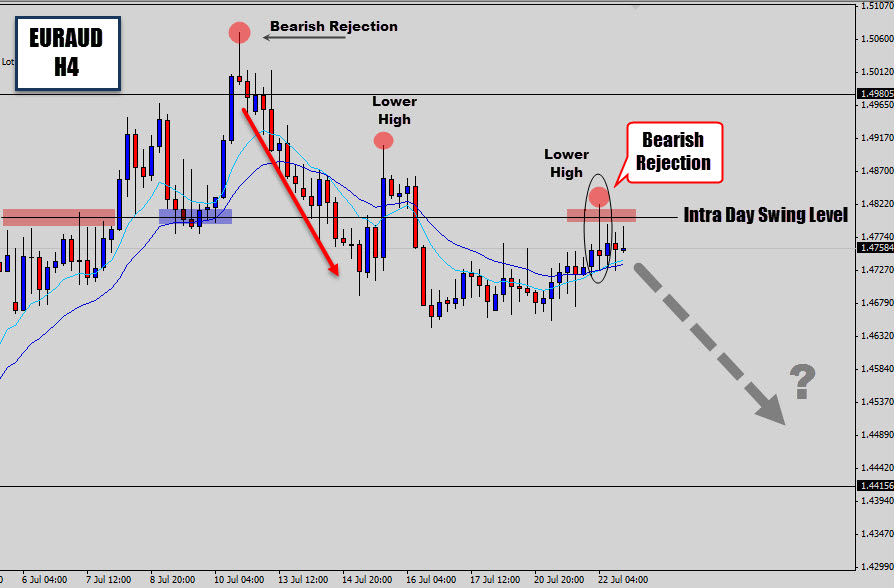

The EURAUD market has been dropping lower highs on the 4 hour chart as it progressively weakness, swinging down into lower prices. The daily chart also is dropping below support levels and look quite bear heavy. The daily chart is testing resistance now, which corresponds to the intra day swing level I have marked on … “EURAUD Price Action Reversal Sell Signal – Swing Trade”

Category: Opinions

GBP/USD: Trading the British Retail Sales Jul 2015

British Retail Sales is considered one of the most important economic indicators. A reading that is higher than the market forecast is bullish for the British pound. Here are all the details, and 5 possible outcomes for GBP/USD. Published on Thursday at 8:30 GMT. Indicator Background Retail Sales is the primary gauge of consumer spending, a critical component of economic … “GBP/USD: Trading the British Retail Sales Jul 2015”

Drilling down the deals: aGreekment and Iran – #59

We had two highly important deals: on Greece and on Iran, and both have significant market implications. After digesting the deals and their impact down the road, we preview the events of the next two weeks. You are welcome to listen, subscribe and provide feedback. Greece – what happened and what’s next: Nobody likes the aGreekment. What happened … “Drilling down the deals: aGreekment and Iran – #59”

Why The GBP Rally Against The USD Is ‘Puzzling’ –

Carney’s bullish comments sent the pound higher, but doubts remain. The team at Credit Agricole pours some cold water: Here is their view, courtesy of eFXnews: The latest GBP-rally reflects investors’ bets on growing policy divergence between the increasingly hawkish BoE and dovish central banks like the ECB, the SNB and the BoJ. What puzzles … “Why The GBP Rally Against The USD Is ‘Puzzling’ –”

GBP/CHF: Strength in Numbers

In a previous publication, A Clockwork Trade, 27 May 2015 I had pointed out that the Swiss export economy was threatened by its reputation as a financial safe haven. In particular, capital inflows into Swiss assets caused the Swiss Franc to become, in the words of Swiss National Bank Chairperson Thomas Jordan, “significantly overvalued”. By … “GBP/CHF: Strength in Numbers”

EUR/USD – Trading the UoM Consumer Sentiment Index

The University of Michigan Consumer Sentiment Index surveys consumer attitudes and expectations about the US economy. An increase in consumer confidence is a positive sign about the health of the economy and is bullish for the US dollar. Here are all the details, and 5 possible outcomes for EUR/USD. Published on Friday at 14:00 GMT. Indicator … “EUR/USD – Trading the UoM Consumer Sentiment Index”

