision is the main event this week … “Fed Up With The USD Or Not Just Yet? – Credit Agricole”