Yesterday, the US dollar suffered badly. The story was that China was doing the Fed’s tightening work and that a rate hike might wait and wait. 24 hours make a big difference: the greenback is making a comeback on some Chinese calm and good data from the US consumer. China A third day of yuan devaluation awaited … “Markets may be re-warming to a Fed hike after data,”

Category: Opinions

EUR/USD: Trading the Preliminary German GDP August 2015

Gross Domestic Product (GDP) indicator is a measurement of the production and growth of the economy. Analysts consider GDP one the most important indicators of economic activity. A reading which is better than the market forecast is bullish for the euro. Here are all the details, and 5 possible outcomes for EUR/USD. Published on Friday at … “EUR/USD: Trading the Preliminary German GDP August 2015”

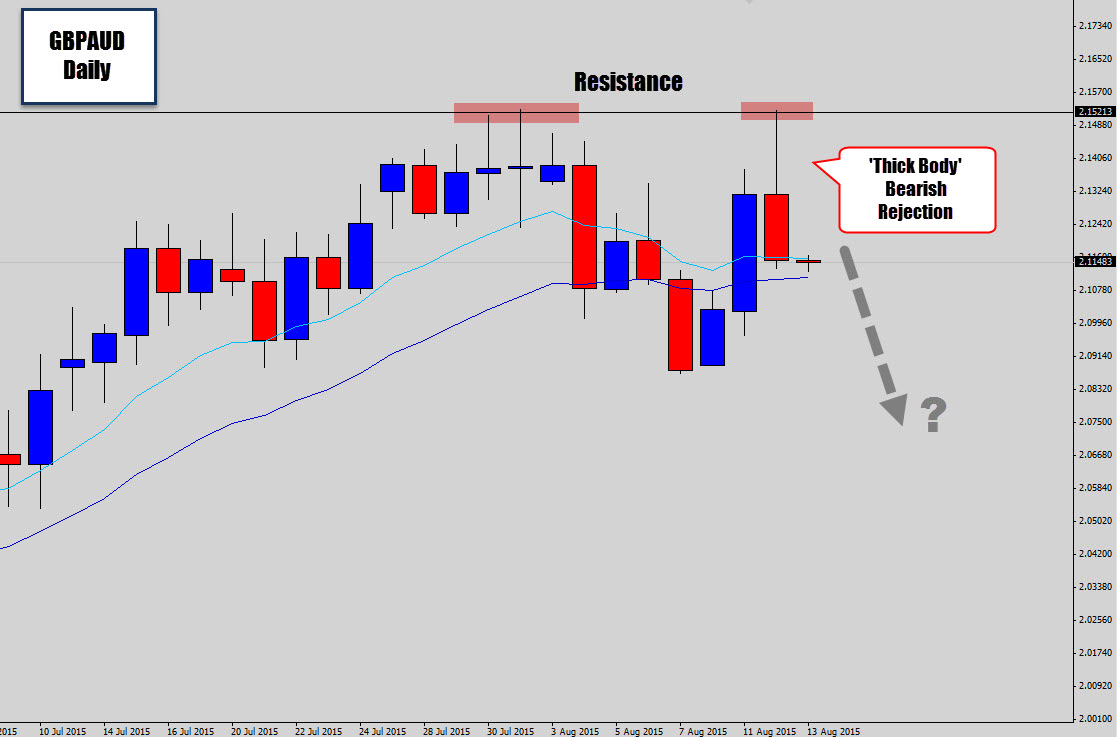

GBPAUD Sells off Resistance – Strong Bearish Rejection Candle

After a nice extended rally here on the GBPAUD daily chart, price has become a little turbulent as it slams into some stubborn resistance. The resistance level has been defended by the bears after two attempts to push up into higher prices, both times the higher prices were denied. The most recent test – during … “GBPAUD Sells off Resistance – Strong Bearish Rejection Candle”