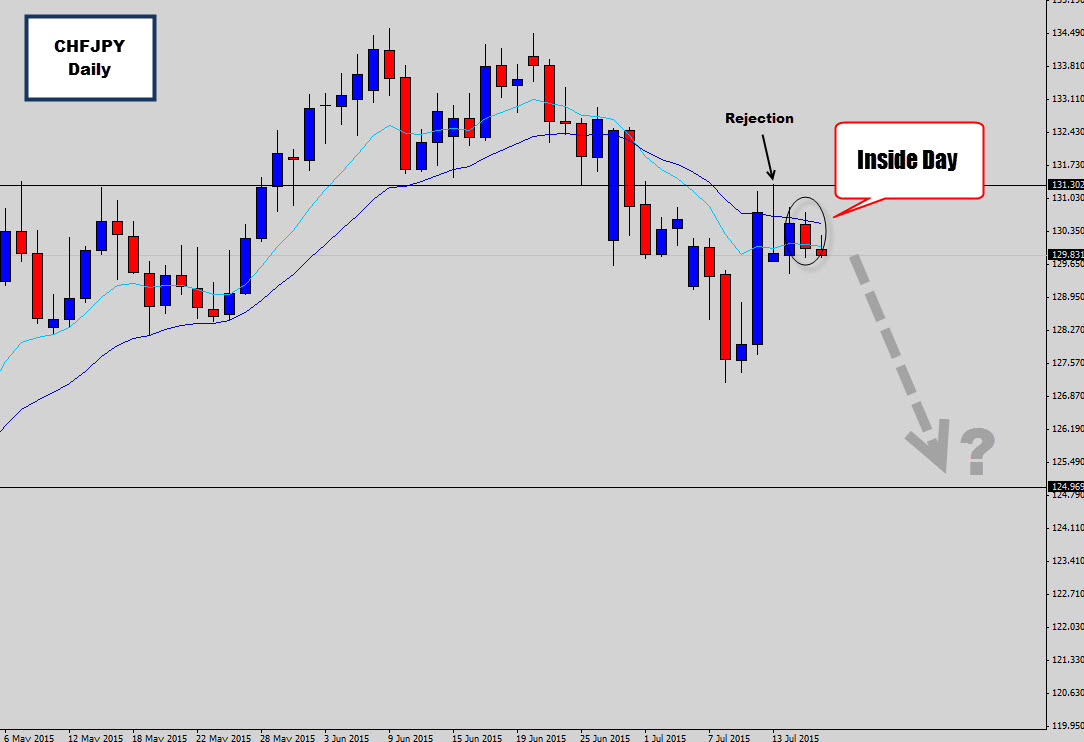

CHFJPY Respects Resistance and Prints Bearish Inside Candle

CHFJPY has retrace back up the recent down move to re-test an old swing level – which is now holding as resistance. We can see the small bearish rejection candle that communicates that price wants to hold under the level. We haven’t seem much bearish follow through – but an inside day has formed with … “CHFJPY Respects Resistance and Prints Bearish Inside Candle”

German hard line on Greece begins to backfire on 5

Germany defeated Greece in the EU Summit and received huge concession and a humiliating capitulation. Tsipras, the hero of the Greferendum, was severely defeated by the scare of a Grexit. However, as time passes by and despite the probable approval of harsh austerity in the parliament, there are signs that Germany’s hard line could backfire. Here are 5 fronts were the attitude … “German hard line on Greece begins to backfire on 5”

EUR/USD: Base Against 1.0965; GBP/USD: Strong Bullish Signal –

EUR/USD is hugging 1.10 in the aftermath of the Greek deal. GBP/USD enjoyed a rise following bullish comments from Carney. What’s next for these pairs? The team at RBS looks at the charts: Here is their view, courtesy of eFXnews: RBS Techs maintains its bullish views on EUR/USD, and GBP/USD. Starting with EUR/USD, RBS notes that … “EUR/USD: Base Against 1.0965; GBP/USD: Strong Bullish Signal –”

3 Reasons Why EUR/USD Should Fall; We Stay Short –

EUR/USD has been suffering the ramifications of the late Greek deal, but that’s certainly not the only factor moving the pair. The team at Dankse stays short and explains in detail: Here is their view, courtesy of eFXnews: -EUR/USD should fall near term on Greece, Fed and FX hedging flows -The disagreement between eurozone countries … “3 Reasons Why EUR/USD Should Fall; We Stay Short –”