The Chinese crisis was already hitting the Aussie when data from home such as capital expenditure hit it. What’s next? The team at ANZ has clear targets: Here is their view, courtesy of eFXnews: Over the past twelve months we have seen an evolution in the drivers of the weakness in the AUD from outright … “AUD/USD to 0.68 by December – ANZ”

Category: Opinions

USD, EUR, JPY: Different Dynamics Emerge – ANZ

The US dollar is certainly back on track following the strong GDP numbers. Does this change the whole dynamic? This isn’t the only force: Here is their view, courtesy of eFXnews: “For the G3, we may start to see some different dynamics emerge. The driver of JPY strength is clear – risk appetite. But a key driver … “USD, EUR, JPY: Different Dynamics Emerge – ANZ”

EUR/USD: Trading the US Preliminary GDP Aug 2015

US Preliminary GDP is a measurement of the production and growth of the economy. Analysts consider GDP one the most important indicators of economic activity, so publication of Preliminary GDP could have a significant impact on the movement of EUR/USD. A reading which is better than the market forecast is bullish for the dollar. Here are all the … “EUR/USD: Trading the US Preliminary GDP Aug 2015”

AUD/USD: Trading the Australian Capex Aug 2015

Australian Private Capital Expenditure, released each quarter, is an important leading indicator which can have a significant impact on the markets. A reading which is higher than the market forecast is bullish for the Australian dollar. Here are the details and 5 possible outcomes for AUD/USD. Published on Thursday at 1:30 GMT. Indicator Background Private Capital Expenditure … “AUD/USD: Trading the Australian Capex Aug 2015”

EURUSD – Can This Be A Real Break?

Talking Points Euro climbed higher against the US Dollar, and cleared a few major hurdles for a move towards $1.1700. The EURUSD is now correcting lower and forming an interesting structure on the daily chart. German Gross Domestic Product published by the Statistisches Bundesamt Deutschland posted a rise of +0.4% in the second quarter of … “EURUSD – Can This Be A Real Break?”

EUR/USD: Squeezing Both ECB And Fed; How To Trade It?

EUR/USD shot up and is trading on high ground. Has it stabilized here? Is it going to stabilize at all? A lot depends on central banks. Here is Nordea’s take: Here is their view, courtesy of eFXnews: China and EM fears is currently triggering massive de-risking in global markets, leading to a substantial squeeze higher … “EUR/USD: Squeezing Both ECB And Fed; How To Trade It?”

USD/JPY: Trading the Conference Board Consumer Confidence Index

The Conference Board Consumer Confidence Index is based on a monthly survey of about 5,000 households regarding their opinion of the economy. Its release always has a strong impact on market prices. A reading which is higher than expected is bullish for the US dollar. Here are all the details, and 5 possible outcomes for … “USD/JPY: Trading the Conference Board Consumer Confidence Index”

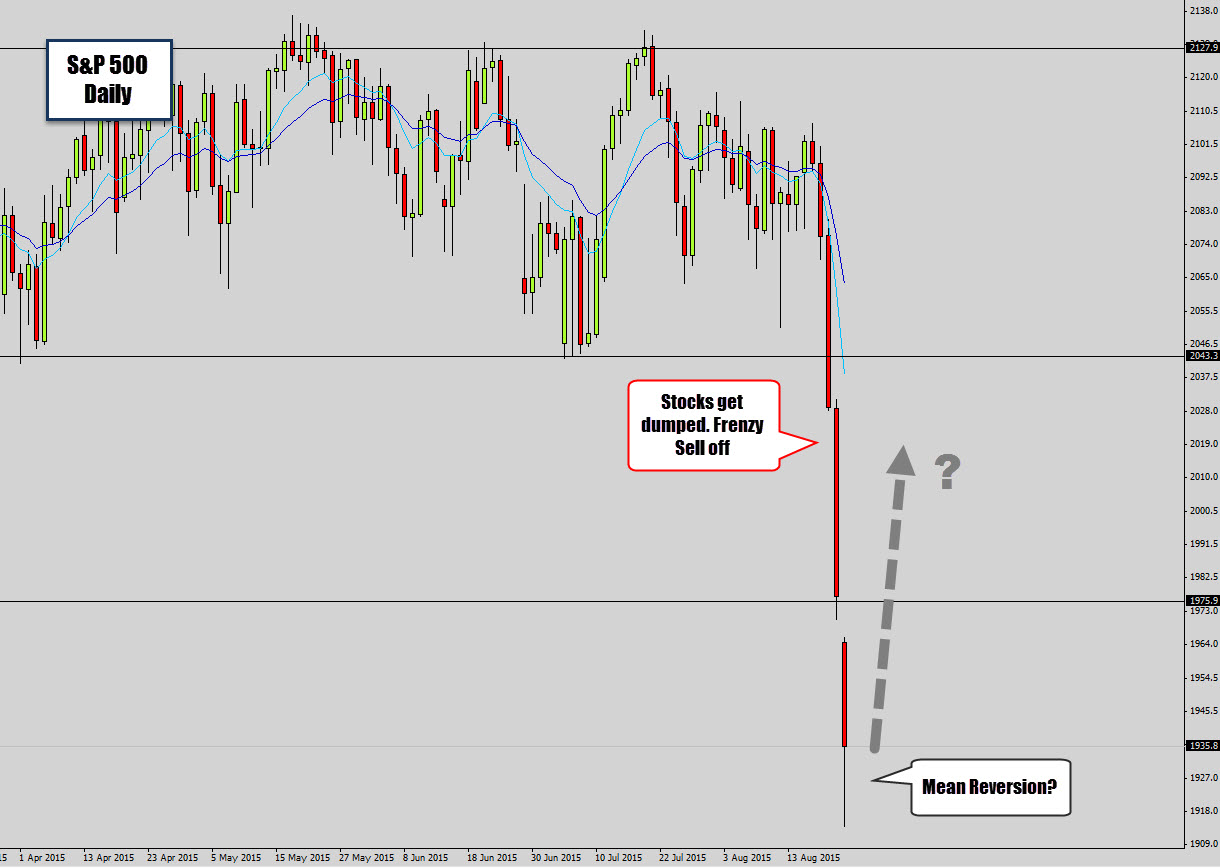

S&P Crashes After US Stocks Get Dumped – Mean

Traders were shocked by almost a mini market crash, what certainly looks like a very serious situation at least on the daily chart. We’ve had 3 days of intense selling as investors dump US stocks, causing the S&P, and the DOW to drop like a rock. Simple mean value analysis tell us that the market … “S&P Crashes After US Stocks Get Dumped – Mean”

EUR/USD Timeline: What Drivers At What Horizons? We stay

EUR/USD shot to higher ground, riding on 3 global worries. What will drive it next? The team at Danske explain all the moving parts and why they remain short: Here is their view, courtesy of eFXnews: The increasingly hesitant stance from the FOMC is challenging our long-held view that USD should continue to strengthen ahead … “EUR/USD Timeline: What Drivers At What Horizons? We stay”

EUR/GBP relief rally might continue, USD/CHF looks heavy; Gold

The summer markets imply that exaggerating moves might be seen in forex, notes Steven Woodcock, Senior FX Analyst at Plutus FX, as he joins Tip TV to share the outlook for EUR/GBP, USD/JPY, USD/CAD, USD/CHF and Gold. EUR/GBP seeing a relief rally Woodcock maintains his positive outlook on the cross, expecting a continuation of the … “EUR/GBP relief rally might continue, USD/CHF looks heavy; Gold”