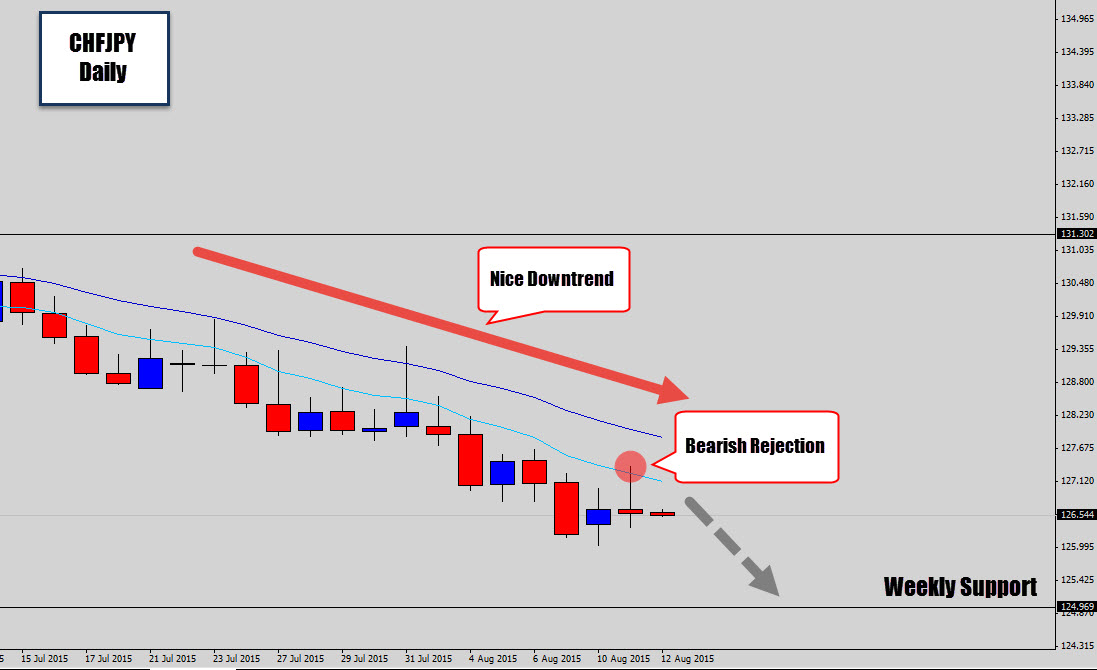

CHFJPY Drops Bearish Rejection Signal Aligned with Trend

The CHFJPY market has been gliding down at a steady pace – producing a nice stable bearish trend. We’ve had a couple of sell opportunities along the way here that have worked out well. Last session the market moved higher into the mean value – the move was denied and price was pushed down lower … “CHFJPY Drops Bearish Rejection Signal Aligned with Trend”

After The CNY Tumble, JPY Should Be Next – Credit

The Chinese authorities made their move and devalued the yuan by nearly 2%. This move, accompanied by some liberalization of currency markets, hurt the Aussie, but it certainly has wider implications. The team at Credit Agricole explains: Here is their view, courtesy of eFXnews: In a surprise move overnight, the PBOC devalued the CNY by most … “After The CNY Tumble, JPY Should Be Next – Credit”

EUR/NZD: Got Milk?

Like most of its neighbors in the Asia-Pacific region, New Zealand has an export economy. However, as the chart demonstrates, New Zealand’s balance of trade seems to swing between trade surpluses and deficits over the past several years. Guest post by Mike Scrive of Accendo Markets The five largest of New Zealand’s export partners account for … “EUR/NZD: Got Milk?”

GBP/USD: Trading the British Aug 2015

British Average Earnings Index, released each month, is a leading of consumer inflation. A reading which is higher than the market forecast is bullish for the pound. Update: UK wages: +2.4% – GBP falls Here are all the details, and 5 possible outcomes for GBP/USD. Published on Tuesday at 8:30 GMT. Indicator Background The Average Earnings Index is closely … “GBP/USD: Trading the British Aug 2015”

USDSGD Bearish Rejection Candles – Mean Reversion Likely

The USDSGD has been in a monster bullish trend this year, but we’ve started to see some signs of temporary slow down. Going into last week’s close, we see two bearish rejection candles, with those upper tails displaying denials of higher prices right around a weekly resistance level. To usher us into this week’s trading, … “USDSGD Bearish Rejection Candles – Mean Reversion Likely”

Oil Predominantly Drills Into CAD; A Dovish Curveball for

The Canadian dollar managed to sift through an OK employment report and the pound survived the BOE blow. What’s next for both currencies? The team at CIBC explains: Here is their view, courtesy of eFXnews: The following are CIBC’s weekly outlook for the CAD, and GBP. Oil Predominantly Drills Into C$. As oil prices have … “Oil Predominantly Drills Into CAD; A Dovish Curveball for”

Will they or won’t they? The Fed and also falling

Where is the Fed headed? A lot depends on the NFP. We discuss everything and also talk about falling oil and the somewhat neglected price of silver before previewing next weeks’s events. You are welcome to listen, subscribe and provide feedback. Direction of the Fed: Will they or won’t they in September? We hold opposing opinions and argue … “Will they or won’t they? The Fed and also falling”